Research Methodology on Blockchain in Fintech Market

Introduction

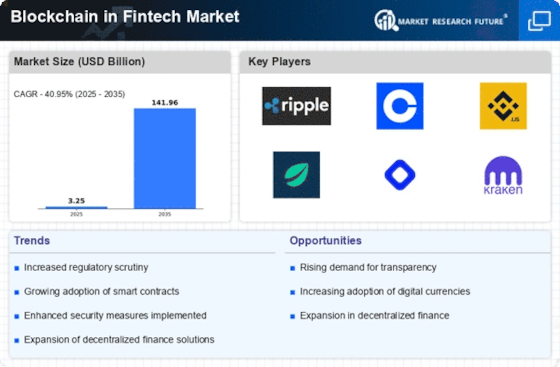

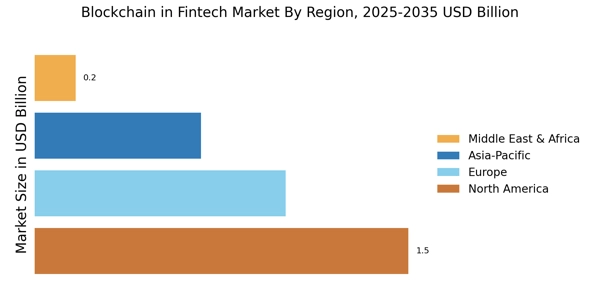

This report provides an in-depth assessment and evaluation of the Blockchain in the Fintech Market. The primary objectives of the study are to provide a detailed analysis of the market’s growth, opportunities, and challenges. A comprehensive market survey is conducted through secondary and primary research, which involves data compilation from various industry sources. Exhaustive research methodology is adopted to obtain qualitative and quantitative insights into the market dynamics such as drivers, trends, threats, and restraining factors.

Information Procurement Process

The report’s information has been obtained from primary and secondary sources such as commercial databases, company annual reports, financial reports, industry institutions, government sources, and third-party reliable sources. The data has been examined through industry-standard analysis techniques to validate its integrity and accuracy. To gain insights into the Blockchain in Fintech Market, data triangulation methods such as supply side and demand side have been used, which has enabled the report to provide a comprehensive overview of the market.

Research Methodology

The research methodology includes bottom-up and top-down approaches used to estimate the market size. The information sources include primary and secondary sources such as industry publications, industry associations, company presentations, and industry reports. Exhaustive research is conducted using market sizing, competitive strategies, market segmentation, market dynamics, macro-and micro-economic factors, and technology advancements in the Blockchain in Fintech Market.

Bottom-up Approach

The bottom-up approach is used to estimate the total market size of the global Blockchain in Fintech Market. The approach starts with an estimation of various segments of the market and an assessment of the same. The data is collected from various players in the market and validated by industry experts. This approach provides the accurate and most accurate market size estimation.

Top-down Approach

The top-down approach is used to derive the market size of the global Blockchain in Fintech Market. The approach starts with the estimation of the total market size and further quantifies the individual segments and sub-segments to derive the exact market size estimates. Data from reliable industry sources is collected and validated by industry experts.

Factor Analysis

This is a statistical technique used to analyze the impact of various factors on the market such as market growth, product lifecycle, competitive strategies, new product development, risk management, pricing strategies, market trends, and others. This analysis helps in understanding the factors driving the market and how they are expected to change the market dynamics during the forecast period 2023 to 2030. The data has been collected from primary and secondary sources and validated by industry experts.

Time-Series Analysis

Time-series analysis is used to analyze the historical market data and to estimate the future growth of the market. This analysis is used to identify the trends in the market and to forecast the market size till 2030. Data from reliable industry sources is collected and validated by industry experts.

Data Triangulation

Data triangulation is used to validate the market size and to ensure a comprehensive view of the market. This method combines different data sources from both the demand side and supply side to obtain reliable market estimates. The data has been collected from trusted industry sources and verified by industry experts to ensure its integrity and accuracy.

Conclusion

The comprehensive assessment of the Blockchain in Fintech Market’s dynamics is conducted through primary and secondary research, which helps in understanding the market’s drivers, trends, opportunities, and challenges. The research methodology used in the report helps in understanding the market size and gives the exact market estimates. The primary, secondary, and triangulated data help in providing an accurate view of the market and by providing reliable market size estimations. This helps in developing insights into the market dynamics and in the understanding of the opportunities and challenges present in the market.