Brazil Financial Cloud Market Overview

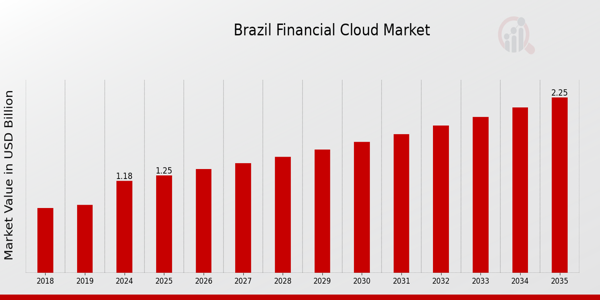

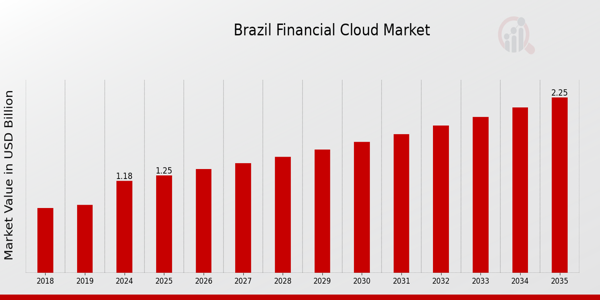

As per MRFR analysis, the Brazil Financial Cloud Market Size was estimated at 1.11 (USD Billion) in 2023.The Brazil Financial Cloud Market Industry is expected to grow from 1.18(USD Billion) in 2024 to 2.24 (USD Billion) by 2035. The Brazil Financial Cloud Market CAGR (growth rate) is expected to be around 6.033% during the forecast period (2025 - 2035)

Key Brazil Financial Cloud Market Trends Highlighted

The Brazil Financial Cloud Market is experiencing significant growth, driven primarily by the increasing digital transformation among financial institutions. Banks and fintech companies in Brazil are rapidly adopting cloud technology to improve operational efficiency, enhance customer experiences, and meet regulatory compliance. This shift is fueled by the Brazilian Central Bank's initiatives promoting innovation and technology adoption in the financial sector, creating a conducive environment for cloud solutions. There are substantial opportunities to be explored, particularly in the areas of data security and analytics.

As financial organizations process vast amounts of sensitive customer information, there is a pressing need for robust security measures.Additionally, with the rise of data-driven decision-making, cloud solutions that offer advanced analytics capabilities can help businesses gain valuable insights into customer behavior and market trends. Recent trends indicate a strong movement towards hybrid and multi-cloud strategies among Brazilian financial institutions. This approach allows organizations to combine on-premises infrastructure with cloud services, providing greater flexibility and scalability.

Furthermore, the collaboration between traditional banks and fintech startups is becoming more prominent, enhancing innovation and expanding service offerings. The adaptation of cloud solutions is also being expedited by investments in infrastructure, as companies recognize the importance of staying competitive in an increasingly digital landscape. Overall, the Brazil Financial Cloud Market is set to evolve significantly in response to technological advancements and shifting consumer expectations, demonstrating a promising trajectory in the coming years.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Brazil Financial Cloud Market Drivers

Digital Transformation in Brazilian Financial Institutions

The Brazil Financial Cloud Market Industry is growing rapidly, owing mostly to the continuous digital transformation of Brazil's financial institutions. According to research published by the Brazilian Federation of Banks (FEBRABAN), over 89% of Brazilian banks have adopted digitization in various forms, with approximately 80% of banking transactions currently handled digitally. This change to digital platforms needed collaboration with cloud service providers in order to improve customer service, save operating costs, and meet severe regulatory standards.

Established businesses, such as Ita Unibanco and Banco do Brasil, are substantially investing in cloud technology to improve their operations and provide novel financial services. Their significant investment in cloud infrastructure not only benefits the economy but also sets a standard for other institutions to follow, moving the Brazil Financial Cloud Market Industry ahead.

Regulatory Compliance and Data Security Requirements

In Brazil, regulatory compliance and data security measures are critical drivers of growth for the Brazil Financial Cloud Market Industry. The General Data Protection Law (LGPD), which was enacted in 2020, has given businesses a stringent framework to adhere to when handling customer data. A recent survey indicated that approximately 60% of Brazilian financial institutions consider compliance with LGPD as a top priority, driving them to invest in secure cloud solutions.

Organizations such as the Brazilian Central Bank (Banco Central do Brasil) have put pressure on banks to enhance their regulatory compliance mechanisms, which, in turn, accelerates the adoption of cloud-based solutions that are equipped with advanced security features. This focus on regulatory compliance is thus contributing to the growth of the Brazil Financial Cloud Market Industry.

Increase in Financial Technology Startups

The rapid growth of financial technology (fintech) startups in Brazil is a substantial driver for the Brazil Financial Cloud Market Industry. In recent years, Brazil has established itself as a fintech hub, boasting over 1,000 active fintech companies, according to AbFintechs (the Brazilian Association of Fintechs). These companies are leveraging cloud technologies to offer innovative solutions such as peer-to-peer lending, digital wallets, and robo-advisors.

For instance, companies like Nubank and PagSeguro have gained millions of users, highlighting the substantial market share these startups are capturing. The increasing demand for agile, cost-effective, and scalable financial solutions from these startups is propelling the adoption of cloud services, thereby fueling the growth of the Brazil Financial Cloud Market Industry.

Rising Demand for Scalable Financial Solutions

The need for scalable financial solutions is becoming increasingly vital in the Brazil Financial Cloud Market Industry. Many traditional financial institutions are struggling with legacy systems that limit their ability to scale efficiently. According to a study conducted by the Brazilian Association of Private Banks, around 70% of banks are seeking cloud solutions to overcome the limitations posed by outdated systems.

Prominent organizations such as Bradesco are increasingly moving their operations to cloud platforms in order to maintain competitive advantages and improve service delivery.The demand for scalable cloud-based financial solutions is thus gaining momentum in Brazil, serving as a key driver for the growth of the Brazil Financial Cloud Market Industry.

Brazil Financial Cloud Market Segment Insights

Financial Cloud Market Component Insights

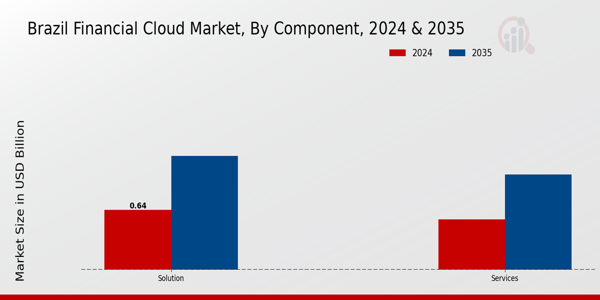

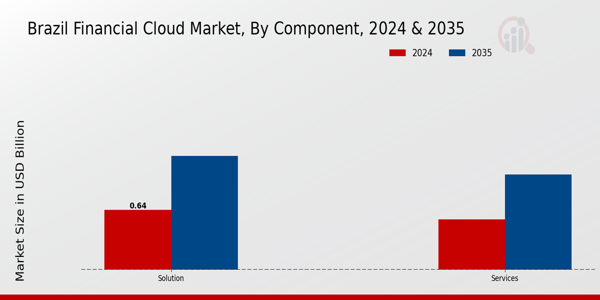

The Brazil Financial Cloud Market is characterized by a robust Component segment, which plays a pivotal role in shaping the overall landscape of the industry. This segment encompasses a variety of offerings that cater to the evolving needs of financial institutions and service providers within Brazil. The Component segment is broadly divided into two key areas: solutions and services, each contributing uniquely to market dynamics. Solutions in this sector include innovative software applications, platforms, and infrastructure that enable financial entities to leverage cloud technology for enhanced operational efficiency, security, and compliance.

The growing demand for digital transformation among banks and financial corporations is a significant driver for these solutions, facilitating real-time data access, streamlined processes, and improved customer experiences. On the other hand, services within the Component segment encompass a wide range of support functions, including consulting, deployment, and ongoing management, which are essential for ensuring successful adoption and integration of cloud technologies in various financial operations. The trend towards outsourcing IT services to specialized providers contributes to the expansion of this segment, allowing financial organizations to focus on core competencies while enhancing their technological capabilities.

With the government of Brazil encouraging digital innovation and supporting the fintech ecosystem, there is a favorable backdrop for the growth of the Component segment. This evolving landscape also presents challenges such as data privacy concerns and regulatory compliance that organizations must navigate. However, the opportunities outweigh these challenges, particularly as the demand for agile, scalable, and cost-effective financial solutions continues to grow. Overall, the Component segment stands as a critical foundation for fostering innovation and driving sustainable growth in the Brazil Financial Cloud Market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Financial Cloud Market Cloud Type Insights

The Brazil Financial Cloud Market is experiencing notable growth, driven by the increasing digitization of financial services, which emphasizes the importance of technology in enhancing operational efficiency. Within this market, the Cloud Type segmentation plays a critical role, with key categories including Public Cloud and Private Cloud. The Public Cloud is often adopted due to its cost-effectiveness and scalability, making it a popular choice among startups and smaller financial institutions looking to optimize their resources.

Conversely, Private Cloud holds significant appeal for larger corporations that require heightened security and control over their data, positioning it as a vital component of the financial sector to comply with stringent regulations.

The rising demand for cloud-based solutions in Brazil correlates closely with the country's commitment to innovation in the fintech sector, supported by favorable government initiatives. The evolving landscape of financial services presents both challenges and opportunities for organizations, reinforcing the necessity for robust cloud infrastructure to meet customer expectations while navigating regulatory frameworks. As these segments continue to evolve, they are anticipated to shape the future of the Brazil Financial Cloud Market, defining how financial institutions operate and serve their clients effectively.

Financial Cloud Market Organization Size Insights

The Brazil Financial Cloud Market, particularly in the Organization size segment, displays significant diversity in its application across various sectors. The banking and financial services sector stands out as a substantial contributor to this market, driven by the increasing demand for digital transformation, enhanced operational efficiency, and compliance with regulatory standards. Organizations within this sector are embracing cloud solutions to streamline their processes and improve customer experiences, thereby gaining a competitive edge in the fast-evolving financial landscape.

Similarly, the insurance industry is leveraging financial cloud technologies to modernize its operations, enhance risk management, and support data-driven decision-making. As insurance providers in Brazil face challenges like rapid technological advancements and changing consumer expectations, cloud solutions help them become more agile and responsive. This emphasis on digitization reflects a broader trend in Brazil, where companies are increasingly shifting toward cloud-based infrastructures to optimize performance and drive innovation, positioning themselves to capture emerging opportunities effectively.

Brazil Financial Cloud Market Key Players and Competitive Insights

The Brazil Financial Cloud Market has become an arena of intense competition as businesses increasingly adopt cloud technologies to enhance operational efficiency and deliver better services to customers. This growth is fueled by the rising demand for secure, scalable, and cost-effective financial solutions that can be tailored to meet the evolving needs of various organizations, from small startups to large enterprises.

The market is characterized by several key players that bring unique value propositions, enabling them to carve out significant market shares. With the increased focus on digital transformation, regulatory compliance, and data security, understanding the competitive position of these players is critical for investors, stakeholders, and businesses considering entering this dynamic landscape.SAP stands out in the Brazil Financial Cloud Market with its comprehensive portfolio of cloud-based financial solutions that cater to companies across various industries.

The firm is known for its robust enterprise resource planning (ERP) systems that integrate financial management capabilities, allowing organizations to streamline processes, enhance reporting accuracy, and improve decision-making.

SAP's strong market presence in Brazil is supported by its local partnerships and expertise in navigating the regulatory framework, which is particularly important in the financial services sector. Its ability to offer tailored solutions that address unique market challenges strengthens SAP’s position in the regional landscape.

Furthermore, the company invests significantly in research and development to innovate and adapt its offerings to align with local market needs, ensuring a competitive edge over other players in the industry.Cisco plays a pivotal role in the Brazil Financial Cloud Market by leveraging its advanced networking and security technologies to support financial institutions as they transition to cloud environments.

The company provides a range of services, including networking solutions that enable seamless data flow and communication, as well as security tools that help safeguard sensitive financial data. Cisco's strengths lie in its established brand reputation, extensive portfolio of products, and commitment to innovation, which positions it as a trusted partner for financial organizations. Additionally, Cisco has been actively involved in strategic mergers and acquisitions to enhance its capabilities in cloud solutions, enhancing its competitive foothold in Brazil.

Through these efforts, Cisco continues to strengthen its market presence, addressing the growing demand for cloud-based financial services while ensuring robust cybersecurity measures are in place to protect client data and comply with local regulations.

Key Companies in the Brazil Financial Cloud Market Include

- SAP

- Cisco

- Capgemini

- Google Cloud

- Accenture

- Infosys

- Atos

- Microsoft

- Alibaba Cloud

- Rackspace

- Oracle

- IBM

- Salesforce

- VMware

- Amazon Web Services

Brazil Financial Cloud Industry Developments

The Brazil Financial Cloud Market has witnessed significant developments recently, with increases in market valuations leading to robust growth opportunities. Notably, in May 2023, SAP announced a partnership with Brazil's Banco do Brasil to enhance cloud financial services, aiming to leverage SAP's technology for improved efficiency in banking operations. In terms of mergers and acquisitions, in June 2023, Microsoft acquired a regional cloud services provider to bolster its presence in Brazil, ensuring enhanced compliance with local data regulations.

There have been notable growth trends, as evidenced by IBM's reported 25% year-over-year growth in cloud services in Brazil as of January 2023, indicating a strong shift towards digital solutions among financial institutions.

The rise of remote banking and digital finance platforms has accelerated the demand for secure and scalable financial cloud solutions, further stimulating activity within this sector. Over the last two to three years, significant advancements in cloud adoption have reshaped the financial services landscape in Brazil, with ongoing investments from major players like Oracle and Amazon Web Services helping to drive innovation and competition.

Brazil Financial Cloud Market Segmentation Insights

Financial Cloud Market Component Outlook

Financial Cloud Market Cloud Type Outlook

- Public Cloud

- Private Cloud

Financial Cloud Market Organization Size Outlook

- Sub-industry (Banking and financial services)

- Sub-industry (insurance)

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

1.11(USD Billion) |

| MARKET SIZE 2024 |

1.18(USD Billion) |

| MARKET SIZE 2035 |

2.24(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

6.033% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

SAP, Cisco, Capgemini, Google Cloud, Accenture, Infosys, Atos, Microsoft, Alibaba Cloud, Rackspace, Oracle, IBM, Salesforce, VMware, Amazon Web Services |

| SEGMENTS COVERED |

Component, Cloud Type, Organization size |

| KEY MARKET OPPORTUNITIES |

Regulatory compliance solutions, Digital payment integrations, Financial data analytics tools, Cloud-based risk management systems, Enhanced cybersecurity services |

| KEY MARKET DYNAMICS |

regulatory compliance requirements, increasing adoption of fintech, demand for data security, digital transformation initiatives, cost optimization strategies |

| COUNTRIES COVERED |

Brazil |

Frequently Asked Questions (FAQ):

The Brazil Financial Cloud Market is expected to be valued at 1.18 billion USD in 2024.

By 2035, the Brazil Financial Cloud Market is anticipated to reach a valuation of 2.24 billion USD.

The market is projected to grow at a CAGR of 6.033% from 2025 to 2035.

In 2024, the solutions segment is valued at 0.64 billion USD.

The services segment is expected to grow to a value of 1.02 billion USD by 2035.

Major players include SAP, Cisco, Google Cloud, Microsoft, and Amazon Web Services among others.

Increased adoption of advanced analytics and enhanced security measures are notable trends.

Data privacy concerns and regulatory compliance are significant challenges for the market.

The Brazil Financial Cloud Market exhibits a strong growth rate, driven by increasing digital transformation.

Key applications include financial management, risk compliance, and data storage solutions.