Rising Cyber Threats

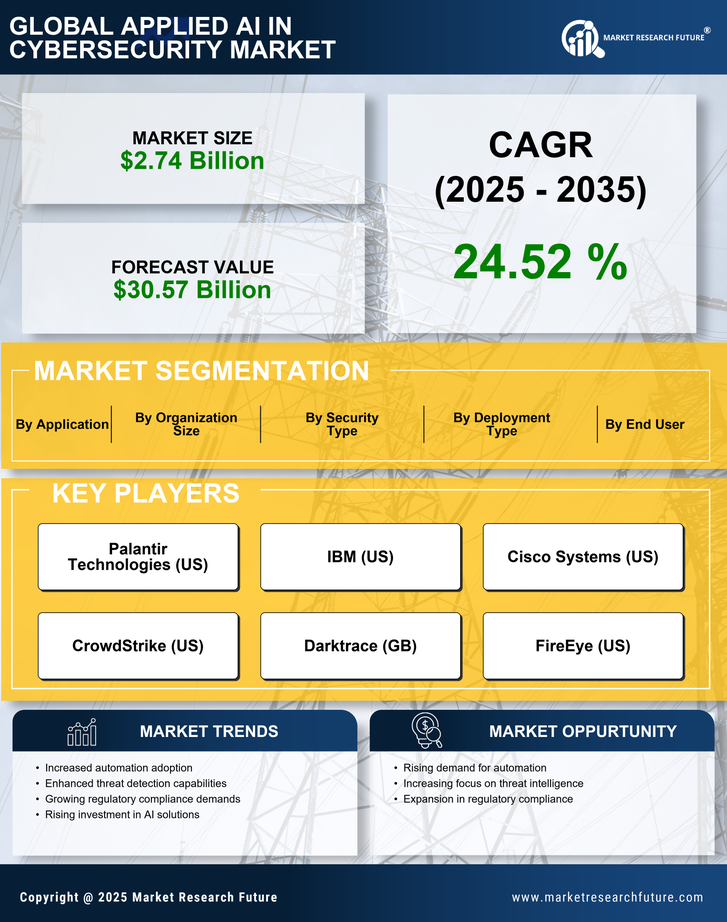

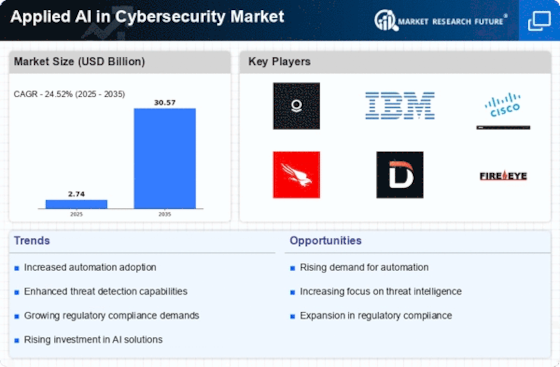

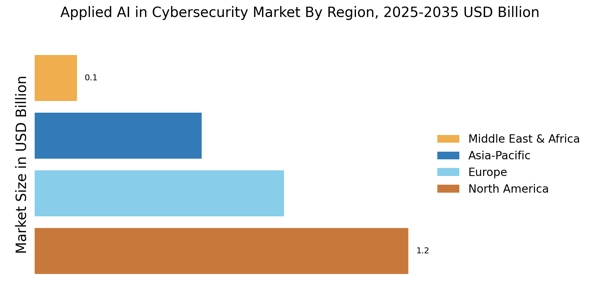

The Applied AI in Cybersecurity Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are facing a myriad of challenges, including ransomware attacks, phishing schemes, and data breaches. According to recent data, cybercrime is projected to cost businesses over 10 trillion dollars annually by 2025. This alarming trend compels organizations to adopt advanced technologies, such as applied AI, to enhance their security posture. AI-driven solutions can analyze vast amounts of data in real-time, identifying potential threats before they escalate. As cyber threats evolve, the need for innovative security measures becomes paramount, driving growth in the Applied AI in Cybersecurity Market.

Regulatory Compliance Requirements

The Applied AI in Cybersecurity Market is significantly influenced by the increasing regulatory compliance requirements imposed on organizations. Governments and regulatory bodies are enacting stringent data protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations necessitate that organizations implement robust cybersecurity measures to protect sensitive data. Failure to comply can result in hefty fines and reputational damage. As a result, businesses are turning to applied AI solutions to ensure compliance and enhance their security frameworks. AI technologies can automate compliance processes, monitor data access, and provide real-time reporting, thereby facilitating adherence to regulatory standards. This trend is likely to bolster the growth of the Applied AI in Cybersecurity Market.

Advancements in Machine Learning Algorithms

The Applied AI in Cybersecurity Market is benefiting from advancements in machine learning algorithms, which are becoming increasingly sophisticated and effective in identifying and mitigating cyber threats. These algorithms can learn from historical data, adapt to new patterns, and improve their accuracy over time. As machine learning technologies evolve, they enable organizations to detect anomalies and potential threats with greater precision. The integration of machine learning into cybersecurity solutions is expected to enhance threat detection rates significantly. Industry analysts suggest that the machine learning segment within the cybersecurity market could grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is indicative of the increasing reliance on applied AI technologies to bolster cybersecurity defenses, thereby driving the Applied AI in Cybersecurity Market.

Increased Investment in Cybersecurity Solutions

The Applied AI in Cybersecurity Market is experiencing a notable increase in investment as organizations prioritize cybersecurity in their budgets. With the rising costs associated with cyber incidents, businesses are allocating more resources to enhance their security measures. According to recent statistics, global spending on cybersecurity is projected to exceed 200 billion dollars by 2025. This influx of capital is facilitating the development and deployment of advanced AI-driven cybersecurity solutions. Organizations are recognizing that traditional security measures may no longer suffice in the face of evolving threats. As a result, they are investing in applied AI technologies that offer improved threat detection, response capabilities, and overall security effectiveness. This trend is likely to sustain the growth trajectory of the Applied AI in Cybersecurity Market.

Growing Demand for Real-time Threat Intelligence

The Applied AI in Cybersecurity Market is witnessing a growing demand for real-time threat intelligence solutions. Organizations are increasingly recognizing the importance of timely and accurate information regarding potential threats. The ability to detect and respond to threats in real-time is crucial for minimizing damage and ensuring business continuity. AI technologies can process and analyze data from various sources, providing actionable insights that enhance situational awareness. According to industry reports, the market for threat intelligence solutions is expected to reach 12 billion dollars by 2026. This trend indicates a shift towards proactive security measures, driving the adoption of applied AI in cybersecurity. As organizations seek to stay ahead of cyber adversaries, the demand for AI-driven threat intelligence solutions is likely to escalate, further propelling the Applied AI in Cybersecurity Market.