- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

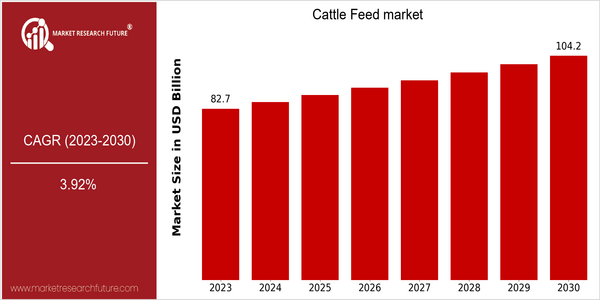

| Year | Value |

|---|---|

| 2023 | USD 82.72 Billion |

| 2030 | USD 104.18 Billion |

| CAGR (2023-2030) | 3.92 % |

Note – Market size depicts the revenue generated over the financial year

The global cattle feed market is expected to reach a value of around $82.72 billion by 2023, and to reach a value of around $104.18 billion by 2030, at a CAGR of 3.92%. The demand for cattle feed is rising steadily, driven by increasing meat consumption, especially in developing countries, and by the growing importance of animal health and productivity. As the world's population grows, the need for efficient and sustainable livestock farming is increasing. There are several reasons for this growth, including the development of feed technology, which increases the nutritional value and efficiency of cattle feed. Moreover, innovations such as precision feeding and the use of alternative proteins are increasingly used, allowing producers to optimize feed costs while improving animal health. The leading players in the industry, such as Cargill, Archer Daniels Midland, and Alltech, are also investing in research and development and forming strategic alliances in order to develop and launch new products and solutions. These efforts not only meet the evolving needs of livestock producers, but also meet the goals of global sustainability, which further drives the market.

Regional Market Size

Regional Deep Dive

In the cattle-feed market, the resolute growth is due to the growing demand for meat, the improvement of the composition of feed, and the growing concern for the conservation of livestock. The market in North America is characterized by a strong emphasis on high-quality feed ingredients and the introduction of new feeding methods. In Europe, the trend is towards organic and non-GMO feeds, while in Asia-Pacific the market is expanding rapidly due to population growth and income growth, which has led to increased demand for beef. The Middle East and Africa are also growing strongly, due to government support for livestock, while Latin America is taking advantage of its vast agricultural resources to increase cattle feed production.

Europe

- There is a notable trend towards the use of organic and non-GMO feed in Europe, a trend driven by the growing demand for meat produced sustainably. The European Feed Manufacturers’ Federation (FEFAC) is promoting greater transparency in feed production.

- The European Union's Green Deal and Farm to Fork Strategy are pushing for stricter regulations on livestock feed, which is expected to accelerate the shift towards environmentally friendly feed options and impact market dynamics significantly.

Asia Pacific

- The Asia-Oceania region is experiencing a growing demand for cattle feed, especially in China and India. Rising incomes are increasing the consumption of meat. The local companies New Hope Liuhe and China Animal Husbandry Group are increasing their feed production.

- Innovations in feed formulations, including the incorporation of alternative protein sources like insects and algae, are gaining traction as a response to feed shortages and sustainability concerns in the region.

Latin America

- Latin America is leveraging its extensive agricultural resources to enhance cattle feed production, with Brazil being a key player in the market. Companies like BRF S.A. are investing in feed innovation to improve livestock health and productivity.

- The region is also experiencing a rise in demand for high-protein feed ingredients, driven by the growing export market for beef, which is prompting local producers to adapt their feed formulations accordingly.

North America

- The cattle feed market in North America is increasingly being influenced by the adoption of precision feeding, which optimizes nutrient delivery and improves feed efficiency. Cargill and Land O’Lakes are the companies at the forefront of this development, as they are developing more precise and more targeted feed solutions.

- Regulatory changes, such as the FDA's guidelines on antibiotic use in livestock, are prompting feed manufacturers to explore alternative feed additives and probiotics, which are expected to reshape product offerings in the market.

Middle East And Africa

- The Cattle Feed market is driven by government initiatives to improve livestock productivity in the Middle East and Africa. For instance, the government of Saudi Arabia has launched a program to improve the quality and availability of cattle feed, which is expected to drive local production.

- The region is also seeing an increase in partnerships between local feed manufacturers and international companies to adopt advanced feed technologies, which will likely enhance the overall quality and efficiency of cattle feed.

Did You Know?

“Did you know that cattle feed accounts for approximately 60-70% of the total cost of beef production, making it a critical factor in the profitability of cattle farming?” — National Cattlemen's Beef Association

Segmental Market Size

The cattle-feed market is an important part of the livestock industry, which is growing steadily as a result of the increasing world consumption of meat and the rising demand for dairy products. This industry is mainly driven by the need for a high-quality diet for livestock, the implementation of stricter regulations for animal health and food safety, and the growing number of organic farms. Also, the technological innovations in the formulation and production of feeds are reshaping the industry, enabling more efficient and sustainable production. Cargill and Archer Daniels Midland are currently the leading companies in the implementation of innovations in the cattle-feed industry in several regions, especially North America and Europe. The main application areas for this market are beef and dairy cattle, where specialized feeds are formulated to meet the nutritional requirements of different growth stages. These trends, along with the growing demand for organic meat and dairy products, are fuelling the growth of the cattle-feed market. In addition, the technological developments in precision nutrition and feed additives are reshaping the cattle-feed industry, improving feed efficiency and animal health.

Future Outlook

From 2023 to 2030, the Cattle Feed market is expected to grow steadily, with a market value of $82,721,000,000. This growth is mainly due to the increase in the consumption of meat around the world, especially in developing countries, where the population is growing rapidly and urbanization is increasing, thereby increasing the demand for high-quality food sources. To meet this demand, the cattle industry will intensify, which will lead to the development of cattle feed and the penetration of advanced feeds and additives. The development of new technology, such as the development of precision feeding, and the use of alternative feed sources, is expected to have a major impact on the development of cattle feed. Also, with the increase in the demand for sustainable development and the introduction of regulations to reduce the impact on the environment, the use of new feed additives with a higher nutritional value and a better health effect will increase. The use of advanced feeds will also increase, and the market will grow further. As the industry adapts to these trends, it will become more competitive, and the R & D investment will increase, which will lead to the improvement of feed efficiency and the productivity of cattle.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 3.92% (2023-2030) |

Cattle Feed Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.