Rising Urbanization

The trend of increasing urbanization appears to be a pivotal driver for The Car Rental Industry. As more individuals migrate to urban areas, the demand for flexible transportation solutions rises. Urban centers often face congestion and limited parking, making car rentals an attractive alternative for residents and visitors alike. According to recent data, urban populations are projected to reach 68% by 2050, which could significantly boost the car rental sector. This shift in demographics suggests that rental services may need to adapt their offerings to cater to the preferences of urban dwellers, who often prioritize convenience and accessibility over ownership.

Environmental Regulations

Environmental regulations are increasingly influencing The Car Rental Industry. Governments worldwide are implementing stricter emissions standards and promoting sustainable practices. This regulatory landscape is pushing rental companies to invest in eco-friendly vehicles, such as hybrids and electric cars. The shift towards sustainability not only aligns with regulatory requirements but also meets the growing consumer demand for environmentally responsible options. As a result, rental firms that prioritize sustainability may gain a competitive edge, appealing to a demographic that values green initiatives. This trend suggests a potential transformation in fleet composition and operational strategies within the industry.

Technological Advancements

Technological advancements are likely to play a crucial role in shaping The Car Rental Industry. Innovations such as mobile applications, online booking systems, and telematics are enhancing customer experiences and operational efficiencies. The integration of artificial intelligence and machine learning into rental platforms may streamline processes, from vehicle selection to payment. Furthermore, data analytics can provide insights into consumer behavior, enabling companies to tailor their services more effectively. As technology continues to evolve, it is anticipated that the car rental industry will increasingly leverage these tools to improve service delivery and customer satisfaction.

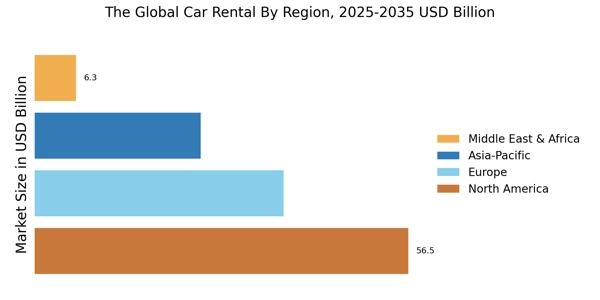

Increased Travel and Tourism

The resurgence of travel and tourism is expected to significantly impact The Car Rental Industry. As international travel restrictions ease, there is a notable uptick in both leisure and business travel. Data indicates that global tourism is projected to grow at a compound annual growth rate of 3.3% through 2028. This growth is likely to drive demand for rental vehicles, as travelers seek convenient transportation options to explore new destinations. Car rental companies may need to enhance their fleets and services to accommodate the diverse needs of tourists, thereby capitalizing on this expanding market.

Changing Consumer Preferences

Changing consumer preferences are reshaping The Global Car Rental Industry. There is a noticeable shift towards more flexible and cost-effective transportation solutions, particularly among younger generations. Many consumers now prefer access over ownership, leading to an increased interest in car-sharing, including corporate car sharing and rental services. This trend is supported by data indicating that millennials and Gen Z are more inclined to use rental services for short-term needs rather than purchasing vehicles. As these demographics continue to dominate the market, rental companies may need to adapt their business models to cater to this evolving mindset, potentially offering subscription services or tailored rental packages.