Global Butadiene Market Overview

As per MRFR analysis, the Butadiene Market Size was estimated at 24.11 (USD Billion) in 2023.The Butadiene Market is expected to grow from 24.87 (USD Billion) in 2024 to 35 (USD Billion) by 2035. The Butadiene Market CAGR (growth rate) is expected to be around 3.16% during the forecast period (2025 - 2035)

Key Butadiene Market Trends Highlighted

The Butadiene Market is driven by the growing demand for synthetic rubber, particularly in the automotive sector, where it is a key ingredient in the production of tires and various rubber products. As countries focus on strengthening their automotive industries, the need for butadiene has expanded. Additionally, the shift towards environmentally friendly and sustainable practices is prompting manufacturers to explore bio-based alternatives, creating new usage opportunities. Recent trends indicate a rise in the production of butadiene from unconventional sources, such as crude oil and natural gas liquids, which diversifies supply and reduces dependency on traditional feedstocks.

Geopolitical factors and trade policies also have a big impact on how markets work, which creates both problems and opportunities for stakeholders. For example, changes in tariffs and rules about how goods are made can change prices and availability. As countries try to cut down on carbon emissions, new ways to recycle synthetic rubber and extract butadiene are becoming more popular. This is part of a larger trend in manufacturing toward using more sustainable materials. There are also chances in new markets where industrialization is happening, which could mean more butadiene use. More money spent on research and development will lead to more progress in butadiene production technologies, making them more efficient and environmentally friendly.

This evolving landscape underscores the critical importance of adaptability in strategies for stakeholders in the Butadiene Market.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Butadiene Market Drivers

Increasing Demand from Automotive Industry

The Butadiene Market is significantly influenced by the increasing demand for synthetic rubber in the automotive sector. The automotive manufacturing industry has been experiencing a surge in production, with vehicle production estimated to reach approximately 100 million units annually, as per the International Organization of Motor Vehicle Manufacturers. This demand amplifies the need for butadiene, which is a key component in the production of synthetic rubber used in tires and other vehicle parts.

In addition, the push towards eco-friendly vehicles and advanced materials has led manufacturers to adopt higher quantities of synthetic rubber, further driving the butadiene market. The commitment from leading automotive players towards electric and hybrid vehicles is also likely to increase demand for advanced synthetic materials, providing additional growth opportunities for the Butadiene Market.

Rising Demand for Plastics and Resins

The Butadiene Market is driven by the burgeoning demand for plastics and resins across various sectors, including construction, consumer goods, and electronics. According to the Plastics Industry Association, the U.S. plastic industry alone was valued at over 400 billion USD as of 2021, showcasing sustained growth potential. The application of butadiene in producing thermoplastic elastomers and as a precursor in the manufacturing of various plastics fosters its market expansion.

Additionally, the growing emphasis on lightweight and durable materials in industries such as packaging further fuels the butadiene market, aligning with trends towards sustainability and resource efficiency.

Technological Advancements in Butadiene Production

Innovations in the chemical synthesis and extraction techniques of butadiene are poised to impact the Butadiene Market positively. The adoption of advanced technologies such as oxidative dehydrogenation and the development of bio-based production methods are projected to improve yield and reduce costs. For instance, ongoing Research and Development efforts funded by both governmental initiatives and private sector entities aim to enhance operational efficiencies and lower environmental impacts, following directives from organizations such as the United Nations Environment Programme.

These advancements will likely streamline the production processes of butadiene, making it more accessible and economically viable for a variety of applications, ultimately boosting market growth.

Growth in Emerging Economies

Emerging economies in the Asia-Pacific and Latin America regions are experiencing rapid industrialization, significantly affecting the Butadiene Market positively. According to the Asian Development Bank, the Asia-Pacific region is projected to account for almost 60% of manufacturing output by 2030. This increase in industrial activities and urbanization in these regions is expected to amplify the demand for butadiene, both as a raw material for manufacturing and in downstream applications such as automotive and consumer products.

The proactive governmental policies aimed at fostering industrial growth in these regions create a conducive environment for the butadiene market, further reinforcing its expansion trajectory.

Butadiene Market Segment Insights

Butadiene Market Application Insights

The Butadiene Market exhibits a diverse range of applications that are crucial for various industries and contribute significantly to the overall market dynamics. Within this sphere, the total valuation for 2024 stands at 24.87 USD billion, expected to grow robustly by 2035, reaching 35.0 USD billion. Major applications include Synthetic Rubber, which dominates with a substantial valuation of 10.0 USD Billion in 2024, projected to increase to 14.5 USD Billion by 2035. This specific application is critical due to its widespread use in tire manufacturing, automotive components, and various rubber goods.

Following it, Acrylonitrile Butadiene Styrene holds a significant position with a valuation of 5.5 USD Billion in 2024, anticipated to rise to 8.0 USD Billion in 2035. This material is noted for its strength and versatility, making it vital in producing consumer goods, automotive interior parts, and electronic housings. Butadiene Rubber, valued at 6.0 USD billion in 2024 and expected to grow to 8.5 USD billion by 2035, is another key application, primarily utilized in the production of high-performance tires and industrial applications due to its excellent resilience and elasticity.

Lastly, Latex is projected to have a value of 3.37 USD Billion in 2024, expected to reach 4.0 USD Billion by 2035, serving a wide range of applications in gloves, paints, and adhesives. The continued demand for these applications is driven by advancements in the automotive and consumer goods sectors, which rely heavily on the properties that these butadiene-based materials offer. The Butadiene Market segmentation showcases a clear trend toward increased utilization and innovation across these applications, reflecting their importance in driving market growth and adapting to evolving consumer and industrial needs.

As markets evolve, sustainability practices and innovations will play a critical role in shaping the demand and applications of butadiene, thus offering new opportunities within the industry.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Butadiene Market End Use Insights

The Butadiene Market is diverse and segmented by various end uses, showcasing its vital role in multiple industries. As of 2024, the overall market is valued at approximately 24.87 USD billion, highlighting the significance of increasing utilization in manufacturing processes. Notably, the automotive sector is a major consumer, utilizing butadiene to produce synthetic rubber for tires, providing durability and performance. Footwear also contributes substantially to the market, with the material's flexibility and resilience making it ideal for various types of footwear.

In the textile industry, butadiene plays a crucial role in creating synthetic fibers, thus enhancing fabric properties and offering better durability. Consumer goods represent another prominent avenue where butadiene-derived materials are used to manufacture various everyday products, ensuring quality and longevity. The growth in these end-use applications is driven by increasing demand for durable products, innovations in synthetic material production, and an emphasis on sustainability. Challenges such as fluctuating raw material prices and environmental regulations could impact the market; however, ongoing Research and Development efforts present numerous opportunities for future growth within the Butadiene Market.

Butadiene Market Production Method Insights

The Butadiene Market is expected to showcase significant growth in the coming years, with a projected valuation of 24.87 billion USD by 2024 and a rise to 35.0 billion USD by 2035. The market segmentation around Production Method highlights various techniques, each playing a critical role in butadiene production. Steam Cracking is one of the most commonly employed methods, recognized for its efficiency in producing high yields of butadiene from hydrocarbons. Dehydrogenation also holds importance, particularly in converting hydrocarbons into higher-value butadiene; this method is gaining traction due to advancements in catalyst technology.

Extraction methods contribute to the market by isolating butadiene from other hydrocarbons, while Catalytic Cracking is notable for its ability to maximize output from crude oil and natural gas derivatives. The combination of these production techniques helps meet the rising demand for butadiene, which is key in the manufacturing of synthetic rubber, plastics, and various chemicals. As environmental regulations tighten, there is a trend towards adopting more efficient and sustainable production conventions in the Butadiene Market, fueling continued growth and innovation in these production methods.

Butadiene Market Purity Level Insights

The Butadiene Market, particularly in the context of Purity Level, is poised for growth as it focuses on various grades of butadiene, each catering to unique industrial applications. By 2024, the market is expected to reach a value of approximately 24.87 USD billion, driven by strong demand across sectors such as automotive, synthetic rubber, and plastics. Within this segment, Standard Butadiene serves as the backbone for numerous manufacturing processes, offering a cost-effective solution for producing synthetic rubbers used in tires and other automotive components.

High Purity Butadiene is significantly crucial for the production of specialty chemicals and polymers, ensuring optimal performance in high-tech applications, which will see increased adoption in various industries. Technical Grade Butadiene is widely used in the petrochemical industry and is essential for producing a range of products, including resins and polymers. This segment's importance is underscored by evolving trends toward eco-friendly products, fostering innovation in butadiene production and applications. As the market dynamics shift, driven by changing consumer preferences and technological advancements, the segmentation around purity levels will continue to significantly influence the overall Butadiene Market statistics and growth trajectories in the coming years.

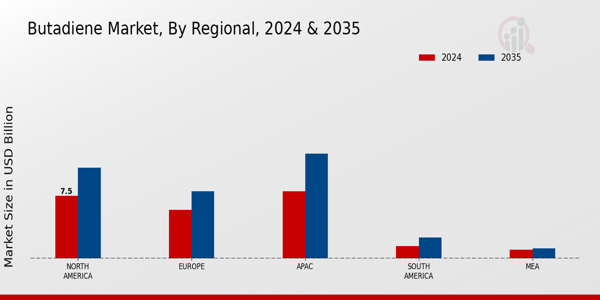

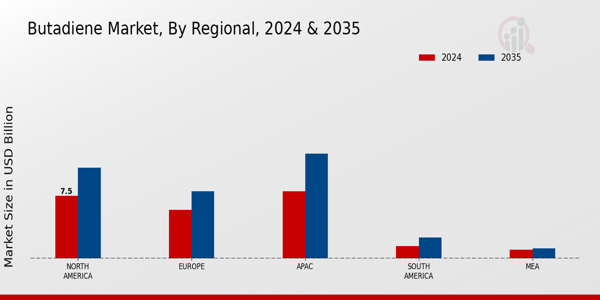

Butadiene Market Regional Insights

The Butadiene Market is poised for growth across various regions, with significant valuations expected by 2024. Notably, the North America region holds a valuation of 6.0 USD billion, reflecting its robust production capacity and demand for synthetic rubber and plastics. Europe follows closely with a market value of 5.5 USD Billion, driven by its strong automotive sector, which relies heavily on butadiene derivatives. The Asia Pacific region dominates the Butadiene Market with a substantial valuation of 10.5 USD Billion in 2024, supported by rapid industrialization and increasing demand for plastics across countries like China and India.

South America, although smaller, shows promise with a market value of 2.0 USD billion, bolstered by emerging economies investing in production capabilities. The Middle East and Africa region represents a smaller portion of the market at 1.87 USD billion, yet it benefits from abundant oil resources that facilitate butadiene production. This diverse regional segmentation illustrates the Butadiene Market's expansion potential, influenced by varying growth drivers, manufacturing capacities, and regional demands for butadiene applications in sectors such as automotive, construction, and consumer goods.

Furthermore, understanding these regional dynamics is essential for stakeholders as they navigate opportunities and challenges in this evolving market landscape.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Butadiene Market Key Players and Competitive Insights

The Butadiene Market is characterized by a diverse range of players who engage in strategic maneuvers to enhance their market positions and competitiveness. This sector plays a vital role in the petrochemical industry, with butadiene being a crucial feedstock for producing synthetic rubber and various chemicals. Competitive insights reveal that various factors such as production capabilities, technological advancements, raw material sourcing, and regional market dynamics significantly influence the competitive landscape. Companies are continuously striving to optimize their operational efficiencies and adopt innovative production methods. Moreover, the push towards sustainability has led to an increasing emphasis on eco-friendly production techniques, which has become a determining factor in assessing competitiveness among market players.

BP is one of the prominent players in the Butadiene Market, highlighted by its robust production facilities and commitment to maintaining high operational standards. The company has established a significant footprint with its advanced technology and expertise in petrochemical production, allowing it to cater to diverse consumer needs effectively. BP's strengths include its focus on sustainable practices, investments in innovation, and strategic partnerships that enhance its production capabilities. The company's extensive network and established relationships with customers and suppliers further enable it to maintain a strong competitive edge in the market. Furthermore, BP's proactive approach to adapting to changing market trends solidifies its status as a key contender in the butadiene sector, enabling it to respond adeptly to the evolving demands of the industry.

China National Petroleum Corporation is a major entity in the Butadiene Market, having developed an extensive portfolio of products and services that encompass a wide array of petrochemical applications. The company excels in butadiene production, leveraging its significant operational scale and integrated supply chain to optimize efficiency and reduce costs. Key strengths of China National Petroleum Corporation include its advanced technological capabilities and a strategic focus on research and development, which has led to innovative production processes. Additionally, the company actively engages in mergers and acquisitions to expand its operations and enhance market share, thereby strengthening its competitive position in the market. With its vast infrastructure and commitment to sustainability, China National Petroleum Corporation continues to be a formidable player in the Butadiene Market, addressing the growing demand for butadiene while ensuring compliance with regulatory standards and consumer expectations.

Key Companies in the Butadiene Market Include

- BP

- China National Petroleum Corporation

- Kraton Corporation

- Braskem

- LyondellBasell

- Mitsubishi Chemical Corporation

- Shell

- ENEOS Corporation

- LG Chem

- Nexen Inc.

- Reliance Industries

- TotalEnergies

- Tosoh Corporation

- INEOS

- SABIC

Butadiene Market Developments

Recent developments in the Butadiene Market have shown fluctuations in prices due to changes in supply and demand dynamics. As of October 2023, LyondellBasell reported an increase in production capacity to meet rising demands for synthetic rubber, highlighting an optimistic outlook for the market. Mitsubishi Chemical Corporation is also expanding its operations in Asia to leverage the growing automotive sector, leading to an increased butadiene output. In terms of mergers and acquisitions, in September 2023, Kraton Corporation announced its acquisition of a specialty chemical producer to strengthen its position in the value chain of butadiene derivatives, aiming to enhance product offerings and market share.

Shell and TotalEnergies have been collaborating on sustainability initiatives that align with butadiene production, focusing on reducing carbon emissions. The valuation of companies such as BP and ENEOS Corporation has also seen positive growth, driven by the increasing demand for butadiene in various applications, particularly in tires and automotive components. Over the past two to three years, major developments included the acquisition of Reliance Industries’ stake in a joint venture with INEOS, reflecting strategic consolidation within the industry.

Butadiene Market Segmentation Insights

Butadiene Market Application Outlook

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

Butadiene Market End Use Outlook

- Automotive

- Footwear

- Textiles

- Consumer Goods

Butadiene Market Production Method Outlook

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

Butadiene Market Purity Level Outlook

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Butadiene Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

24.11 (USD Billion) |

| Market Size 2024 |

24.87 (USD Billion) |

| Market Size 2035 |

35.0 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

3.16% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

BP, China National Petroleum Corporation, Kraton Corporation, Braskem, LyondellBasell, Mitsubishi Chemical Corporation, Shell, ENEOS Corporation, LG Chem, Nexen Inc., Reliance Industries, TotalEnergies, Tosoh Corporation, INEOS, SABIC |

| Segments Covered |

Application, End Use, Production Method, Purity Level, Regional |

| Key Market Opportunities |

Rising demand for synthetic rubber, Growth in automotive production, Expansion of renewable energy sector, Increasing demand for butadiene derivatives, Technological advancements in extraction processes |

| Key Market Dynamics |

Supply and demand fluctuations, Price volatility, Environmental regulations impact, Technological advancements, Growing automotive industry |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Butadiene Market Highlights:

Frequently Asked Questions (FAQ) :

The Butadiene Market is expected to be valued at 24.87 USD billion in 2024.

By 2035, the Butadiene Market is projected to reach a value of 35.0 USD billion.

The expected CAGR for the Butadiene Market from 2025 to 2035 is 3.16%.

The Asia Pacific region is anticipated to have the largest share, valued at 10.5 USD billion in 2024.

North America is projected to reach a market size of 8.5 USD billion by 2035.

The Synthetic Rubber segment is expected to grow to 14.5 USD billion by 2035.

Major players include BP, China National Petroleum Corporation, and LyondellBasell, among others.

The market value for Acrylonitrile Butadiene Styrene is expected to be 5.5 USD Billion in 2024.

The Butadiene Rubber segment is anticipated to reach a size of 8.5 USD billion by 2035.

The Middle East and Africa region is projected to grow to 2.0 USD billion by 2035.