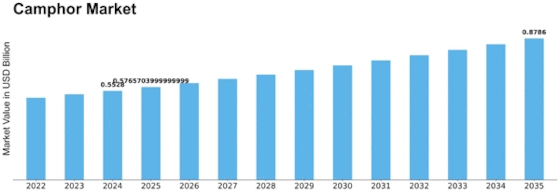

Camphor Size

Camphor Market Growth Projections and Opportunities

The Camphor market is influenced by various factors that contribute to its growth and dynamics. One significant factor is the widespread application of camphor in various industries, including pharmaceuticals, food and beverages, cosmetics, and agriculture. Camphor is used in pharmaceutical products such as topical analgesics, cough suppressants, and decongestants due to its soothing and medicinal properties. In the food and beverage industry, camphor is used as a flavoring agent and preservative. Additionally, camphor finds applications in cosmetics and personal care products such as creams, lotions, and perfumes. Moreover, camphor is used in agriculture as a natural insect repellent and fungicide. The diverse range of applications drives the demand for camphor across multiple sectors, contributing to market growth.

Furthermore, technological advancements play a crucial role in shaping the Camphor market. Continuous innovation in extraction techniques, purification processes, and formulation methods has led to improvements in camphor quality, purity, and usability. Advanced technologies enable manufacturers to produce high-quality camphor products that meet industry standards and consumer expectations. These advancements also facilitate the development of new camphor-based formulations and applications, driving market expansion and adoption of camphor products.

Another key factor influencing the Camphor market is the growing consumer awareness and demand for natural and herbal products. Camphor is derived from the wood of the camphor tree or synthesized from natural sources such as turpentine oil. As consumers become increasingly health-conscious and environmentally aware, there is a growing preference for natural and plant-based ingredients in pharmaceuticals, personal care products, and food items. Camphor's natural origin and perceived medicinal properties make it a popular choice among consumers seeking alternative and holistic remedies, driving market growth.

Market regulations and standards also impact the Camphor market. Camphor products used in pharmaceuticals, food, and cosmetics must comply with various regulatory requirements and quality standards set by regulatory agencies such as the FDA (Food and Drug Administration) and EFSA (European Food Safety Authority). Compliance with these regulations is essential for manufacturers to ensure product safety, efficacy, and market acceptance. Additionally, regulations related to environmental protection, sustainability, and fair trade practices influence the sourcing, production, and marketing of camphor products, shaping market dynamics.

Moreover, market competition drives innovation and product development in the Camphor market. The market is characterized by numerous manufacturers and suppliers offering a wide range of camphor products tailored to specific industry requirements and consumer preferences. Competitive pricing strategies, product differentiation, and marketing initiatives drive market competition and influence consumer purchasing decisions.

Economic factors also play a significant role in shaping the Camphor market. Economic conditions such as GDP growth, disposable income levels, and consumer spending influence demand for camphor products across various industries. During periods of economic expansion, increased consumer spending on healthcare, personal care, and wellness products drives demand for camphor, while economic downturns may lead to temporary slowdowns in market growth as consumers reduce discretionary spending.

Furthermore, the availability and cost of raw materials impact the production and pricing of camphor products. Camphor is primarily derived from natural sources such as the camphor tree or synthesized from turpentine oil. Fluctuations in the prices of raw materials, supply chain disruptions, and geopolitical factors can affect production costs and profit margins for camphor manufacturers, influencing market dynamics.

Global market trends and geopolitical factors also influence the Camphor market. Factors such as trade policies, tariffs, currency exchange rates, and geopolitical tensions can impact market dynamics, trade flows, and supply chain logistics, affecting the availability and pricing of camphor products in different regions. Additionally, changing consumer preferences, technological advancements, and industry consolidation shape the competitive landscape and market opportunities in the Camphor market.

Leave a Comment