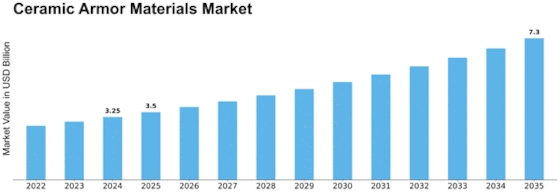

Ceramic Armor Materials Size

Ceramic Armor Materials Market Growth Projections and Opportunities

Several market aspects shape the Ceramic Armor Materials Market. Rising need for lightweight and durable materials in defense and security is a consideration. As global tensions rise, military capabilities are prioritized, pushing the demand for sophisticated armor systems. Due to their great hardness and low weight, ceramic materials are used for armor applications, driving market expansion. The Ceramic Armor Materials Market is expected to reach USD 2.80 billion in 2025, growing 7.65%. Technology in ceramic armor manufacture has also changed market dynamics. Ceramic composites with increased ballistic performance have been developed via materials research and industrial innovations. This has increased the use of ceramic armor materials and made them cheaper, driving market development. Growing research and development spending is another important market element. Global governments and military groups are investing heavily in armor material research. Innovative ceramic armor materials are being used by military and law enforcement agencies to keep ahead in the arms race. Geopolitics and regional security concerns also affect ceramic armor demand. Nations facing increased security threats are investing in military modernization, driving the demand for sophisticated defensive materials. The growing requirement for personal protective equipment (PPE) for military and law enforcement in crisis zones also drives the industry. Defence expenditures and government investment shape the ceramic armor materials industry. Defense budget fluctuations effect purchase choices and advanced armor demand. Ceramic materials' cost-effectiveness relative to conventional alternatives is boosting their use in diverse applications, further affecting market dynamics. Environmental concerns are growing in the ceramic armor materials business. As companies prioritize sustainability, eco-friendly and recyclable materials are in demand. In line with global sustainability initiatives, manufacturers are producing ceramic armor materials with lower environmental effect. Finally, regulatory frameworks and international weapons control agreements affect the ceramic armor materials industry. Manufacturers and suppliers in this sector must follow strict laws and international standards. Regulatory changes may affect ceramic armor material development, manufacturing, and sales, changing the competitive environment. In conclusion, technical advances, research investments, geopolitical conflicts, and economic reasons drive the Ceramic Armor Materials Market. As demand for effective and lightweight armor solutions rises, the market is predicted to increase, with continuing advancements shaping its trajectory.

Leave a Comment