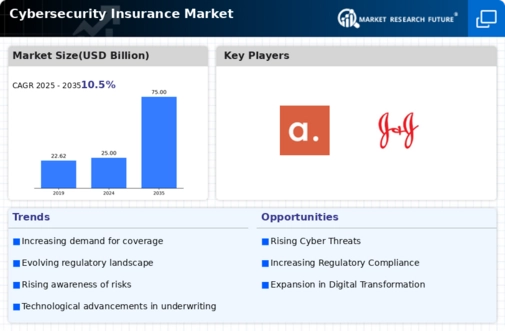

The Cybersecurity Insurance Market has become increasingly competitive as organizations recognize the importance of protecting themselves against cyber threats. This market offers insurance solutions designed to mitigate financial losses resulting from cyber incidents such as data breaches, ransomware attacks, and other cyber-related liabilities.

The rapid digital transformation and the escalating rate of cyber incidents have spurred a surge in demand for cybersecurity insurance. Insurance providers are now competing to enhance their product offerings, refine their underwriting processes, and improve risk assessment tools.

As businesses across various industries become more reliant on digital technologies, insurers are adapting their strategies to address the unique challenges posed by cyber risks, creating a dynamic and evolving competitive landscape.

Hiscox has established itself as a formidable player within the Cybersecurity Insurance Market by focusing on providing tailored insurance solutions that address the specific needs of small and medium-sized enterprises, as well as larger organizations.

The company has a strong market presence, leveraging advanced technology and a wealth of sector-specific expertise to assess individual client risks more accurately.

Their strengths lie in the breadth and depth of their coverage options, which offer comprehensive protection against various cyber threats, alongside their commitment to providing exceptional customer service.

Hiscox has effectively positioned itself as a trusted partner for organizations seeking to enhance their cybersecurity posture through risk management and mitigation strategies, bolstered by an ability to adapt to emerging cyber risks while maintaining competitive premiums.

Berkshire Hathaway has also made notable strides in the Cybersecurity Insurance Market, utilizing its extensive financial resources and powerful underwriting capabilities to craft innovative insurance products. With a reputation for stability and reliability, the company offers a strong assurance to clients in an increasingly uncertain cyber landscape.

Berkshire Hathaway's strength comes from its comprehensive risk assessment processes and a keen understanding of the evolving threats that organizations face. It has developed a portfolio that appeals to a broad range of clients, from startups to established corporations, ensuring that their cybersecurity insurance offerings can meet diverse client needs.

The backing of Berkshire Hathaway grants it the financial strength necessary to support clients through significant cyber incidents, reinforcing its position in the competitive market while fostering trust and long-term relationships with its customer base.