Market Share

Applied AI in Cybersecurity Market Share Analysis

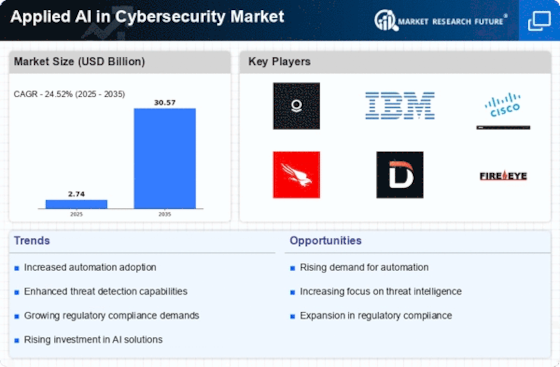

In the rapidly evolving realm of Applied Artificial Intelligence (AI) in Cybersecurity, companies deploy a multitude of strategies to position themselves effectively and gain market share. One primary strategy is differentiation, where companies strive to set themselves apart from competitors by offering unique AI-driven cybersecurity solutions. These solutions may incorporate advanced machine learning algorithms, predictive analytics, or behavioral analysis to detect and mitigate cyber threats effectively. By providing distinct and innovative offerings, companies can attract customers seeking cutting-edge cybersecurity solutions, thereby gaining a competitive edge and increasing market share.

Cost leadership is another critical strategy within the Applied AI in Cybersecurity market. Companies pursuing this approach focus on delivering cost-effective solutions without compromising on security or performance. By streamlining their processes, leveraging cloud computing resources, and automating routine tasks, companies can offer competitive pricing to appeal to budget-conscious clients. Providing affordable AI-powered cybersecurity solutions enables companies to expand their customer base and capture market share in a highly competitive environment.

Moreover, targeting specific niches or customer segments is a strategic move for many companies in the Applied AI in Cybersecurity market. By tailoring their solutions to meet the unique requirements of particular industries or use cases, such as finance, healthcare, or critical infrastructure, companies can address specific compliance regulations, security challenges, or operational needs. This targeted approach allows companies to establish themselves as leaders within specific market segments, build strong relationships with customers, and gain a competitive advantage in the market.

Strategic partnerships and alliances play a pivotal role in market share positioning within the Applied AI in Cybersecurity market. Collaborations with technology vendors, cybersecurity firms, or industry stakeholders enable companies to leverage complementary strengths and resources. These partnerships can facilitate access to new technologies, expand market reach, and integrate AI-driven cybersecurity solutions with complementary products or services, driving growth and increasing market share.

Furthermore, mergers and acquisitions (M&A) are prevalent strategies for companies in the Applied AI in Cybersecurity market aiming to consolidate their position and expand market share rapidly. Through strategic acquisitions, companies can gain access to new technologies, talent, or customer bases, thereby enhancing their competitive position and capabilities. M&A activities provide opportunities for companies to scale their operations, enter new markets, or eliminate competitors, contributing to solidifying their position in the Applied AI in Cybersecurity market.

Effective marketing and branding strategies are essential for companies looking to establish a strong market position in the Applied AI in Cybersecurity sector. Building a compelling brand identity and effectively communicating the value proposition of their solutions are critical components of these strategies. Marketing efforts may include targeted advertising campaigns, participation in industry events, and partnerships with key stakeholders to position the company as a trusted provider of AI-driven cybersecurity solutions.

Continuous innovation is vital for companies seeking to maintain or improve their market share in the rapidly evolving Applied AI in Cybersecurity market. Investment in research and development allows companies to stay ahead of emerging threats, technologies, and customer requirements. Continuous innovation enables companies to enhance their solutions, introduce new features, and adapt to evolving cybersecurity challenges, ultimately driving market share growth.

Customer service and support are also crucial for market share positioning within the Applied AI in Cybersecurity market. Providing exceptional customer service, offering timely support, and delivering ongoing training and updates are essential for building customer loyalty and satisfaction. Satisfied customers are more likely to recommend a company's solutions to others, contributing to positive word-of-mouth marketing and aiding in the expansion of market share.

Leave a Comment