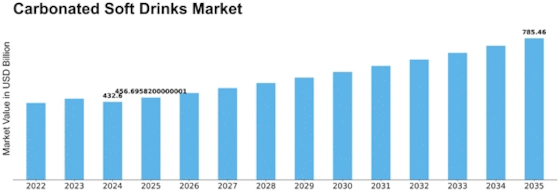

Carbonated Soft Drinks Size

Carbonated Soft Drinks Market Growth Projections and Opportunities

There are numerous factors that shape the behavior of the carbonated soft drinks (CSD) market in many ways, and all these contribute to what impacts on its dynamics and flow. One of the key points is consumer behaviour, which determines the demand for carbonate beverages. Swings in consumer tastes and preferences informed by several factors which include health consciousness, taste inclinations or even adjustments in lifestyle translate directly to the types of soft drinks that take up ground from their respective rivals. Companies need to keep up with these cheek behaviors so that they can provide products designed according to consumer behavior. Factors range the economic variables also play a great role in influencing carbonated soft drinks market. Living standards, creation intensities, and general financial steadiness control the rates of customer spending. When consumers have limited resources due to economic hardships, they may choose lower-priced beverages that serve the function of carbonated soft drinks because this is more affordable than branded beverages. The result would be increased demand for value-based or private label carbonated soft drinks brought about by their low-cost savvy buyers. On the opposite side, when an economy is positive and in boom the consumers will be more willing to treat themselves spending premium or niche products which then stimulate the market for innovation and premiumization. Market dynamics are sometimes caused by factors that exist within the competitive forces operating in the industry. The competition in the carbonated soft drinks market is high and fierce as both major brands and potential players fight for market share. Some of the key factors in competitiveness that many companies employ to have a competitive advantage include pricing mechanisms, marketing campaigns, and product diversity. Innovativeness and dominance over competitors in all weather-flavor profiles, packaging and branding also acts as a safeguard to keep market share. The supply chain dynamics are equally a big factor in influencing the carb sat soft drinks market. If raw materials like sweeteners, flavorings are susceptible to low availability or high-cost flight alternatives may also determine production costs and eventually influence pricing. Secondly, the effectiveness of distribution networks impacts in influencing consumers’ accessibility to products. The companies that have ability to optimize their supply chains in terms of cutting costs and timely delivery provide themselves company brand value in the market with a variety of challenges. The carbonated soft drinks market is also heavily affected by several major regulations, with the most prominent being relating to work health and safety laws. In this regard, governments may devise principles aimed at addressing several elements like use of ingredients, labelling and advertising practices. For example, increased attention has been paid to the sugar tax in many jurisdictions where sufficient consumer education is provided along with printed instructions about possible health risks and even allergic reactions. It is very important for companies to enter and abide by these standards if they wish market access and consumer acceptability.

Leave a Comment