Customer-Centric Innovations

In the Digital Transformation In BFSI Market, customer-centric innovations are paramount. Financial institutions are increasingly focusing on enhancing customer experiences through personalized services and tailored solutions. The rise of digital banking has led to a shift in consumer expectations, with customers demanding seamless and efficient interactions. Institutions are leveraging data analytics and artificial intelligence to gain insights into customer behavior, enabling them to offer customized products. Recent studies suggest that organizations prioritizing customer experience are likely to see a 20% increase in customer satisfaction and retention rates. This emphasis on customer-centricity is driving the digital transformation agenda, compelling institutions to innovate continuously and adapt to changing consumer preferences.

Increased Focus on Data Analytics

An increased focus on data analytics is shaping the Digital Transformation In BFSI Market. Financial institutions are recognizing the value of data in driving strategic decision-making and enhancing operational efficiency. By harnessing big data analytics, institutions can gain insights into market trends, customer behavior, and risk management. This analytical approach enables organizations to make informed decisions, optimize resource allocation, and improve service delivery. According to industry reports, the data analytics market in the BFSI sector is expected to grow to USD 30 billion by 2025. This growth reflects the critical role of data in informing strategies and driving the digital transformation agenda within the industry.

Rise of Digital Payment Solutions

The rise of digital payment solutions is transforming the Digital Transformation In BFSI Market. With the increasing adoption of mobile wallets, contactless payments, and online banking, consumers are shifting away from traditional payment methods. This trend is driven by the convenience and speed offered by digital payment platforms. Recent data indicates that the digital payment market is projected to grow at a compound annual growth rate of 13% over the next five years. Financial institutions are investing in secure and efficient payment systems to capture this growing demand. As a result, the digital payment landscape is evolving, compelling institutions to enhance their offerings and ensure a seamless payment experience for customers.

Regulatory Compliance and Standards

The Digital Transformation In BFSI Market is increasingly influenced by the need for regulatory compliance. Financial institutions are required to adhere to stringent regulations, which necessitates the adoption of advanced technologies. This transformation is driven by the need to ensure data privacy, anti-money laundering, and consumer protection. As regulations evolve, institutions are compelled to invest in digital solutions that facilitate compliance. For instance, the implementation of automated reporting systems and real-time monitoring tools has become essential. According to recent data, compliance-related technology spending in the BFSI sector is projected to reach USD 10 billion by 2026, indicating a robust growth trajectory. This trend underscores the critical role of regulatory compliance in shaping the digital landscape of the BFSI market.

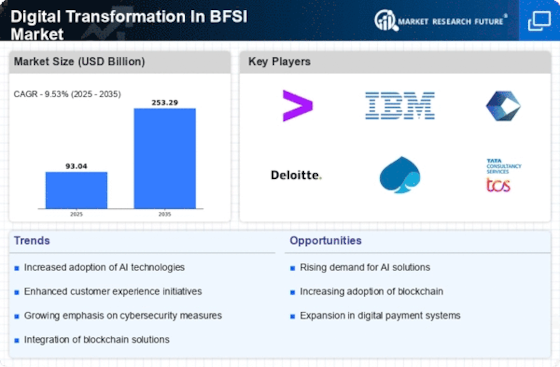

Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the Digital Transformation In BFSI Market. Technologies such as blockchain, artificial intelligence, and big data analytics are being adopted to enhance operational efficiency and improve service delivery. For example, blockchain technology is being utilized for secure transactions and to streamline processes, reducing the time and cost associated with traditional banking methods. Furthermore, the global market for AI in the BFSI sector is expected to reach USD 22 billion by 2025, reflecting the growing reliance on technology to drive innovation. This integration not only enhances operational capabilities but also positions institutions to respond more effectively to market demands.