- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

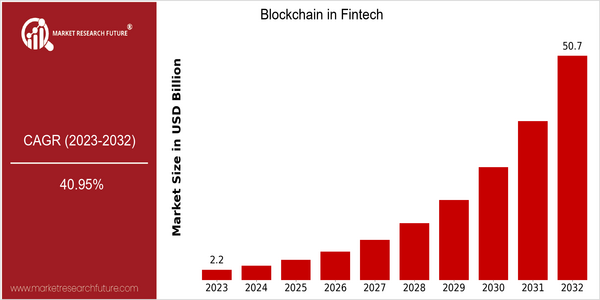

| Year | Value |

|---|---|

| 2023 | USD 2.2 Billion |

| 2032 | USD 50.7 Billion |

| CAGR (2024-2032) | 40.95 % |

Note – Market size depicts the revenue generated over the financial year

The growth of the financial technology market, which is expected to grow from $ 2 billion in 2023 to $ 50 billion in 2032, is expected to be remarkable. The annual growth rate is 40.95% between 2024 and 2032. This growth shows that the integration of blockchain technology into the financial services sector will increase significantly. The rapid growth of this market is due to several important factors, such as the growing demand for secure and transparent methods of payment, the rise of decentralized finance (DeFi), and the increasing interest in digital assets and cryptocurrencies. Regulators are also encouraging financial institutions to look at how to use blockchain to optimize their operations and reduce costs. Companies such as Ripple, Chainalysis, and IBM are investing in innovation and forming strategic alliances to strengthen their position in the market. Ripple, for example, is focusing on the solution of international payments, which places it at the forefront of the blockchain-based financial technology market. In addition, the collaboration between traditional banks and blockchain-based companies is becoming more frequent, as financial institutions are trying to take advantage of the potential of this technology to speed up and secure transactions. The interplay between technological development and strategic initiatives will play a key role in the future of blockchain in the financial technology market.

Regional Market Size

Regional Deep Dive

The use of Blockchain in the financial industry is growing at a rapid pace across the globe. The main reason for this growth is the increasing demand for transparency, security, and speed in financial transactions. There are however, different trends in different regions, depending on the regulatory framework, technological developments, and the culture towards digital currencies and Blockchain technology. There is a strong interest in the use of Blockchain technology by both established financial institutions and new entrants in the market. This is leading to a transformation of the financial industry.

Europe

- The European Union is now preparing a regulatory framework for cryptocurrencies and the blockchain, and aims to create a comprehensive legal framework that encourages innovation and protects consumers.

- Countries like Switzerland and Estonia are leading the way in blockchain adoption, with initiatives such as the Swiss Blockchain Act and Estonia's e-Residency program, which encourage startups to leverage blockchain for financial services.

Asia Pacific

- The Chinese government has taken a keen interest in the development of the blockchain, and is pushing for the establishment of a “blockchain super highway” that will integrate the technology into all industries, including finance.

- India is witnessing a rise in fintech startups utilizing blockchain for remittances and digital payments, supported by the Reserve Bank of India's exploration of a Central Bank Digital Currency (CBDC).

Latin America

- Latin America is seeing increased interest in blockchain technology as a solution for remittances and financial inclusion, with countries like Brazil and Mexico leading the charge through regulatory frameworks that support cryptocurrency use.

- The rise of decentralized finance (DeFi) platforms in the region is enabling unbanked populations to access financial services, with local startups innovating to provide blockchain-based solutions tailored to regional needs.

North America

- The U.S. is witnessing a surge in blockchain adoption among major financial institutions, with companies like JPMorgan Chase and Goldman Sachs investing heavily in blockchain technology to enhance transaction efficiency and security.

- Regulatory clarity is evolving, with the SEC and CFTC actively engaging in discussions about cryptocurrency regulations, which is fostering a more stable environment for blockchain innovation in the financial sector.

Middle East And Africa

- The UAE is emerging as a blockchain hub, with the Dubai Blockchain Strategy aiming to make Dubai the first city fully powered by blockchain by 2025, significantly impacting the financial services landscape.

- Africa, especially in countries like Nigeria and South Africa, has a great future in the use of the blockchain to improve financial inclusion. The central bank of Nigeria is working on a digital currency, and fintechs are using the blockchain to facilitate cross-border payments.

Did You Know?

“As of 2023, over 80% of financial institutions globally are expected to adopt blockchain technology in some form, highlighting its growing importance in the financial services sector.” — World Economic Forum

Segmental Market Size

The use of blockchain in financial technology is a major trend in the industry, which is growing at a fast pace. The demand for transparency, security, and speed in financial transactions is growing. This is driven by the growing demand for secure digital transactions from consumers, as well as the regulatory push for compliance and anti-fraud measures. Also, the development of the blockchain protocol is enabling faster and more cost-effective solutions for financial institutions. At present, the development of blockchain in financial technology is moving from the experimental stage to the scaled-up stage. Some examples of the transition are Ripple's cross-border payment solution and JP Morgan's Onyx digital asset management platform. The most important applications are smart contracts, decentralized finance platforms (DeFi) for loans and borrowing, and blockchain-based identity verification systems. A major trend such as the Cov19 epidemic accelerates the digital transformation of financial institutions. Also, the pursuit of sustainable development leads financial institutions to use the blockchain to track carbon emissions. The DLT and cryptographic security technology are influencing the development of financial technology, and will be a major trend in the future of finance.

Future Outlook

The market for blockchain in the financial sector is expected to grow from $ 2 billion to $ 50 billion by 2032, a CAGR of 40.95%. The rapid growth of the market is due to the increasing use of blockchain technology in the financial sector, including payment, credit and asset management. The decentralized nature of the blockchain can be seen as a solution to the problems of transparency, fraud and inefficiency in the financial industry. By 2032, the penetration rate of the financial sector will reach 30%. The integration of smart contracts and decentralized finance (defi) platforms will change the traditional financial model. The regulatory framework is evolving to accommodate the innovations of the blockchain, thereby enabling the application of fintech to be more secure and compliant. Besides, the emergence of central bank digital currencies and the increasing emphasis on green finance will also promote the development of blockchain solutions. The combination of these factors will not only bring about a significant growth in the market for blockchain in the financial sector, but will also change the way we do business in the financial sector in the next ten years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.5 Billion |

| Market Size Value In 2023 | USD 2.2 Billion |

| Growth Rate | 47.90% (2023-2032) |

Blockchain Fintech Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.