- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Car Rental Market Size Snapshot

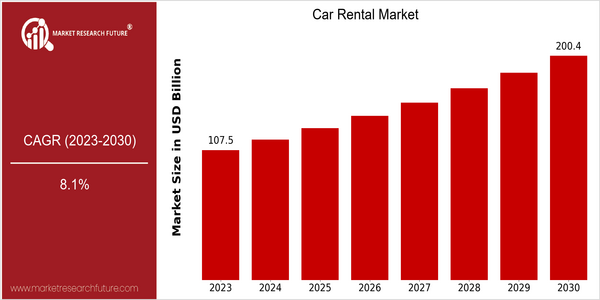

| Year | Value |

|---|---|

| 2023 | USD 107.5 Billion |

| 2030 | USD 200.4 Billion |

| CAGR (2024-2030) | 8.1 % |

Note – Market size depicts the revenue generated over the financial year

Car rental market is estimated to reach $ 73.1 billion by 2023 and $ 139.4 billion by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The trend of this growth is mainly driven by the factors of urbanization, the rise in travel and tourism, and the growing demand for flexible transportation solutions. Furthermore, technological developments such as the integration of mobile applications and digital platforms for seamless booking and customer service will further improve the car rental experience, which will further drive the growth of the car rental market. The industry's major players, such as Enterprise Holdings, Hertz Global Holdings, and Avis Budget Group, have been actively investing in innovation and strategic cooperation to gain market share. These companies, for example, are actively exploring the rental of electric vehicles (EVs) to meet the needs of the world's sustainable development. In addition, cooperation with ride-hailing platforms and travel agencies has been established to provide more convenient and more comprehensive services for customers. These strategic initiatives not only reflect the fierce competition in the market, but also reflect the industry's ability to adapt to changes in customer preferences and technological developments.

Regional Deep Dive

The car rental market is growing across various regions, owing to factors such as increasing demand for travel, technological advancements and changing consumer preferences. In North America, the market is characterized by the strong presence of established players and a growing trend towards digitalization and sustainability. In Europe, the market is diverse, with a focus on eco-friendly vehicles and a regulatory framework that encourages shared mobility. In the Asia-Pacific region, increasing urbanization and a growing middle class are driving the demand for car rental services. In the Middle East and Africa, there are huge investments in infrastructure and tourism, while in Latin America, the market is facing economic upheavals and changing consumer preferences. All these factors are shaping the future of the car rental market in these regions.

North America

- Hertz and Avis, whose business model is that of the rental car, have been forced to adopt the new methods of the new era, and to offer more flexible rental options.

- Sustainability is gaining ground. Enterprise Holdings has just announced its commitment to a fleet transition to electric vehicles, responding to the demand for a greener way to travel.

- Urban regulation, such as the congestion tax in New York, is changing the rental patterns, encouraging consumers to rent rather than own.

Europe

- The Green Deal of the European Union is pushing the car rental industry to invest in hybrid and electric vehicles, and Sixt is leading the way in expanding its fleet of green cars.

- IT AND COMMUNICATION TECHNOLOGIES ARE CONTRIBUTING TO A GREATER CONVENIENCE FOR CUSTOMERS AND ARE ENABLING EUROP CAR TO IMPLEMENT INNOVATIVE TECHNOLOGIES TO IMPROVE THE CUSTOMER EX

- In a word, the change in the cultural orientation of mobility towards sharing and towards a more sustainable use of resources is reflected in the preferences of consumers, who are beginning to demand car-sharing services in addition to car rental.

Asia-Pacific

- In countries like China and India, where urbanization is taking place at a rapid pace, there is a growing demand for car rentals. Local car rental companies such as Zoomcar and Carzonrent are expanding their services to meet the needs of the public.

- A new government policy promoting electric vehicles has led to a proliferation of car rental companies. With the backing of major corporations like Orix and Toyota, the electric car is now an established part of the rental car fleet.

- Technology is changing the way customers rent and use their vehicles. The rise of mobile applications to manage rentals and reservations is reshaping the customer experience, making it more convenient and accessible.

MEA

- Vision 2021 has also sparked the development of the car rental sector, with significant investments in tourism and development, leading to a higher demand for rental services.

- Thrifty and Budget are expanding their business in the region, taking advantage of the influx of foreign tourists and business travelers.

- The legal framework is evolving. Governments are putting in place policies to improve road safety and the sustainable practices of the rental car industry.

Latin America

- Brazil and Argentina, where the economic situation is constantly changing, have prompted car rental companies to change their strategies and offerings.

- A growing e-commerce and digital payment industry is making it easier to access car rental services. Localiza and Movida have developed their own platforms.

- The mobility and convenience of the times are bringing a growing number of people, especially the young, who prefer flexibility to ownership.

Did You Know?

“In 2022, the world car rental market was expected to have more than 1,500,000 rental vehicles in circulation, which showed the importance and scale of the industry in the field of travel and mobility.” — Statista

Segmental Market Size

In the meantime the rental car market is booming, the demand for flexible means of transport being greater than ever. The reasons for this are the increase in travel and tourism, especially after the pandemic, and the growing preference of the urban population for car-sharing services. Moreover, the regulatory emphasis on sustainable mobility also encourages consumers to prefer rental to ownership.

Enterprise and Hertz are the leading companies in the car rental industry, and they are mainly active in the United States and Europe. Leisure travel, business trips and ride-sharing are the main applications of this industry. The most innovative players in this market are Zipcar and Turo. The push for electric cars and the green economy are a major growth driver, while technological innovations such as mobile applications for reservations and fleet management systems are reshaping the industry.

Future Outlook

The Car Rental Market is expected to grow significantly from 2023 to 2027, with a CAGR of 8.1 %. This growth is mainly driven by the rising demand for flexible mobility solutions, the growing travel and tourism sector, and the growing popularity of car-sharing services. The rental of cars will rise to about 15% of the overall transportation market by 2030, from an estimated 8% in 2023. This indicates a shift in consumer preferences towards renting instead of owning.

The integration of telematics into fleet management systems will enhance customer service and operational efficiency. In addition, the growing focus on sustainable mobility will result in the introduction of electric and hybrid vehicles into rental fleets in line with global efforts to reduce CO2 emissions. In addition, government initiatives promoting the sharing economy and the integration of public transport will further stimulate growth. As a result, the car rental market will not only grow but also evolve, to meet the needs of a more demanding, more informed and more technologically advanced clientele.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 107.5 Billion |

| Growth Rate | 8.1% (2022-2030) |

Car Rental Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.