China Applied AI in Finance Market Overview

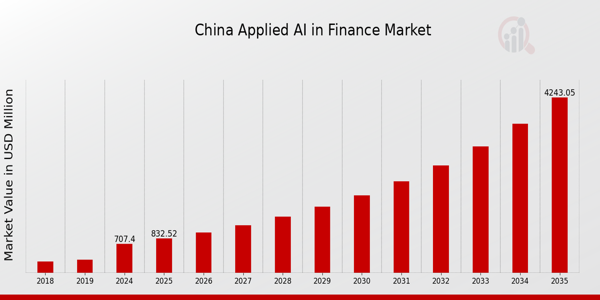

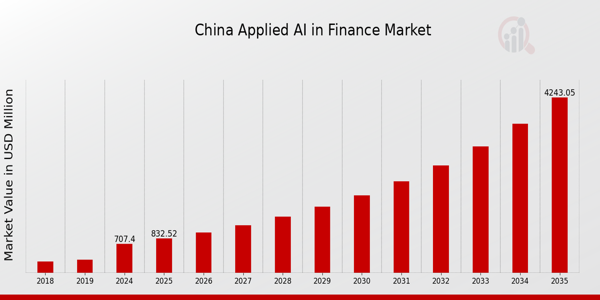

As per MRFR analysis, the China Applied AI in Finance Market Size was estimated at 577.47 (USD Million) in 2023. The China Applied AI in Finance Market Industry is expected to grow from 707.4(USD Million) in 2024 to 4,243 (USD Million) by 2035. The China Applied AI in Finance Market CAGR (growth rate) is expected to be around 17.687% during the forecast period (2025 - 2035).

Key China Applied AI in Finance Market Trends Highlighted

In the China Applied AI in Finance Market, there is a notable drive towards enhancing operational efficiency and risk management through technology. Key market drivers include the increasing need for financial institutions to automate processes, improve customer experiences, and comply with regulatory requirements, which is facilitated by advancements in AI technologies such as machine learning and natural language processing. The Chinese government is actively supporting the integration of AI technologies into the finance sector as part of its push for innovation and digital transformation, which creates a favorable environment for growth.

Opportunities to be explored in this market include the rising demand for personalized financial products and services, as AI can help analyze customer data to offer tailored solutions.Furthermore, traditional banks are increasingly collaborating with these agile companies to leverage AI solutions, which is opening up new opportunities for development, as fintech ventures emerge. The comprehensive impact of AI in transforming financial operations is reflected in the growing implementation of AI across various financial services, including trading, fraud detection, and customer service, as highlighted by recent trends.

Additionally, the regulatory environment in China is changing to accommodate AI technologies, which enables a larger degree of experimentation and innovation in financial services. It is anticipated that Chinese financial institutions will progressively employ AI technologies to sustain their competitiveness in the rapidly evolving market environment as the adoption of AI continues to grow. In general, the landscape is on the brink of a significant transformation as a result of the intersection of AI and finance. Consequently, it is essential for stakeholders in China to remain informed about these emergent trends.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

China Applied AI in Finance Market Drivers

Growing Demand for Enhanced Financial Services

The China Applied AI in Finance Market Industry is driven by the increasing demand for innovative financial services that enhance customer experience and operational efficiencies. A survey conducted by the People's Bank of China indicates that over 85% of financial institutions are investing in Artificial Intelligence technologies to improve customer service and reduce operational costs.

As China's middle class expands, consumers are seeking more personalized and responsive banking solutions.Companies like Ant Group, known for its AI-driven innovations in financial technology, exemplify the trend of leveraging Artificial Intelligence to meet rising consumer demands, driving the significant growth potential of the market.

Regulatory Support for Technological Advancements

The Chinese government has been actively promoting the adoption of Artificial Intelligence in various sectors, including finance. The 'New Generation Artificial Intelligence Development Plan' released by the State Council emphasizes the importance of AI in realizing economic growth and financial stability.

By providing supportive regulatory frameworks and fostering a conducive environment for innovation, the government is encouraging financial institutions to adopt AI technologies.This regulatory support not only enhances operational efficiency but also boosts consumer trust in AI-based financial solutions, which is essential for market growth in the China Applied AI in Finance Market Industry.

Increasing Cybersecurity Concerns

As the financial sector in China becomes increasingly digitized, there is a growing concern about cybersecurity threats. A report by the China Banking Regulatory Commission highlighted that cybersecurity incidents in the finance sector increased by 30% in the last two years.

In response, financial institutions are turning to Applied AI solutions to enhance their cybersecurity measures. Companies like Tencent are leading the charge by developing AI-powered security solutions that can detect and respond to threats in real-time.This increased focus on cybersecurity is driving demand for Applied AI technologies within the China Applied AI in Finance Market Industry.

China Applied AI in Finance Market Segment Insights

Applied AI in Finance Market Component Insights

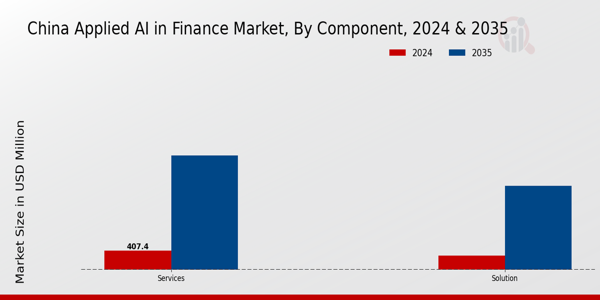

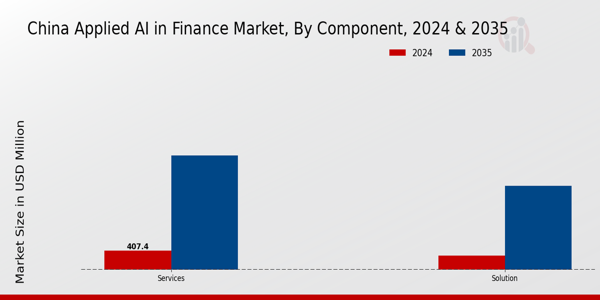

The Component segment of the China Applied AI in Finance Market is of great importance, as it encompasses essential elements such as Solutions and Services that drive the industry's growth and development. These components are vital for facilitating the integration of artificial intelligence technologies into various financial services, enhancing operational efficiency, and providing innovative solutions to customer needs. Solutions in this market typically include advanced analytical tools, machine learning algorithms, and predictive analysis, which aid financial institutions in better decision-making and risk management.

Furthermore, Services in the market encompass a range of offerings, from technology support to consulting, which help organizations navigate the complexities of adopting artificial intelligence within their operations. The rapid advancement of technology and an increasing demand for personalized financial products and services are key growth drivers in this segment. As China's fintech landscape evolves, there is a notable shift towards adopting AI-driven solutions that can provide competitive advantages and streamline processes across sectors such as banking, investment, and insurance.

Additionally, the Chinese government's initiatives for digitization and smart finance are creating a robust environment for innovation and adoption of these components, ultimately leading to improved customer experiences.Moreover, opportunities in this segment are augmented by the significant rise in data generation and availability, which empowers financial institutions to leverage AI for effective data analysis and insights, further solidifying the Component's relevance.

However, it is crucial to recognize potential challenges, such as regulatory compliance and data privacy concerns, that businesses must address as they implement AI-enabled solutions and services in finance. Understanding the dynamic nature of the China Applied AI in Finance Market segmentation, particularly within the Component segment, is crucial for stakeholders looking to capitalize on the transformative potential of AI technologies.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Applied AI in Finance Market Deployment Mode Insights

The Deployment Mode segment of the China Applied AI in Finance Market plays a pivotal role in shaping the industry's landscape. The market is primarily divided into On-premise and Cloud-based solutions, both serving distinct needs and contributing to overall efficiency. On-premise deployment offers enhanced control and security for financial institutions, allowing them to customize applications tailored to their unique requirements. Conversely, Cloud solutions have gained significant traction due to their scalability, lower upfront costs, and the ability to leverage advanced analytics and machine learning capabilities without substantial investment in infrastructure.

Moreover, as the digital transformation accelerates across China's finance sector, businesses are increasingly adopting hybrid models that combine the strengths of both deployment modes. The demand for real-time data processing and insights drives innovation within this segment, making it critical for enhancing customer experience and operational efficiency. As financial institutions navigate the challenges presented by evolving regulatory requirements and competition, the Deployment Mode segment is expected to adapt and expand, presenting various opportunities for growth and investment in the years to come.The dynamics of the China Applied AI in Finance Market segmentation reflect broader trends in technology adoption and the increasing reliance on data-driven decision-making in the financial services sector.

Applied AI in Finance Market Application Insights

The China Applied AI in Finance Market is characterized by diverse Applications that drive innovation within the financial sector. Among these, Virtual Assistants have become essential in streamlining customer interactions, providing timely responses, and enhancing user experience. Business Analytics and Reporting applications leverage AI to enable organizations to derive actionable insights from vast datasets, thereby optimizing decision-making processes. Customer Behavioral Analytics is also a significant focus, as it utilizes AI to analyze purchasing trends and client preferences, which aids in personalized service offerings.

Beyond these, other applications contribute to improving efficiency and compliance within financial institutions, addressing the complexities of China's dynamic regulatory environment. The market is shaped by key drivers such as growing digitalization, demand for operational efficiency, and support from government initiatives to foster AI development. However, challenges like data privacy concerns and integration issues persist. Overall, as the industry evolves, the emphasis on the Application segment growth is anticipated to significantly enhance the capability of financial services in China, reflecting on overall market statistics and segmentation trends.

Applied AI in Finance Market Organization Size Insights

The Organization Size segment of the China Applied AI in Finance Market reveals significant insights into the varying scales of enterprises leveraging AI technologies. Small and Medium Enterprises (SMEs) play a crucial role by adopting applied AI solutions to enhance efficiency, streamline operations, and gain competitive advantages despite their limited resources. Meanwhile, Large Enterprises dominate the market landscape, taking advantage of substantial budgets that allow for the comprehensive implementation of cutting-edge AI systems and advanced analytics.This bifurcation represents not just a contrast in financial capacity but also in operational strategies, with larger firms often driving innovation and establishing benchmarks within the industry.

The increasing trend of digital transformation across all organization sizes indicates a robust demand for applied AI solutions in finance, driven by the need for improved decision-making, risk management, and customer engagement. Ultimately, the growth of this sector also faces challenges such as regulatory compliance and the availability of skilled personnel, yet it offers abundant opportunities for growth and investment, particularly in a rapidly evolving market like China, where financial technology is gaining momentum.This dual approach by SMEs and Large Enterprises is shaping the trajectory of the applied AI landscape in the finance sector.

China Applied AI in Finance Market Key Players and Competitive Insights

The China Applied AI in Finance Market has emerged as a dynamic sector characterized by rapid technological advancement and intense competition among key players. Leveraging artificial intelligence to enhance financial services, firms are exploring innovative applications to improve customer experience, streamline operations, and optimize risk management. As the market evolves, companies are investing heavily in research and development to harness the capabilities of AI, machine learning, and big data analytics. The competitive landscape is defined by a mix of traditional financial institutions and tech-centric firms, all vying for market share in this burgeoning segment. With the increasing acceptance of digital finance solutions and a growing consumer base, the China Applied AI in Finance Market is poised for substantial growth, presenting opportunities for forward-thinking players to solidify their positions and gain a competitive edge.

BaiDu has positioned itself strategically within the China Applied AI in Finance Market by utilizing its robust technological foundation and extensive data resources. Known for its strengths in artificial intelligence and natural language processing, BaiDu is focusing on developing intelligent risk assessment systems and customer service solutions that cater specifically to financial institutions. The company's capabilities in analytics enable it to deliver insights that enhance decision-making processes for banks and other financial entities. Furthermore, its emphasis on collaborations and partnerships within the financial sector has bolstered its market presence. By integrating AI-driven technologies, BaiDu aims to address challenges faced by financial institutions, such as fraud detection and customer engagement, further solidifying its reputation as a leader in this competitive landscape.

Ping An Technology has gained significant traction in the China Applied AI in Finance Market by offering a suite of innovative products and services designed to revolutionize the financial industry. The company leverages its core strengths in artificial intelligence and data analytics to provide smart insurance, banking, and health management solutions. Its notable advancements in AI-driven wealth management and customer support improve operational efficiency while elevating user experiences. Ping An Technology's market presence is characterized by strategic mergers and acquisitions aimed at expanding its technological capabilities and market reach.

By continuously investing in research and development, Ping An Technology seeks to enhance its service portfolio, thereby fortifying its position as a formidable player in the financial technology landscape in China. The company's commitment to applying AI in various financial applications underscores its vision of transforming how financial services are delivered, making it a key competitor in the market.

Key Companies in the China Applied AI in Finance Market Include:

- BaiDu

- Ping An Technology

- ByteDance

- WeBank

- JD Technology

- Dianrong

- Ant Group

- Tencent

- Zhengin Cloud

- Qianxin

- Huaan Technology

- China UnionPay

- Xuanwu Financial

- Huawei

- YooSee

China Applied AI in Finance Industry Developments

China's Applied AI in Finance Market has witnessed significant developments recently, with companies like Ping An Technology and Ant Group advancing their capabilities in artificial intelligence for financial services. In December 2022, Ant Group announced a collaboration with WeBank to enhance AI-driven credit scoring technologies, streamlining loan processes for consumers.

ByteDance has also made strides by integrating AI analytics into its financial products, aiming to broaden its footprint in fintech.In the realm of mergers and acquisitions, JD Technology acquired a minority stake in Zhengin Cloud in September 2023, enhancing its financial data processing capabilities. Furthermore, Tencent and Dianrong jointly launched an AI-driven risk management platform that has gained traction among financial institutions since its unveiling in June 2023.

Growth in the valuation of these companies reflects a robust market interest; Ping An Technology reported a 30% increase in its market valuation in Q3 of 2023. Recent government initiatives are pushing for AI adoption in banking and finance, further fueling investments in this sector, enabling greater efficiency and innovation across financial offerings in China. The ongoing regulatory support underscores the potential for further advancements in this rapidly evolving landscape.

China Applied AI in Finance Market Segmentation Insights

Applied AI in Finance Market Component Outlook

Applied AI in Finance Market Deployment Mode Outlook

Applied AI in Finance Market Application Outlook

- Virtual Assistants

- Business Analytics and Reporting

- Customer Behavioral Analytics

- Others

Applied AI in Finance Market Organization Size Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

577.47 (USD Million) |

| MARKET SIZE 2024 |

707.4 (USD Million) |

| MARKET SIZE 2035 |

4243.0 (USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

17.687% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

BaiDu, Ping An Technology, ByteDance, WeBank, JD Technology, Dianrong, Ant Group, Tencent, Zhengin Cloud, Qianxin, Huaan Technology, China UnionPay, Xuanwu Financial, Huawei, YooSee |

| SEGMENTS COVERED |

Component, Deployment Mode, Application, Organization Size |

| KEY MARKET OPPORTUNITIES |

Fraud detection enhancement, Personalized financial services, Credit risk assessment optimization, Regulatory compliance automation, Trading algorithm improvements. |

| KEY MARKET DYNAMICS |

Rapid technological advancements, increasing regulatory compliance, growing investment in fintech, data privacy concerns, rising customer demand for personalization |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ) :

The market is expected to be valued at 707.4 million USD in 2024.

By 2035, the market is anticipated to reach a valuation of 4243.0 million USD.

The market is projected to experience a CAGR of 17.687% from 2025 to 2035.

Key players in the market include BaiDu, Ping An Technology, ByteDance, WeBank, and JD Technology.

The Solutions segment is valued at 300.0 million USD in 2024.

The Services segment is expected to reach 2443.0 million USD by 2035.

Emerging trends, increasing automation, and a growing demand for personalized financial services present significant opportunities.

Challenges include regulatory hurdles and the need for data privacy and cybersecurity measures.

Both segments are expected to grow considerably, with Solutions projected to reach 1800.0 million USD and Services making significant gains to 2443.0 million USD.

Rapid urbanization and technological advancements in major Chinese cities are significantly boosting the market growth.