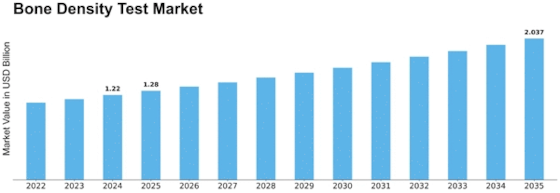

Bone Density Test Size

Bone Density Test Market Growth Projections and Opportunities

People all over the world are living longer, which is making the Bone Density Test Market grow. As people age, they are more likely to get osteoporosis and other diseases linked to it. To keep an eye on bone health and harm risk, bone density checks are needed. What changes the market is the number of people with osteoporosis or osteopenia. When these things happen, bones get weaker and more likely to break. These tests can find bone problems early and fix them, which makes the market bigger. Many menopausal women receive bone density testing. Due to hormone changes that induce bone loss, menopause increases osteoporosis risk. This group should have frequent bone density examinations to determine their risk of breaking a bone and how to prevent it. Changes in bone densitometry affect the market. Due to new imaging technologies like DXA, bone density testing are more accurate and reliable for patients and clinicians. The bone density test business is changed by AI in testing. It is now easier to handle and understand bone density scans thanks to AI. This helps doctors make better decisions about bone health. The market is growing because more people are learning about bone health and getting checked out regularly. The market grows because annual bone density checks are pushed by public health as a way to keep people healthy. Issues with bone health can be caused by bad food, not moving around much, and a lazy way of life. Now that people know how lifestyle affects bone density, they want bone density tests to find and treat lifestyle problems. Because bone density tests are so important in orthopedics and gout, the business is driven by them. Rheumatologists and orthopedic doctors use bone density to see who is most likely to break a bone, plan care, and keep an eye on how drugs affect bone health. Because of steps the government and public health are taking to fight osteoporosis, the business of bone density tests is growing. More people get checked for bone health issues when they know about the tests that can be done. Ability to get health care and money for it both affect how many bone density tests are sold. Health care professionals offer bone density tests when they are paid enough. But money problems could make it hard to use, especially in some places. Even though there are good market forces at work, there are problems with patients following through on their appointments and tests. People who want to improve their bone health must follow the lifestyle and drug ideas that are made based on the results of their tests. The Bone Density Test Market is used in medical medicine to find out about bone health and the chance of getting hurt. Health care companies must come to smart deals in order to place themselves in the market. Bone density test companies work with clinics, hospitals, and imaging centers to make their services a normal part of health care. These deals make professional bone density tests better and help them reach more people. Compact and point-of-care bone density measuring tools are made so that they are easy to use and easy to get to. These small, simple technologies let doctors do tests right away for people who want accurate tools, which grows the market share.

Leave a Comment