Brazil AI in Fintech Market Overview

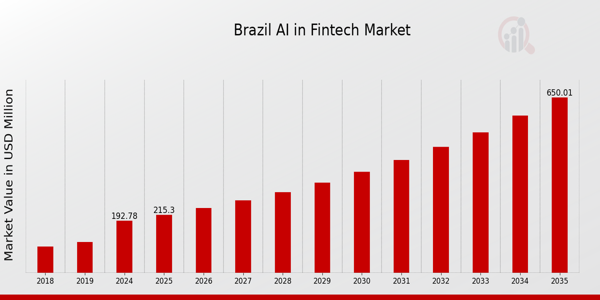

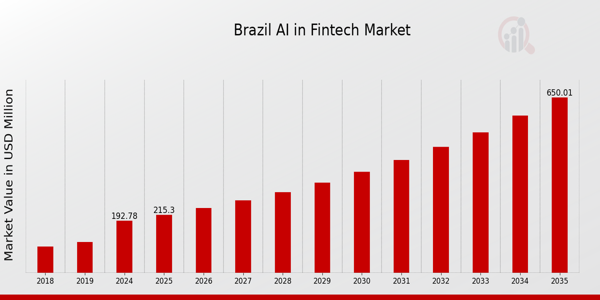

As per MRFR analysis, the Brazil AI in Fintech Market Size was estimated at 170.73 (USD Million) in 2023. The Brazil AI in Fintech Market is expected to grow from 192.78(USD Million) in 2024 to 650 (USD Million) by 2035. The Brazil AI in Fintech Market CAGR (growth rate) is expected to be around 11.683% during the forecast period (2025 - 2035)

Key Brazil AI in Fintech Market Trends Highlighted

The Brazil AI in Fintech Market is experiencing significant momentum as the adoption of AI technologies plays a vital role in revolutionizing financial services. Key market drivers include the increasing demand for personalized banking experiences, which has pushed financial institutions to leverage AI for enhanced customer engagement. The Brazilian government is actively promoting the digitalization of financial services, aiming to foster innovation while ensuring consumer protection. This supportive regulatory environment encourages fintech companies to integrate AI solutions into their offerings, creating a seamless user experience.

Opportunities to be explored or captured in Brazil's AI in fintech landscape include the growing need for fraud detection and risk management solutions.Given Brazil's status as one of the biggest rising markets, artificial intelligence-driven tools with the ability to examine transaction trends and spot suspicious activity have great promise. Furthermore, small and medium-sized businesses (SMEs) in Brazil are looking for access to financial services more and more, which presents a chance for fintech companies to offer customized artificial intelligence solutions meant to simplify credit evaluations and lending applications.

Recent trends show that neobanks and digital wallets—which use artificial intelligence to maximize operations and improve service delivery—have become rather common in Brazil. Driven by a younger, tech-savvy population that values efficiency and ease of use, these financial companies are acquiring great momentum.

Moreover, collaborations between traditional banks and fintech startups are on the rise, fostering innovation and enabling established institutions to adopt AI technologies more swiftly. As Brazil continues to embrace technological advancements, the future of AI in the fintech sector looks promising, with various stakeholders poised to benefit from this transformative shift.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Brazil AI in Fintech Market Drivers

Growing Digital Financial Services Adoption

The Brazil AI in Fintech Market is experiencing significant growth driven by the increasing adoption of digital financial services. The Central Bank of Brazil reported that in 2020, there were approximately 64 million digital bank accounts opened, reflecting a year-on-year increase of over 25%. This shift towards online banking and digital payments is a response to customer demand for convenience and improved access to financial services.

Established organizations such as Nubank and PagSeguro have played a crucial role in this transition by offering innovative digital solutions that are highly appealing to younger demographics. The growing smartphone penetration, reaching about 80% in urban areas, further supports this trend, enabling more Brazilians to access financial services online.

Investment in Artificial Intelligence Technologies

The increase in investment towards Artificial Intelligence technologies in Brazil is becoming a driving force in the Brazil AI in Fintech Market. Reports suggest that AI-related investments in the Brazilian fintech sector have surged, reflecting a compound annual growth rate (CAGR) of over 30% in recent years. Major players like Banco do Brasil and ITAU have been investing actively in AI to enhance customer service and risk assessment capabilities.

As the fintech landscape continues to mature, the integration of AI becomes essential for these organizations to maintain a competitive edge, asserting Brazil's position as a leader in AI adoption in fintech within the Latin American region.

Regulatory Support and Reforms

The Brazilian government has been actively supporting the fintech sector through various regulatory reforms, which are essential for fostering growth in the Brazil AI in Fintech Market. The recent enactment of the Open Banking initiative by the Central Bank aims to increase competition by allowing third-party companies to access customer data, enhancing service personalization through AI.

This initiative follows the positive results reported in other sectors where open data principles have increased innovation.Additionally, regulatory bodies are working towards creating an environment that encourages fintech startups, which contributes to healthy competition and innovation within the financial ecosystem in Brazil.

Increased Cybersecurity Requirements

As the reliance on digital financial services grows, Brazil AI in Fintech Market is also experiencing a heightened focus on cybersecurity. In recent years, Brazil has seen a rise in cyber threats, particularly against the financial sector. In response, regulators have implemented stricter cybersecurity guidelines to protect consumers. For instance, the Central Bank has mandated that financial institutions enhance their cybersecurity frameworks, thus driving demand for AI solutions that can monitor and mitigate risks effectively.

Major entities like the Federation of Banks of Brazil (FEBRABAN) emphasize that the integration of AI in cybersecurity can lead to significant reductions in fraud, creating a safer environment for consumers and businesses.

Brazil AI in Fintech Market Segment Insights

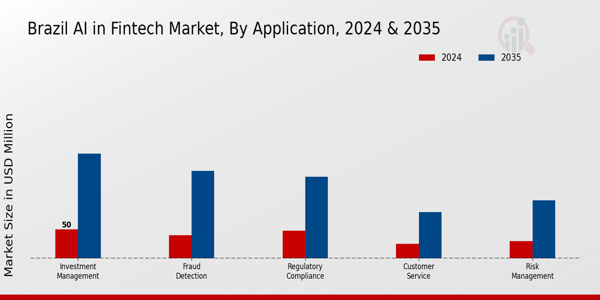

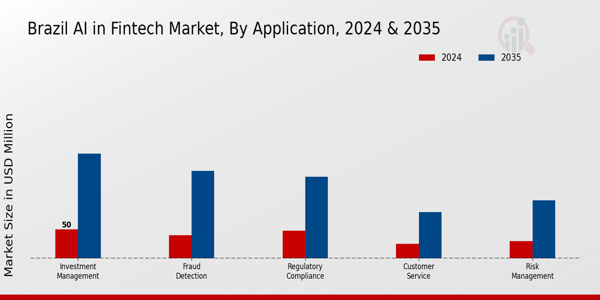

AI in Fintech Market Application Insights

The Brazil AI in Fintech Market, particularly in the Application segment, showcases a focal point that significantly influences the growth of the overall industry. In recent years, the Brazilian government has made strides towards digital transformation, allowing financial services to transition from traditional methods to AI-driven solutions. This transformation has paved the way for enhanced Fraud Detection systems, which utilize advanced algorithms for monitoring transactions in real time, thus enhancing security and consumer trust.

Similarly, Risk Management processes have evolved to harness AI tools, enabling firms to analyze vast amounts of data swiftly, predict potential risks, and provide strategies to mitigate them effectively.

Customer Service has also drastically improved through AI, as chatbots and virtual assistants are now ubiquitous in assisting clients, providing 24/7 support, and significantly reducing wait times. Investment Management relies heavily on AI to analyze market trends and consumer behavior, helping firms make data-driven decisions that align with client goals.

Furthermore, Regulatory Compliance has gained immense importance as firms navigate complex regulations; AI tools can assist in monitoring compliance, ensuring that organizations adhere to financial regulations without incurring hefty penalties.The implications of these advancements hold profound significance for Brazil, as the country’s financial sector strives to innovate while ensuring security and transparency for its users.

As these technology-driven applications dominate the landscape, they present ample opportunities for future growth and development in the Brazilian fintech ecosystem, promising an enriched collaboration between technology and finance. The emphasis placed on refining each of these areas indicates a robust intent by financial institutions to not only adopt but also excel in integrating AI solutions, thereby solidifying Brazil's position as a forward-thinking player in the global fintech arena.Such advancements are likely to empower enterprises to serve their customers more effectively, adapt to changing market dynamics, and ultimately drive the overall market growth within the region.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

AI in Fintech Market End Use Insights

Brazil AI in Fintech Market demonstrates a robust landscape characterized by various end-use segments crucial for driving financial innovation within the nation. The banking sector stands out with a significant emphasis on enhancing customer service through AI-driven chatbots and automated processes, which streamline operations and improve efficiency. Meanwhile, in insurance, AI technology aids in risk assessment and fraud detection, leading to more personalized insurance products and better claim management. Investment firms leverage AI algorithms for predictive analytics, transforming investment strategies and optimizing portfolio management, further enticing investors in a competitive market environment.

Additionally, payment services are experiencing a transformation with the integration of AI for fraud prevention and seamless transaction processing, catering to the growing demands of digital payment solutions among consumers. The combined influence of these sectors is essential for Brazil AI in Fintech Market revenue growth, positioning the country as a notable hub for fintech advancements in Latin America. As technological innovations continue to evolve, opportunities and challenges present themselves, ultimately shaping the future of the financial landscape in Brazil.

AI in Fintech Market Technology Insights

The Brazil AI in Fintech Market is experiencing significant growth, driven by technological advancements. In this market, Machine Learning plays a crucial role by enabling predictive analytics and fraud detection, thereby improving risk management in financial institutions. Natural Language Processing stands out for its capabilities in enhancing customer service through chatbots and virtual assistants, making financial services more accessible to a broader audience. Additionally, Computer Vision is making strides in regulatory compliance and surveillance, enhancing security measures across financial sectors.Robotic Process Automation is streamlining operations, reducing operational costs, and improving efficiency significantly within the financial services landscape.

As these technologies evolve, they collectively contribute to a more efficient and innovative financial ecosystem in Brazil, facilitating the country's progress towards a sophisticated digital economy. The trends within Brazil AI in Fintech Market also indicate that companies are increasingly adopting these technologies to maintain competitive advantage and align with consumer expectations, illustrating a substantial shift towards automation and data-driven decision-making.Emphasizing these technologies is essential for leveraging the potential of AI in reshaping the Brazilian fintech landscape.

AI in Fintech Market Deployment Type Insights

The Brazil AI in Fintech Market is significantly influenced by its Deployment Type segment, which encompasses both On-Premises and Cloud-Based models. The transformation towards cloud-based solutions is evident, driven by the need for scalability, flexibility, and cost-effectiveness among financial institutions. As technology evolves, many Brazilian banks and fintech companies are adopting cloud solutions to enhance their operational efficiency and customer experience, facilitating real-time data processing and advanced analytics. Conversely, On-Premises deployment continues to retain its importance among larger institutions with stringent security and regulatory requirements, providing control over sensitive financial data.

This dual deployment strategy highlights the diversified approach that companies in Brazil are taking to leverage AI technologies. The increasing demand for integrated solutions and improved customer service in the country's rapidly growing fintech sector reinforces the significance of these Deployment Types in shaping the future of finance. Overall, the adoption trends within Brazil AI in Fintech Market are driven by a balance between robust security concerns and the pursuit of technological advancements, underscoring the dynamic nature of the industry.

Brazil AI in Fintech Market Key Players and Competitive Insights

Brazil AI in Fintech Market is experiencing a dynamic and transformative phase, characterized by an influx of innovative technologies and strategic players that are reshaping the financial landscape. The integration of artificial intelligence into fintech solutions has given rise to a new era of financial services, enhancing efficiency, personalization, and risk assessment. Key players are harnessing AI-driven analytics to streamline processes, improve customer engagement, and deliver tailored financial products.

The competitive landscape is marked by a blend of established banks, emerging fintech startups, and technology companies, all seeking to capitalize on the growing demand for intelligent financial solutions. As the market evolves, regulatory compliance, data security, and customer trust remain critical factors influencing competition among industry participants.Within this vibrant ecosystem, Creditas has established a significant presence as a leader in the Brazil AI in Fintech Market. The company has thrived by leveraging advanced AI algorithms to provide innovative lending solutions, particularly in the secured loan sector.

Creditas focuses on streamlining loan applications, risk assessment, and customer service through advanced data analysis and machine learning.

This technology-driven approach allows Creditas to offer competitive interest rates and flexible repayment terms, thus attracting a diverse consumer base. Its proprietary algorithms analyze vast amounts of data to assess creditworthiness accurately, which strengthens its position in the market. Furthermore, Creditas' ability to create personalized financial products based on individual customer profiles enhances customer loyalty and engagement, reinforcing its competitive advantage in the Brazilian financial services landscape.Sicredi is another prominent player within Brazil AI in Fintech Market, operating with a strong cooperative model and a focus on financial inclusion.

The company's key products and services include personal loans, credit cards, and investment solutions tailored to local community needs. Leveraging AI, Sicredi aims to optimize its banking operations and enhance risk management, making banking more accessible to underserved populations. Sicredi's strength lies in its extensive network of branches and community-oriented approach, which cultivates strong customer relationships. Additionally, the company has engaged in strategic partnerships and collaborations to bolster its service offerings and technological capabilities.

Although mergers and acquisitions are not extensively highlighted within their strategy, Sicredi actively explores opportunities to enhance its market position and drive sustainable growth in the Brazilian fintech landscape.

With a solid commitment to innovation and community development, Sicredi plays a crucial role in driving the adoption of AI within Brazil's evolving financial ecosystem.

Key Companies in the Brazil AI in Fintech Market Include

- Creditas

- Sicredi

- Olist

- A saas

- Zeta

- Geru

- Rebel

- Banco Inter

- StoneCo

- Guiabolso

- PagSeguro

- Mercado Livre

- Nubank

- PicPay

Brazil AI in Fintech Market Developments

In Brazil's AI in Fintech Market, there have been significant developments and activities reflecting the robust growth of this sector. Companies like Nubank and PagSeguro have been investing in AI technologies to enhance customer service and risk assessment, driving market growth. In September 2023, Banco Inter announced a partnership with StoneCo to leverage AI for streamlining payment processes, which is expected to improve efficiency. Furthermore, in August 2023, Creditas secured a new funding round aimed at expanding its AI capabilities in credit scoring.

Notably, in July 2023, Sicredi integrated AI into its platform to personalize user experiences, demonstrating the industry's shift towards more innovative solutions.

The growth in market valuation for fintech companies such as Olist and A saas has been notable, with Olist reporting a 30% increase in year-over-year revenue, indicative of the growing demand for AI-driven financial services. Over the past few years, from 2021 to 2023, Brazil has seen a surge in AI adoption in fintech, with companies like Mercados Livre and Rebel also making strides in developing AI-driven platforms for improved customer engagement. As Brazil continues to embrace digital transformation, the AI in Fintech Market is poised for further advancements.

Brazil AI in Fintech Market Segmentation Insights

AI in Fintech Market Application Outlook

- Fraud Detection

- Risk Management

- Customer Service

- Investment Management

- Regulatory Compliance

AI in Fintech Market End Use Outlook

- Banking

- Insurance

- Investment Firms

- Payment Services

AI in Fintech Market Technology Outlook

- Machine Learning

- Natural Language Processing

- Computer Vision

- Robotic Process Automation

AI in Fintech Market Deployment Type Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

170.73(USD Million) |

| MARKET SIZE 2024 |

192.78(USD Million) |

| MARKET SIZE 2035 |

650.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

11.683% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Creditas, Sicredi, Olist, Asaas, Zeta, Geru, Rebel, Banco Inter, StoneCo, Guiabolso, PagSeguro, Mercado Livre, Nubank, PicPay |

| SEGMENTS COVERED |

Application, End Use, Technology, Deployment Type |

| KEY MARKET OPPORTUNITIES |

Personalized financial advisory services, Fraud detection and risk management, Automated customer service solutions, Credit scoring via AI analytics, Regulatory compliance automation tools |

| KEY MARKET DYNAMICS |

Regulatory compliance challenges, Rising investment in AI, Consumer demand for personalization, Integration with legacy systems, Data security and privacy concerns |

| COUNTRIES COVERED |

Brazil |

Frequently Asked Questions (FAQ):

The Brazil AI in Fintech Market is expected to be valued at 192.78 USD Million in 2024.

By 2035, the Brazil AI in Fintech Market is projected to reach a valuation of 650.0 USD Million.

The expected CAGR for the Brazil AI in Fintech Market from 2025 to 2035 is 11.683%.

The Investment Management segment is expected to grow to 180.0 USD Million by 2035.

The Fraud Detection application is projected to be valued at 40.0 USD Million in 2024.

The Risk Management application is expected to reach a value of 100.0 USD Million by 2035.

Major players in the market include Creditas, Sicredi, Olist, Asaas, and Nubank.

Customer Service applications are anticipated to be valued at 80.0 USD Million by 2035.

The Regulatory Compliance segment is expected to be valued at 140.0 USD Million by 2035.

The market will likely experience growth driven by advancements in technology and increasing demand for efficient financial solutions.