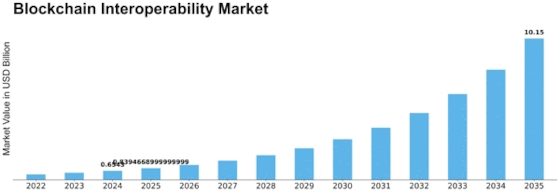

Blockchain Interoperability Size

Blockchain Interoperability Market Growth Projections and Opportunities

Blockchain interoperability is a vital aspect of the rapidly evolving digital panorama, wherein numerous blockchain networks aim to connect and talk with everyone seamlessly. Several market elements contribute to the dynamics of the blockchain interoperability market. One number one motive force is the growing reputation of the constraints related to isolated blockchain ecosystems. As corporations and industries increasingly undertake blockchain generation, the need for those disparate networks to interoperate becomes paramount. The aggressive landscape is also shaping the market for blockchain interoperability. Various projects and protocols are vying for dominance in providing interoperability solutions. Standards, which include the Interledger Protocol (ILP), Polkadot, and Cosmos, have emerged as frontrunners, each providing precise processes to allow interoperability. The success of these answers is contingent on extensive adoption and collaboration amongst blockchain developers and tasks, which, in turn, fuels innovation and increases the marketplace. Regulatory trends play an essential role in influencing the trajectory of the blockchain interoperability market. As governments around the world grapple with regulating blockchain and cryptocurrency, the status quo of clean hints can both propel or obstruct interoperability projects. Regulatory help can instill self-belief in groups and customers, encouraging them to include interoperable solutions. Interoperability additionally hinges on technological advancements in the blockchain ecosystem. As blockchain platforms evolve and improve, they contain capabilities and functionalities that facilitate interoperability. Smart settlement abilities, move-chain verbal exchange protocols, and advancements in consensus mechanisms contribute to the technical basis for seamless interoperability. The marketplace is responsive to those technological improvements, with customers and establishments alike looking for answers that now not only join unique blockchains but also do so securely and efficiently. The broader monetary landscape also prompts market elements. Economic situations, investor sentiment, and global monetary tendencies affect the willingness of businesses to invest in blockchain interoperability answers. In times of monetary uncertainty, groups may also prioritize price-cutting measures over adopting new and doubtlessly disruptive technologies. On the flip facet, throughout intervals of financial growth and digital transformation, the demand for interoperability solutions may additionally surge as companies attempt to live competitively and leverage the blessings of a linked blockchain ecosystem.

Leave a Comment