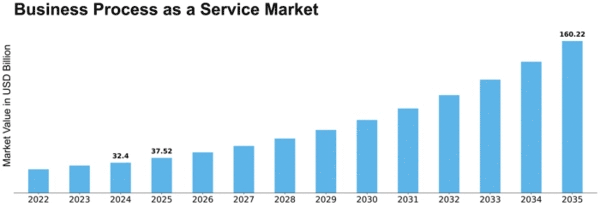

Business Process As A Service Size

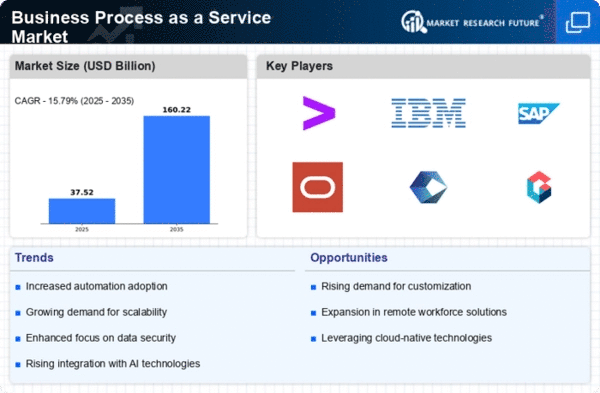

Business Process as a Service Market Growth Projections and Opportunities

The factors that drive and shape the market of Business Process as a Service (BPaaS) include various important factors. The main factor behind this market development is the increasingly important role companies are placing on cost reduction and efficiency in operations. There is a growing need of BPaaS solutions (a business process as a service) which are standardized and effective as the companies strive to streamline the operations and make them efficient. Of all operational efficiency routes taken, BPaaS has been adopted amongst some verticals and has boosted market expansion. This market has been strongly affected by the change of digital transformation pace and the cooperation with cloud solutions as a service providers. Cloud computing is quickly becoming an indispensable part of business environment where it is used for its scalability, flexibility and easy access to modern BPM solutions. The BPaaS model with its flexible options offered, has designed delivery on cloud which is the preferred option to many companies trying to modernize the operations and have to adjust to a changing digital world. This is driving the rapid growth of the market. BPaaS support has also been driven by the need for specific expertise; this, as well as the business operation complexities, has also been a factor. Directing complex and sophisticated business processes, which include for example supply chain management, customer service, human resources, and finance and accounting, might be a burden for most firms. Companies in the market place recognise the value in customized and domain-specific knowledge provided by providers of BPaaS and therefore there is a growth of the BPaaS market. Crucial market elements for BPaaS solutions have also been their affordability and scalability. Organizations may achieve lower capital expenses, predictable operating costs, and the flexibility to grow their business process management capabilities in accordance with their changing demands by using BPaaS services. Because BPaaS is scalable and affordable, it has drawn interest from small and medium-sized organizations to major corporations, propelling market development in a variety of market areas. Furthermore, the proliferation of BPaaS solutions may be attributed to the growing emphasis on agility and business resilience. Organizations require flexible and agile process management systems that can effectively react to changes in the market and business demands in today's fast-paced and dynamic business environment. Because of its flexible and on-demand service delivery approach, business process as a service (BPaaS) allows firms to quickly adjust their workflows, improve their overall operational flexibility, and accelerate market growth. The BPaaS market has also been impacted by the expanding trend of business process outsourcing (BPO) and the combination of BPO and technology-driven services. The need for BPaaS providers that provide integrated technology platforms, value-added services, and complete process management has grown as companies seek to outsource non-essential operations and concentrate on their core capabilities. The development of comprehensive business process management options has resulted from the confluence of technology-driven BPaaS solutions and BPO, propelling the growth and evolution of the market.

Leave a Comment