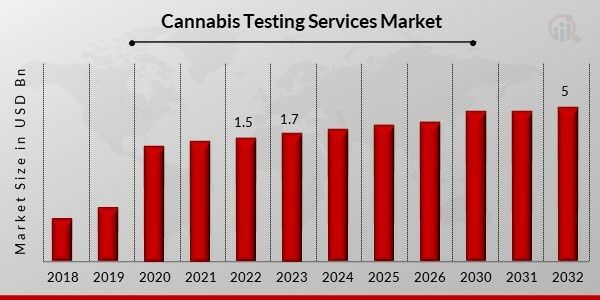

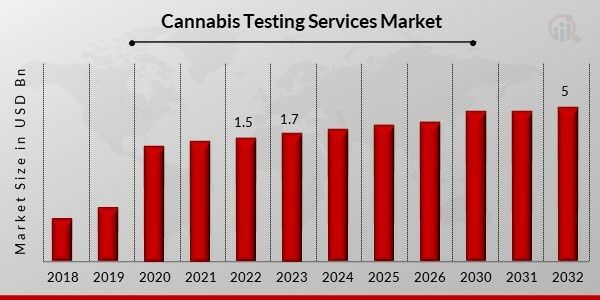

Global Cannabis Testing Services Market Overview

As per MRFR analysis, the Cannabis Testing Services Market Size was estimated at 1.94 (USD Billion) in 2024. The Cannabis Testing Services Market Industry is expected to grow from 2.22 (USD Billion) in 2025 to 7.33 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 14.20% during the forecast period (2025 - 2034). Increased popularity of self-medication with cannabis-based products for pain management, anxiety, and depression are the key market drivers boosting the expansion of the market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Cannabis Testing Services Market Trends

- The growing popularity of self-medication with cannabis-based products is driving the market growth.

Market CAGR for cannabis testing services is being driven by the rising amount of self-medication. Services for cannabis testing are essential for guaranteeing the security and caliber of cannabis items. It is crucial to make sure that the products are secure to consume and adhere to legal requirements, given the rising demand for cannabis for both recreational and health-related applications. Independent testing laboratories, governmental organizations, or cannabis growers, processors, and manufacturers internally may provide these services.

Additionally, the number of health concerns associated with consuming cannabis products polluted with harmful chemicals and poisons is driving up demand for cannabis testing services. As governments across the globe persist in authorizing cannabis for both medicinal and recreational uses, there will likely be a greater need for high-quality cannabis products that comply with regulatory requirements. Over the course of the forecast period, the growing tendency of using cannabis-based products as self-medication for pain management, anxiety, and depression is also anticipated to fuel market revenue growth. It is anticipated that the cannabis industry will see an increase in demand for analytical testing services because of the need for accurate dosing and labeling information to ensure product consistency and patient safety. Regulatory bodies are placing more and more focus on cannabis product standardization and quality assurance.

Governments have begun to regulate the testing of cannabis products in light of public health concerns following the legalization of medical marijuana and other CBD products; this is seen to assist the market expansion for cannabis testing services. Establishing a cannabis testing lab can be costly, and maintaining staff and equipment over time might incur large expenses. The expensive cost of setting up cannabis testing facilities is increased by quality control procedures and employee training, which guarantee the precision and dependability of test results. Given the demand and necessary abilities, professionals providing cannabis testing services are paid a significant salary. Cannabis testing facilities bear substantial liability risks, and the total expenses are increased by the extent of insurance coverage.

For instance, The European Brain Council estimates that there were about 600 neurological disorders registered worldwide as of 2022, making mental illnesses one of the main causes of illness and impairment worldwide. The most typical mental illness is depression. Over 264 million people worldwide of all ages struggle with depression. Depression affects women more often than it does males. Further driving the market are raising awareness and usage of software services in cannabis testing labs. Thus, result in driving the Cannabis Testing Services market revenue.

Cannabis Testing Services Market Segment Insights

Cannabis Testing Services Type Insights

The Cannabis Testing Services market segmentation, based on type, includes Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening, and Others. The potency testing segment dominated the market. This is due to the rising use of potency testing methods like Gas Chromatography (GC) and High-Performance Liquid Chromatography (HPLC) for testing samples and the rising demand for determining the potency of different cannabinoids, especially Tetrahydrocannabinol (THC) and CBD (Cannabidiol) in cultivated cannabis.

Cannabis Testing Services End Use Insights

The Cannabis Testing Services market segmentation, based on End Use, includes Cannabis Drug Manufacturers, Cannabis Cultivators/Growers, and Others (Research Institutes & Labs). The cannabis cultivators/growers category generated the most income. This is due to the fact that governments in many nations have placed limitations on the amount of THC that can be found in cannabis products and because growers are entering into contracts with testing facilities and research organizations. Additionally, these producers must offer various plant types to manufacturers and wholesalers at various costs according to the amount of THC and CBD in each variety.

Figure1: Cannabis Testing Services Market, by End Use, 2023 & 2032 (USD Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Cannabis Testing Services Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Cannabis Testing Services market area will dominate this market, owing to public awareness of the benefits of cannabis for both medical and recreational use, which will boost market growth in this region.

Further, the major countries studied in the market report are China, Japan, India, Australia, South Korea, Brazil, Germany, France, the UK, Italy, and Spain.

Figure2: Cannabis Testing Services Market Share By Region 2023 (USD Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Europe Cannabis Testing Services market has the second-largest portion of the market. This is due to the increase dramatically as a result of the rising usage of medical marijuana and its legalization. Further, the German Cannabis Testing Services market maintained the biggest market share, and the UK Cannabis Testing Services market was the European market with the quickest rate of growth.

The Asia-Pacific Cannabis Testing Services Market is anticipated to expand between 2025 and 2034 at the quickest CAGR. This is due to the growing trend of cannabis legalization in various countries and the rising use of medical marijuana. Moreover, China’s Cannabis Testing Services market held the largest market share, and the Indian Cannabis Testing Services market was the Asia-Pacific region's fastest-growing market.

Cannabis Testing Services Key Market Players & Competitive Insights

Leading market players are putting a lot of money into R&D to expand their range of products, which will help the market for weight reduction products grow. Additionally, market players are engaging in a range of calculated initiatives to increase their worldwide presence, with important market developments involving the introduction of new products, contracts, M&A transactions, increased investment, and cooperation with other enterprises. To grow and endure in an increasingly cutthroat and dynamic market, the Cannabis Testing Services industry must provide reasonably priced goods.

Manufacturing locally is one of the primary business techniques used by manufacturers to cut operational costs in the Cannabis Testing Services industry to help customers and expand the market segment. In recent years, the Cannabis Testing Services industry has provided some of the biggest benefits to medicine. Major players in the Cannabis Testing Services market, including Saskatchewan Research Council (SRC); SC Labs; Steep Hill, Inc.; SGS Canada Inc.; CW ANALYTICAL; Pharm Labs; Green Leaf Lab; Eurofins Scientific are engaging in research and development activities in an effort to boost market demand.

The mission of SC Labs is to offer complete testing services to guarantee the potency, safety, and quality of cannabis products. These testing services are essential because they guarantee adherence to legal requirements and offer insightful data regarding the ingredients in cannabis products, which benefits both users and producers. This entails measuring the concentrations of cannabinoids in cannabis products, such as CBD (cannabidiol) and THC (tetrahydrocannabinol). In May 2020, SC Laboratories introduced a novel testing technique for identifying pesticides in cannabis. Utilizing liquid chromatography-tandem mass spectrometry (LC-MS/MS), the technique yields dependable and precise results.

The goal of Stanford University's Green Leaf Lab is to provide tools for comprehending the physical compaction and folding of the genome as well as the structure and function of molecules that are encoded by the genome. High-throughput biophysics, molecular evolution, chromatin structure, and DNA accessibility are among their areas of interest. For a variety of initiatives, including investigating gene regulatory dynamics and cell-resolved chromatin in brain development and learning paradigms, the lab is currently seeking undergraduates and postdoctoral researchers. In March 2020, the section of Green Leaf Labs, located in Oregon, was the first testing company to receive ISO/IEC 17025:2017 accreditation.

Key Companies in the Cannabis Testing Services market include

Cannabis Testing Services Industry Developments

March 2021: Aurora Cannabis and EnWave Corporation have partnered to process and dry cannabis using EnWave's Radiant Energy Vacuum (REV) technology. The goal of the collaboration was to raise the standard and reliability of Aurora's cannabis offerings.

January 2020: A new analytical tool for the cannabis testing market, the Agilent 6470B Triple Quadrupole LC/MS system, was unveiled by Agilent Technologies, Inc. When identifying cannabinoids and other components in cannabis samples, the system is made to have a high level of sensitivity and accuracy.

February 2020: A novel testing procedure for finding heavy metals in cannabis was introduced by Covance, Inc. Inductively coupled plasma mass spectrometry (ICP-MS) is the technique used to produce precise and trustworthy results.

Cannabis Testing Services Market Segmentation

Cannabis Testing Services Type Outlook

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

Cannabis Testing Services End Use Outlook

- Cannabis Drug Manufacturers

- Cannabis Cultivators/Growers

- Others (Research Institutes & Labs)

Cannabis Testing Services Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

1.94 (USD Billion)

|

|

Market Size 2025

|

2.22 (USD Billion)

|

|

Market Size 2034

|

7.33 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

14.20 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, End Use, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

China, Japan, India, Australia, South Korea, Germany, France, UK, Italy, and Spain |

| Key Companies Profiled |

Saskatchewan Research Council (SRC), SC Labs, Steep Hill, Inc., SGS Canada Inc., CW ANALYTICAL, PharmLabs, GreenLeaf Lab, Eurofins Scientific |

| Key Market Opportunities |

growing popularity of self-medication with cannabis-based products for pain management, anxiety, and depression |

| Key Market Dynamics |

Increase in health difficulties and demand for analytical testing services |

Frequently Asked Questions (FAQ) :

In 2023, the market for Cannabis Testing Services was expected to be worth USD 1.7 billion worldwide.

From 2025 to 2034, the market is expected to expand at a CAGR of 14.20%.

North America held the most market share worldwide.

The key players in the market are Saskatchewan Research Council (SRC), SC Labs, Steep Hill, Inc., SGS Canada Inc., CW ANALYTICAL, PharmLabs, GreenLeaf Lab, Eurofins Scientific, and others.

In 2023, the market was dominated by the Potency Testing sector.

The Cannabis Cultivators/Growers held the biggest market share worldwide.