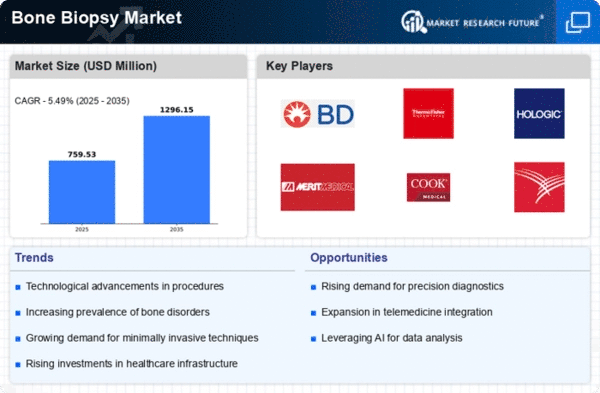

Market Share

Bone Biopsy Market Share Analysis

Better healthcare facilities in developing nations are opening up opportunities for those involved in bone biopsy procedures. As healthcare improves, there's a push for more advanced products related to bone biopsy. Companies in the healthcare sector in developing countries are investing heavily in new technologies. For example, in May 2022, Terumo India, part of Terumo Corporation in India, partnered with Argon Medical, a US-based leader in specialty medical products. They focus on items like guide wires, IVC filters & retrievals, bone & soft tissue biopsy needles, and more in India. This partnership aims to provide more advanced medical solutions. The older population is growing in developing countries like China and India. In 2019, WHO reported that there were 254 million people aged 60 and over and 176 million people aged 65 and over in China. Older people are more prone to chronic diseases like cancer, leading to a higher demand for advanced bone biopsy products in the region. The prevalence of bone cancer is also increasing in emerging areas like the Asia-Pacific region. For example, the Department of Health, State Government of Victoria, Australia, states that around 250 Australians are diagnosed with primary bone cancer every year. Bone biopsies are not only used for cancer but also to diagnose and manage patients with osteoporosis. According to the Journal of the American Medical Association (JAMA Network), in China, 5.0% of men and 20.6% of women aged 40 years or older had osteoporosis. Due to a growing target population in emerging regions, there is an increased demand for bone biopsy products from healthcare providers in these areas. Additionally, there is a trend toward adopting minimally invasive techniques in hospitals, ambulatory surgical centers, and other end-users in developing countries. This trend has driven the demand for bone biopsy needles.

The improvement in healthcare infrastructure in developing countries is creating new opportunities for those involved in bone biopsy procedures. The growth of healthcare infrastructure encourages the development of advanced products for bone biopsy procedures. Companies in the healthcare sector in developing countries are investing heavily in technologies. For example, in May 2022, Terumo India, the Indian arm of Terumo Corporation, entered into a partnership agreement with US-based Argon Medical, a market leader in specialty medical products. This includes items like guide wires, IVC filters & retrievals, bone & soft tissue biopsy needles, and other products in India. This collaboration aims to offer advanced medical solutions. The elderly population is increasing in developing countries such as China and India. According to WHO, in 2019, there were 254 million people aged 60 and over, and 176 million people aged 65 and over in China. Elderly people are more susceptible to chronic diseases such as cancer, which is also driving the demand for advanced bone biopsy products in the region. The prevalence of bone cancer in emerging regions such as Asia-Pacific is growing. For example, according to the Department of Health, State Government of Victoria, Australia, about 250 Australians are diagnosed with primary bone cancer every year. Bone biopsies are also performed to diagnose and manage patients with osteoporosis. According to the Journal of the American Medical Association (JAMA Network), in China, 5.0% of men and 20.6% of women aged 40 years or older had osteoporosis. Due to an increasing target patient population across the emerging region, there is an increased demand for bone biopsy products from healthcare providers in the region. There is also the adoption of minimally invasive techniques in hospitals, ambulatory surgical centers, and other end-users across emerging countries, which has fueled the demand for bone biopsy needles.

The improvement in healthcare infrastructure in developing countries is creating new opportunities for those involved in bone biopsy procedures. The growth of healthcare infrastructure encourages the development of advanced products for bone biopsy procedures. Companies in the healthcare sector in developing countries are investing heavily in technologies. For example, in May 2022, Terumo India, the Indian arm of Terumo Corporation, entered into a partnership agreement with US-based Argon Medical, a market leader in specialty medical products. This includes items like guide wires, IVC filters & retrievals, bone & soft tissue biopsy needles, and other products in India. This collaboration aims to offer advanced medical solutions. The elderly population is increasing in developing countries such as China and India. According to WHO, in 2019, there were 254 million people aged 60 and over, and 176 million people aged 65 and over in China. Elderly people are more susceptible to chronic diseases such as cancer, which is also driving the demand for advanced bone biopsy products in the region. The prevalence of bone cancer in emerging regions such as Asia-Pacific is growing. For example, according to the Department of Health, State Government of Victoria, Australia, about 250 Australians are diagnosed with primary bone cancer every year. Bone biopsies are also performed to diagnose and manage patients with osteoporosis. According to the Journal of the American Medical Association (JAMA Network), in China, 5.0% of men and 20.6% of women aged 40 years or older had osteoporosis. Due to an increasing target patient population across the emerging region, there is an increased demand for bone biopsy products from healthcare providers in the region. There is also the adoption of minimally invasive techniques in hospitals, ambulatory surgical centers, and other end-users across emerging countries, which has fueled the demand for bone biopsy needles.

Leave a Comment