Global Body Control Module Market Overview

Body Control Module Market Size was valued at USD 31.5 Billion in 2022. The Body Control Module market industry is projected to grow from USD 32.85 Billion in 2023 to USD 46.01 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 16.26% during the forecast period (2023 - 2032). Increased demand for cutting-edge convenience, safety, and comfort features in cars; strict government rules and rising demand for automotive are the key market drivers boosting the expansion of the market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

In March 2024, ROHM announced the release of automotive primary LDOs, utilizing its own QuiCur technology, which allows for obtaining the industry’s highest load response characteristics. Such features are most suitable for automotive infotainment, power train and body control modules.

Body Control Module Market Trends

-

Rise in the electrification of vehicles is driving the market growth

Market CAGR for automotive body control module (BCM) is being driven by the rise in the electrification of vehicles. One important component with multiple functions is the automotive body control module (BCM). Data from input devices is read by it. This is the basis for controlling the output devices through a CAN (Controller Area Network) or LIN (Local Interconnect Network), which facilitates communication between different vehicle components. The BCM regulates every one of the car's many electronic systems, which in turn govern a multitude of operations.

Additionally, the need for BCMs to effectively manage many activities is driven by the growing integration of electronic components in automobiles, such as entertainment, lighting controls, and enhanced safety systems. By centralising and automating multiple functions, including power windows, mirrors, and interior lighting, BCMs enhance user comfort and provide a smooth and intuitive driving experience. Advanced safety measures like anti-theft systems and automatically locking doors are required by strict safety rules. In order to maximize these features' adoption and commercial expansion, BCMs are essential to their management.

By combining several tasks into a single module, BCMs lighten and simplify wiring. This integration pushes market expansion, lowers production costs, and improves vehicle economy. The need for BCMs is increased by the increasing rate of vehicle production worldwide since all types of cars need dependable and effective control systems for a variety of body-related operations. BCMs are developing to facilitate communication between vehicle systems as a result of connected cars, improving features like over-the-air updates, remote diagnostics, and smart applications, and so propelling market expansion.

For instance, sales of electric cars doubled to 6.6 million in 2021, increasing the total number of electrical vehicles on the road to 16.5 million, according to the International Energy Agency, which is an autonomous intergovernmental agency with its headquarters in France, in September 2022. The market for automotive body control module (BCM) will thus be driven by the rise in demand for electric cars. Thus, result in driving the Body Control Module market revenue.

Body Control Module Market Segment Insights

Body Control Module Functionality Insights

The Body Control Module Market segmentation, based on functionality includes High End, and Low End. The high end segment dominated the market. High-end automotive body control module (BCM) must be used by OEMs in their vehicle model variants due to the growing demand for concierge body features inside vehicles and managing such a crucial function.

Automotive Body Control Module (BCM) Component Insights

The Body Control Module Market segmentation, based on component, includes Hardware, and Software. The hardware category generated the most income. To create automotive body control module (BCM) that are precisely matched to various models, they combine different combinations of microcontrollers. It is anticipated that this tendency will propel the hardware component industry going forward.

Body Control Module MCU bit size Insights

The Body Control Module Market segmentation, based on MCU bit size includes 8 bit, 16 bit, and 32 bit. The 16 bit dominated the market. 16-bit microcontrollers might provide a compromise between efficiency and price. In some automotive body control module (BCM) applications, where larger bit sizes might not be required, a 16-bit architecture can offer adequate functionality at a more affordable cost.

Body Control Module in Automotive Vehicle Type Insights

The Body Control Module Market segmentation, based on vehicle type, includes Light-Duty Vehicle, and Heavy-Duty Vehicle. The light-duty vehicle category generated the most income. For other body control functions to function properly, each light-duty vehicle has a automotive body control module (BCM) installed. For their particular vehicle models, OEMs are modifying or fine-tuning the automotive body control module (BCM). Customers are particularly inclined to choose these car offers because they can customize their autos.

Body Control Module Communication Protocol Insights

The Body Control Module Market segmentation, based on communication protocol includes CAN, LIN, and FLexray. The flexray segment dominated the market, due to the growing BCM integration with Internet of Things (IoT) and linked car technologies.

Body Control Module Power Distribution Component Insights

The Body Control Module Market segmentation, based on power distribution component, includes Relays, and Fuses. The fuses category generated the most income (70.4%). Fuses have a reputation for being dependable and having safety features. By ensuring that electrical circuits are shielded from overcurrent conditions, fuses in the automotive body control module (BCM) reduce the possibility of electrical fires or harm to delicate parts.

Body Control Module Electric Vehicle Type Insights

The BCM Control Unit market segmentation, based on electric vehicle type includes BEV, FCEV, and PHEV. The BEV segment dominated the market. Drive-by-wire systems, in which electronic controls take the place of conventional mechanical linkages, are frequently used by BEVs. Drive-by-wire systems are managed by the Body Control Module in Automotive, which improves the responsiveness and efficiency of the vehicle.

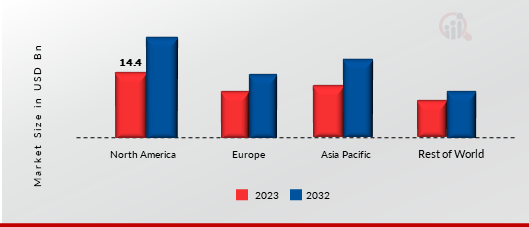

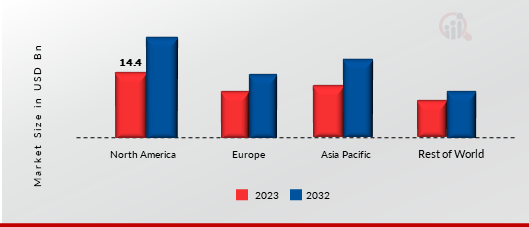

Figure1: Body Control Module Market, by Distribution channel, 2023 & 2032 (USD Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Body Control Module Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American Body Control Module market area will dominate this market. In order to handle and coordinate the numerous electronic components in modern vehicles, including hybrid and electric vehicles, there is an increasing need for advanced Body Control Module in Automotive due to the continued trend toward vehicle electrification.

Further, the major countries studied in the market report are The US, German, France, the UK, Canada, Italy, Spain, India, Australia, South Korea, China, Japan, and Brazil.

Figure2: Body Control Module Market Share By Region 2023 (Usd Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Europe Body Control Module market has the second-largest portion of the market due to expanding Infotainment and Connectivity Demand, as well as developing Partnerships and Strategic Collaborations. Further, the German BCM Control Unit market had the biggest market share, and the UK Body Control Module market was the fastest growing market in the European region

The Asia-Pacific BCM Control Unit market is anticipated to expand between 2023 and 2032 at the quickest CAGR. The need for Body Control Module in Automotive is driven by the rising number of automobiles produced for both local and international markets. Moreover, China’s Body Control Module market had the biggest market share, and the Indian Body Control Module market was the fastest growing market in the Asia-Pacific region.

Body Control Module in Automotive Key Market Players& Competitive Insights

Leading market players are putting a lot of money on R&D to expand their product lines, which will help the market for weight reduction products grow. Additionally, market players are engaging in a range of calculated initiatives to increase their worldwide presence, with important market developments involving the introduction of new products, contracts, M&A transactions, increased investment, and cooperation with other enterprises. To grow and endure in an increasingly cutthroat and dynamic market, Body Control Module in Automotive industry must provide reasonably priced goods.

Manufacturing locally is one of the primary business techniques used by manufacturers to cut operational costs in the global Body Control Module in Automotive industry to help customers and expand the market segment. In recent years, the Body Control Module in Automotive industry has provided some of the biggest benefits to medicine. Major players in the Body Control Module market, including Bosch (Germany), Continental (Germany), Lear Corporation (US), Hella (Germany), and Aptiv (UK) among others, are attempting to increase market demand by investing in research and development operations.

Robert Bosch GmbH, or simply Bosch, is a worldwide engineering and technology firm. Robert Bosch started the business in Stuttgart in 1886. The Robert Bosch Stiftung is a nonprofit organization that owns 94% of Bosch. The charity is funded by the large majority of shares owned, although it is not able to vote and only works on social and health issues unrelated to Bosch's business. In March 2019, Bosch has inaugurated its London Connectory, a "co-innovation space" located in Shoreditch that is accessible to partners in the public, commercial, and academic domains, ranging from start-ups to large corporations.

Continental AG, also referred to as Conti or just Continental, is a multinational automotive parts manufacturer based in Germany that specializes in tires, brake systems, vehicle electronics, automotive safety, the engine, chassis components, tachographs, and other components for the transportation and automotive industries. The six divisions of Continental are: ContiTech, Tires, Interior, Powertrain, Chassis and Safety, and ADAS (Advanced Driver Assistance Systems). Its main office is located in Lower Saxony, Hanover. Third-biggest global supplier to the automobile industry, Continental is also the fourth-biggest tire maker. In February 2021, To enhance its autonomous driving technology, Continental announced that it had purchased a minority share in Recogni, a German-U.S. start-up.

Key Companies in the Body Control Module market include

- Bosch (Germany),

- Continental (Germany),

- Lear Corporation (US),

- Hella (Germany),

- Aptiv (UK)

Body Control Module in Automotive Industry Developments

In March 2024, ROHM announced the release of automotive primary LDOs, utilizing its own QuiCur technology, which allows for obtaining the industry’s highest load response characteristics. Such features are most suitable for automotive infotainment, power train and body control modules.

April 2022: Bosch declared that it had purchased Arioso Systems, a Dresden-based manufacturer of MEMS micro speakers. The business will be a component of Bosch Sensortec GmbH.

In November 2023, JLR made more than £10m of investments into high technology to enable the safeguard against car thieves. Along with those, JLR’s investment consists of body control module updates preventing thieves from making a getaway in a vehicle without a key. In May 2022, Renesas and Intel partnered to launch an enhanced BCM, which, in line with all other advanced systems witnessed, included the Intel Atom processor, wore off previous models in power and energy efficiency and also improved in features support for ADAS and self-driving technology.

In May 2022, both Renesas and Intel worked on developing a new BCM and the responsibility of the processor was held by Intel. The new BICM is more efficient and energy-saving than its predecessors, incorporating even more sophisticated technologies, including ADAS and self-driving vehicles.

In January 2022, Bosch and Nvidia worked on this latest BCM to be based on Nvidia’s Drive Orin platform. The new BC Model is advanced enough to support sophisticated technologies such as ADAS and self-driving capabilities, which was not possible with the earlier models.

Body Control Module Market Segmentation

Body Control Module Functionality Outlook

Body Control Module Component Outlook

Body Control Module MCU bit size Outlook

Body Control Module Vehicle Type Outlook

- Light-Duty Vehicle

- Heavy-Duty Vehicle

Body Control Module Communication Protocol Outlook

Body Control Module Power Distribution Component Outlook

Body Control Module Electric Vehicle Type Outlook

Body Control Module in Automotive Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size2022 |

USD 31.5 Billion |

| Market Size 2023 |

USD 32.85 Billion |

| Market Size2032 |

USD 46.01 Billion |

| Compound Annual Growth Rate (CAGR) |

4.30% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Functionality, Component, MCU bit size, Vehicle Type, Communication Protocol, Power Distribution Component, Electric Vehicle Type, and Region |

| Geographies Covered |

North America, Europe, Asia-Pacific, and the Rest of the World |

| Countries Covered |

The US, German, France, UK, Canada, Italy, Spain, India, Australia, South Korea, China, Japan, and Brazil |

| Key Companies Profiled |

Bosch (Germany), Continental (Germany), Lear Corporation (US), Hella (Germany), and Aptiv (UK) |

| Key Market Opportunities |

· The need for BCMs is increased by the increasing rate of vehicle production worldwide. |

| Key Market Dynamics |

· The need for adaptable BCMs is driven by the desire for individualized interior design and vehicle features. |

Frequently Asked Questions (FAQ) :

In 2022, the size of the worldwide body control module market was estimated to be USD 31.5 billion.

From 2023 to 2032, the global market is expected to expand at a compound annual growth rate (CAGR) of 4.30%.

North America held the most market share worldwide.

Bosch (Germany), Continental (Germany), Lear Corporation (US), Hella (Germany), and Aptiv (UK) are the leading companies in the market.

In 2022, the market was led by the High End category.

Hardware held the most market share worldwide.