Calcium Peroxide Size

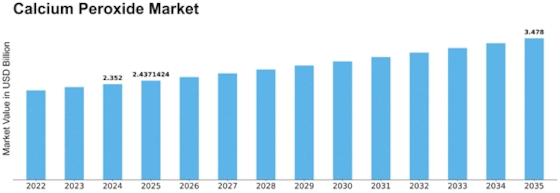

Calcium Peroxide Market Growth Projections and Opportunities

The market factors influencing the calcium peroxide market are multifaceted and dynamic, shaping the demand, supply, and pricing of this chemical compound. Firstly, the agricultural sector plays a significant role in driving the market for calcium peroxide. As a versatile oxidizing agent and source of oxygen, calcium peroxide finds extensive use in soil remediation, water treatment, and food preservation in agriculture. With the increasing focus on sustainable agricultural practices and environmental concerns, there's a growing demand for calcium peroxide as a soil conditioner and for organic farming, boosting its market growth.

Secondly, the water treatment industry contributes significantly to the demand for calcium peroxide. As a powerful disinfectant and oxidizing agent, calcium peroxide is utilized in water treatment processes to remove impurities, eliminate odors, and disinfect water supplies. The rising global concerns regarding water pollution and the need for clean water sources propel the demand for calcium peroxide in water treatment applications, thereby influencing market dynamics.

Moreover, the food industry represents another vital market factor for calcium peroxide. As a food additive, calcium peroxide is approved for use as a bleaching agent and dough conditioner. In the food processing industry, it enhances the quality and appearance of various products such as flour, bread, and certain types of cheese. The growth of the food industry, coupled with the increasing consumer preference for clean-label and minimally processed foods, augments the demand for calcium peroxide, thereby impacting its market trajectory.

Additionally, the construction sector plays a role in shaping the calcium peroxide market dynamics. Calcium peroxide finds application in construction materials as an oxygen-releasing compound, which aids in the stabilization and curing of concrete. With the expansion of infrastructure projects worldwide and the growing construction activities, there's a parallel increase in the demand for calcium peroxide as an additive in construction materials, influencing its market dynamics.

Furthermore, the healthcare and cosmetics industries contribute to the market demand for calcium peroxide. In the healthcare sector, it is used in oral hygiene products and dental formulations for its antimicrobial properties. In the cosmetics industry, calcium peroxide is utilized in teeth whitening products due to its bleaching capabilities. As the global population becomes increasingly health-conscious and beauty-conscious, the demand for oral care and cosmetic products containing calcium peroxide is expected to rise, impacting its market growth.

Moreover, regulatory factors and environmental concerns also play a significant role in shaping the calcium peroxide market. Regulatory approvals and compliance with safety standards influence the production, distribution, and usage of calcium peroxide across various industries. Additionally, the environmental impact of calcium peroxide usage, particularly in agriculture and water treatment, drives the adoption of eco-friendly alternatives and sustainable practices, thereby influencing market dynamics.

Leave a Comment