Market Analysis

In-depth Analysis of Applied AI in Cybersecurity Market Industry Landscape

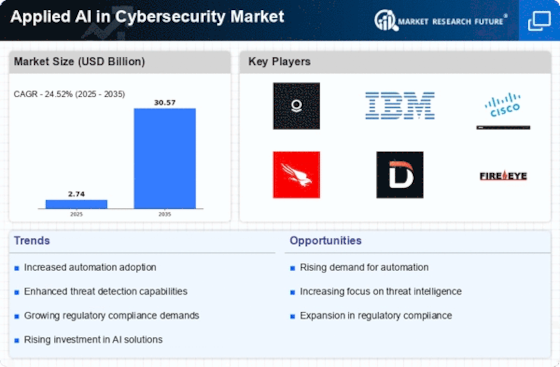

The market dynamics of Applied Artificial Intelligence (AI) in cybersecurity have been witnessing rapid evolution and growth in recent years, driven by the escalating sophistication of cyber threats and the increasing adoption of AI technologies to combat these threats. Applied AI in cybersecurity refers to the use of AI algorithms and machine learning techniques to detect, analyze, and respond to cyber threats in real-time. One of the primary drivers of market growth is the rising frequency and complexity of cyber attacks targeting organizations of all sizes and across various industries. Cybercriminals are constantly evolving their tactics, techniques, and procedures (TTPs) to bypass traditional security defenses, making it increasingly challenging for organizations to detect and mitigate cyber threats using manual or rule-based approaches alone.

Moreover, there is a growing recognition among organizations that traditional security measures such as antivirus software, firewalls, and intrusion detection systems (IDS) are no longer sufficient to protect against advanced and targeted cyber attacks. As a result, there is a growing demand for AI-powered cybersecurity solutions that can analyze large volumes of security data, identify patterns and anomalies indicative of malicious activity, and automate response actions in real-time. Applied AI technologies such as machine learning, deep learning, and natural language processing enable organizations to enhance threat detection capabilities, reduce response times, and adapt to evolving threats more effectively than traditional security approaches.

Another key driver of market growth is the increasing adoption of cloud computing and digital transformation initiatives, which are driving organizations to rethink their cybersecurity strategies and invest in more advanced and agile security solutions. Cloud computing and digital transformation initiatives introduce new attack vectors and security challenges, such as data breaches, insider threats, and misconfigurations, which require innovative approaches to cybersecurity. AI-powered cybersecurity solutions provide organizations with the scalability, flexibility, and automation capabilities needed to protect cloud-based workloads, applications, and data from emerging threats and vulnerabilities. By leveraging AI technologies, organizations can gain better visibility into their cloud environments, detect and respond to security incidents faster, and enforce consistent security policies across hybrid and multi-cloud environments.

Furthermore, there is a growing emphasis on threat intelligence and proactive defense strategies within the applied AI in cybersecurity market. Traditional security approaches often rely on reactive defenses, such as signature-based detection and manual incident response, which are ineffective against advanced and unknown threats. Applied AI technologies enable organizations to proactively identify emerging threats, predict potential attack vectors, and preemptively block or mitigate security incidents before they can cause harm. By integrating threat intelligence feeds, security analytics, and AI-driven security orchestration and automation platforms (SOAPs), organizations can enhance their threat detection and response capabilities, reduce the time to detect and remediate security incidents, and improve overall security posture.

Additionally, there is a growing trend towards the integration of AI-powered cybersecurity solutions with Security Operations Centers (SOCs) and Security Information and Event Management (SIEM) platforms to provide comprehensive threat detection and response capabilities. AI-powered cybersecurity solutions can ingest and analyze vast amounts of security data from disparate sources, including network logs, endpoint telemetry, and threat intelligence feeds, to identify and prioritize security alerts and incidents. By integrating with SIEM platforms and SOCs, AI-powered cybersecurity solutions enable security analysts to correlate and contextualize security events, automate incident triage and investigation processes, and orchestrate response actions across heterogeneous security infrastructure. This integration streamlines security operations, enhances collaboration between security teams, and improves the efficiency and effectiveness of incident response workflows.

Moreover, there is a growing focus on explainability, transparency, and trustworthiness in AI-powered cybersecurity solutions, as organizations seek to understand how AI algorithms make decisions and ensure that they are not biased or susceptible to adversarial attacks. Explainable AI (XAI) techniques such as model interpretability, feature attribution, and decision rationale analysis enable organizations to understand and interpret the behavior of AI algorithms and identify potential biases or vulnerabilities. Additionally, organizations are investing in AI governance frameworks, ethical AI principles, and regulatory compliance measures to ensure that AI-powered cybersecurity solutions are developed and deployed in a responsible and accountable manner. By prioritizing explainability, transparency, and trustworthiness, organizations can build confidence in AI-powered cybersecurity solutions and foster trust among stakeholders, customers, and regulators.

Leave a Comment