Cross-Border Transactions

The blockchain fintech market in South America is significantly influenced by the increasing demand for efficient cross-border transactions. With a diverse range of currencies and economic conditions across the continent, traditional remittance methods often incur high fees and lengthy processing times. Blockchain technology offers a solution by enabling near-instantaneous transactions with lower costs. For instance, the use of cryptocurrencies for remittances can reduce fees to as low as 1%, compared to the average 7% charged by traditional services. This efficiency is particularly appealing to migrant workers who send money back home. As more individuals and businesses recognize the advantages of blockchain for cross-border transactions, the market is poised for substantial growth.

Technological Advancements

The blockchain fintech market in South America is experiencing rapid technological advancements that are reshaping financial services. Innovations such as smart contracts and decentralized finance (DeFi) platforms are gaining traction, enabling more efficient transactions and reducing costs. For instance, the integration of blockchain technology in remittances has the potential to lower transaction fees by up to 80%, making it an attractive option for the region's large expatriate population. Furthermore, the rise of mobile wallets and digital currencies is facilitating greater access to financial services, particularly in underserved areas. As technology continues to evolve, it is likely that the blockchain fintech market will see increased competition and innovation, driving further growth and adoption across South America.

Rising Cybersecurity Concerns

Rising cybersecurity concerns are driving the blockchain fintech market in South America as businesses and consumers seek more secure financial solutions. The increasing frequency of cyberattacks on financial institutions has heightened awareness of the vulnerabilities associated with traditional banking systems. Blockchain technology, with its decentralized and immutable nature, offers enhanced security features that can mitigate these risks. As organizations prioritize data protection and fraud prevention, the adoption of blockchain solutions is likely to accelerate. Reports indicate that the blockchain security market could grow by over 30% in the next few years, reflecting the urgent need for robust cybersecurity measures in the financial sector. This trend underscores the importance of blockchain technology in addressing security challenges within the fintech landscape.

Financial Inclusion Initiatives

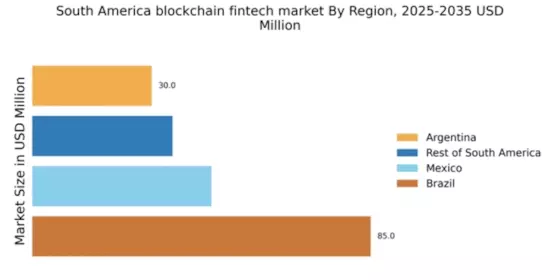

In South America, financial inclusion initiatives are significantly impacting the blockchain fintech market. With approximately 70% of the population lacking access to traditional banking services, blockchain technology offers a viable solution to bridge this gap. By providing decentralized financial services, blockchain enables individuals to participate in the economy without the need for intermediaries. Countries like Brazil and Argentina are witnessing the emergence of blockchain-based platforms that cater to unbanked populations, allowing them to access credit, savings, and investment opportunities. This shift not only empowers individuals but also stimulates economic growth, as more people gain access to financial resources. The potential for blockchain to enhance financial inclusion is a key driver for the market in South America.

Government Support and Policy Frameworks

Government support and favorable policy frameworks are crucial drivers for the blockchain fintech market in South America. Several countries in the region are actively developing regulations that promote the use of blockchain technology while ensuring consumer protection. For example, the Argentine government has introduced initiatives to foster innovation in the fintech sector, which includes blockchain applications. This supportive environment encourages startups and established companies to invest in blockchain solutions, potentially leading to a market growth rate of over 25% in the coming years. As governments recognize the benefits of blockchain for enhancing transparency and efficiency in financial transactions, the regulatory landscape is likely to evolve, further propelling the blockchain fintech market.