Investment in Cybersecurity Measures

As the ai in-fintech market in South America continues to expand, the need for robust cybersecurity measures becomes increasingly paramount. Financial institutions are recognizing the potential risks associated with cyber threats, particularly as they adopt AI technologies. Recent reports indicate that cybercrime costs in the financial sector could reach $6 trillion annually by 2025. In response, companies are investing heavily in AI-driven cybersecurity solutions to protect sensitive customer data and maintain trust. These solutions leverage machine learning to identify and mitigate threats proactively. This focus on cybersecurity not only safeguards financial transactions but also enhances the overall integrity of the ai in-fintech market, as consumers become more aware of the importance of data protection.

Expansion of Digital Payment Solutions

The proliferation of digital payment solutions is a critical driver for the ai in-fintech market in South America. With the increasing penetration of smartphones and internet access, consumers are gravitating towards digital payment methods. Recent data suggests that mobile payment transactions in the region are expected to exceed $100 billion by 2026. This surge is prompting financial institutions to adopt AI technologies to enhance transaction security, streamline processes, and improve user experience. AI algorithms are being utilized to detect fraudulent activities in real-time, thereby instilling greater confidence among users. Consequently, the expansion of digital payment solutions is likely to propel the growth of the ai in-fintech market, as companies seek to innovate and remain competitive in a rapidly evolving landscape.

Growing Interest in Blockchain Technology

The growing interest in blockchain technology is emerging as a significant driver for the ai in-fintech market in South America. Financial institutions are exploring the integration of AI with blockchain to enhance transparency, security, and efficiency in transactions. Recent studies indicate that the blockchain market in the region is projected to reach $1.5 billion by 2027. This convergence of technologies is likely to facilitate the development of innovative financial products and services, such as smart contracts and decentralized finance solutions. By leveraging AI capabilities, companies can analyze blockchain data more effectively, leading to improved decision-making processes. Consequently, the synergy between AI and blockchain may catalyze transformative changes within the ai in-fintech market, positioning South America as a hub for technological advancement.

Government Initiatives to Foster Innovation

Government initiatives aimed at fostering innovation play a pivotal role in shaping the ai in-fintech market in South America. Various countries in the region are implementing policies that encourage the development and adoption of AI technologies within the financial sector. For instance, regulatory frameworks are being established to support startups and promote research and development. These initiatives are likely to create a conducive environment for innovation, enabling companies to explore new AI applications in finance. As a result, the ai in-fintech market may witness accelerated growth, with an increasing number of startups emerging to address specific financial challenges. This supportive ecosystem could lead to enhanced collaboration between public and private sectors, further driving advancements in the industry.

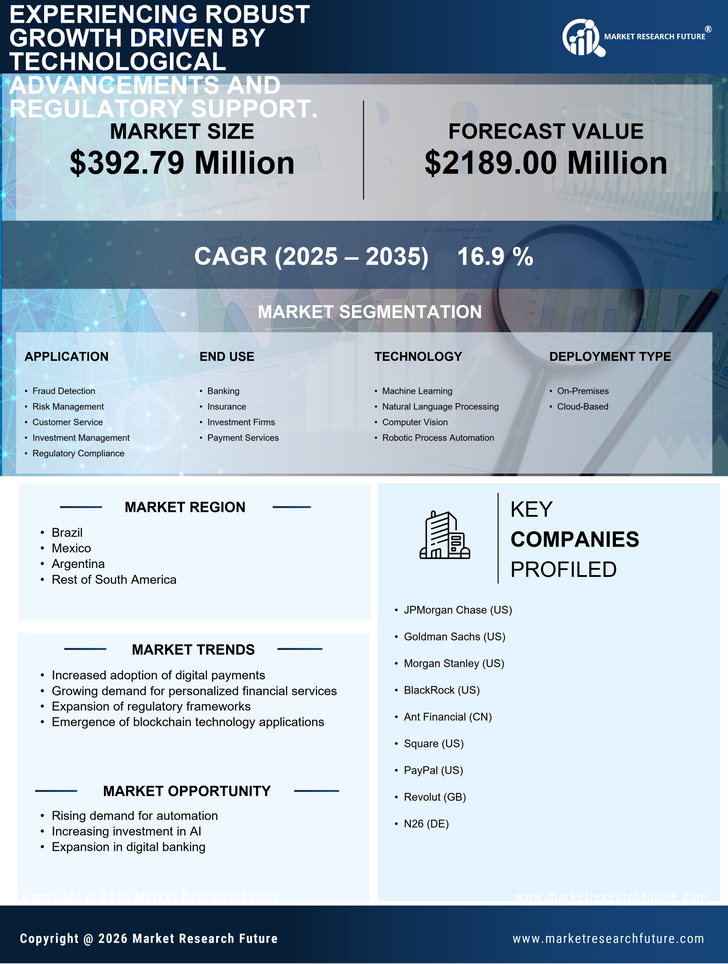

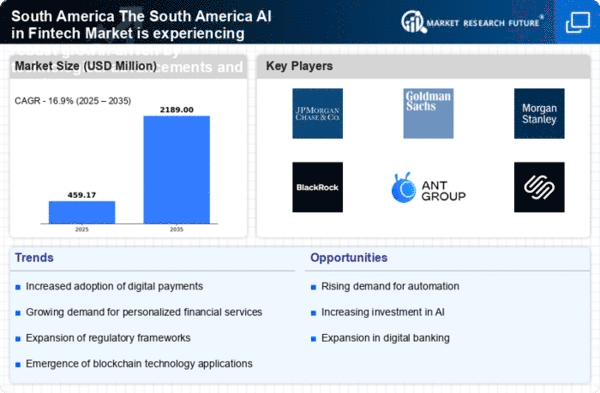

Rising Demand for Personalized Financial Services

The ai in-fintech market in South America is experiencing a notable shift towards personalized financial services. Consumers increasingly seek tailored solutions that cater to their unique financial situations. This demand is driven by the growing availability of data analytics and machine learning technologies, which enable financial institutions to offer customized products. According to recent estimates, the market for personalized financial services is projected to grow by approximately 25% annually. As a result, companies are investing in AI-driven platforms that enhance customer engagement and satisfaction, thereby fostering loyalty and retention. This trend indicates a significant opportunity for innovation within the ai in-fintech market, as firms strive to leverage AI capabilities to meet evolving consumer expectations.