China Financial Cloud Market Overview

As per MRFR analysis, the China Financial Cloud Market Size was estimated at 2.77 (USD Billion) in 2023. The China Financial Cloud Market Industry is expected to grow from 3 (USD Billion) in 2024 to 8 (USD Billion) by 2035. The China Financial Cloud Market CAGR (growth rate) is expected to be around 9.326% during the forecast period (2025 - 2035)

Key China Financial Cloud Market Trends Highlighted

A number of important market factors are propelling the notable expansion of the China Financial Cloud Market. A major driver of the financial sector's fast digitalization in China is the desire of institutions to increase customer service, save expenses, and increase efficiency. Banks and financial institutions have been pushed to switch to cloud-based systems by the Chinese government's aggressive promotion of financial technology advancements and cloud usage through programs and policies that are supportive of these trends. Opportunities abound in the market due to the growing need for integrated solutions that provide sophisticated analytics, security, and data storage.

The growing emphasis on data privacy and adherence to laws such as the Cybersecurity Law has led financial organizations to investigate cloud services that offer strong data protection. Also, the rise of fintech businesses in China is increasing the need for customized cloud services that meet their particular operational requirements, which gives cloud providers an opportunity to serve this market. As Chinese financial organizations look to balance the advantages of public and private clouds, recent trends indicate a push towards hybrid cloud architectures.

This tendency is reinforced by the increasing requirement for financial institutions to retain authority over confidential information while also utilizing the scalability and innovation of public cloud services. Additionally, financial firms are gaining actionable insights and improving their ability to analyze large volumes of data thanks to the growing use of AI and machine learning in cloud settings. The China Financial Cloud Market is characterized by a dynamic environment that is influenced by changing service expectations and technology advancements.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Financial Cloud Market Drivers

Rapid Digital Transformation in Financial Services

The China Financial Cloud Market Industry is experiencing significant growth due to the rapid digital transformation of financial services across the region. According to the People's Bank of China, the implementation of digital finance reached over 70% among banking institutions in urban areas, reflecting a strong transition towards cloud computing solutions.

Major banks like Industrial and Commercial Bank of China are investing heavily in cloud technologies to enhance operational efficiency, streamline services, and improve customer engagement in line with the national strategy to promote financial inclusion and technological innovation by 2025.The push for innovative digital solutions is set to create a robust demand for financial cloud services as businesses adapt to new consumer expectations and regulatory pressures.

Government Initiatives and Support for Cloud Computing

The Chinese government has been proactively supporting the growth of cloud computing within the financial sector through various initiatives and policies. The Ministry of Industry and Information Technology has laid out plans to cultivate the 'New Infrastructure' strategy that emphasizes cloud computing, big data, and AI technologies.

According to a report from the State Council, the potential market size for cloud services in China is projected to reach 1 trillion yuan by 2025, reflecting the government's commitment to digital transformation. Established firms like Alibaba Cloud and Tencent Cloud are benefiting from these initiatives and are poised to play a crucial role in the expansion of the China Financial Cloud Market Industry.

Increased Cybersecurity Concerns Driving Cloud Adoption

With the rise in cyber threats, financial institutions in China are increasingly adopting cloud solutions to enhance their cybersecurity frameworks. The China Internet Security Report has noted a 30% increase in cybersecurity incidents in the financial sector over the past three years, prompting a shift towards cloud computing that offers scalable and robust security measures.

Notably, companies like China Merchants Bank are leveraging cloud technologies to implement advanced security protocols and data protection measures.This emphasis on cybersecurity not only ensures compliance with regulations but also builds consumer trust, leading to increased investment in the China Financial Cloud Market Industry.

China Financial Cloud Market Segment Insights

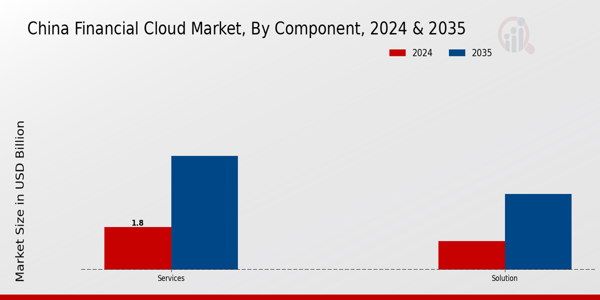

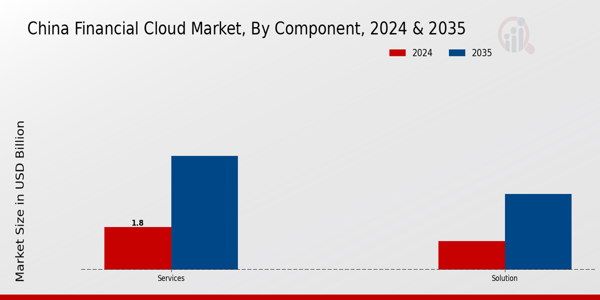

Financial Cloud Market Component Insights

The Component segment of the China Financial Cloud Market comprises critical elements that underpin the broader financial cloud ecosystem, particularly focusing on solutions and services. This segment plays a pivotal role in the overall infrastructure of financial institutions, enabling them to enhance operational efficiency and respond effectively to market demands. The solutions category encompasses a wide range of offerings, including data management systems, analytics tools, and security frameworks, all designed to provide financial entities with the necessary resources to optimize their operations and ensure compliance with stringent regulations.

The importance of robust solutions cannot be understated, as they facilitate real-time data processing and advanced analytics, empowering organizations to make informed decisions swiftly.On the other hand, the services aspect pertains to the support and maintenance of these solutions, encompassing areas such as implementation, training, and ongoing technical support. Services are vital in ensuring that the solutions remain functional and effective over time, which is essential in a rapidly evolving financial landscape. The growing prevalence of digital transformation initiatives within the banking and financial services sector in China drives demand for sophisticated solutions and services, allowing companies to leverage cloud capabilities for scalability and innovation. Moreover, as the

Chinese government continues to encourage modernization through programs that promote digital finance, this component segment is increasingly recognized for its potential to enhance service delivery and customer experience across financial platforms. With ongoing advancements in technology, particularly in artificial intelligence and machine learning, the Component segment is expected to witness significant growth, making it a cornerstone of the overall China Financial Cloud Market landscape. As organizations strive to remain competitive, the ability to effectively utilize solutions and services within this segment will likely determine their future success and sustainability in the marketplace.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Financial Cloud Market Cloud Type Insights

The China Financial Cloud Market is significantly shaped by the Cloud Type segmentation, which includes Public Cloud and Private Cloud. The growing adoption of Public Cloud services is driven by financial institutions seeking scalable resources and improved operational efficiency, as they aim to enhance customer engagement and business agility. Public Clouds also support cost-effective solutions, allowing firms to harness advanced technologies like artificial intelligence and machine learning without heavy infrastructure investment. On the other hand, the Private Cloud segment is essential for firms that prioritize data security and compliance, making it particularly appealing for banks and financial organizations with stringent regulatory requirements.

The rise of digital financial services in China further bolsters the demand for tailored Private Cloud solutions, enabling organizations to maintain control over sensitive data while benefiting from the flexibility of cloud infrastructure. The combination of these two Cloud Types plays a critical role in the evolution of the China Financial Cloud Market, promoting efficiency and innovation while addressing the unique challenges of the financial sector. With the country's push for digital transformation, both Public and Private Cloud options are integral in shaping the future landscape of financial services in China.

Financial Cloud Market Organization Size Insights

The Organization size segment within the China Financial Cloud Market has exhibited notable growth, primarily driven by the robust expansion of industries such as banking and financial services, as well as the insurance sector. The increasing digitization of financial services has prompted organizations to adopt cloud solutions for enhanced operational efficiency, data management, and regulatory compliance. The banking and financial services industry leads in cloud adoption, playing a pivotal role due to its need for secure and scalable infrastructures that handle vast amounts of transactional data.Meanwhile, the insurance industry follows closely, recognizing the importance of the cloud for risk assessment, claims processing, and customer engagement.

As organizations in these sectors increasingly embrace Financial Cloud Market solutions, they are poised to enhance their service offerings and respond more swiftly to market dynamics. The growing emphasis on data analytics and artificial intelligence within these industries further highlights the necessity of financial cloud services for driving innovation and maintaining a competitive edge in the rapidly evolving market landscape.Enhanced regulatory requirements also spur organizations to seek cloud solutions that can ensure compliance while optimizing costs and improving service delivery.

China Financial Cloud Market Key Players and Competitive Insights

The China Financial Cloud Market is a rapidly evolving sector characterized by strong competition among a range of influential players. As financial institutions increasingly migrate to cloud-based solutions for enhanced efficiency and flexibility, the competitive landscape is shifting significantly. This market is driven not only by advancements in technology but also by changing regulatory policies, consumer demands, and digital transformation strategies that emphasize security, scalability, and cost-effectiveness. Companies operating in this space are vying for market share through innovative offerings and strategic partnerships, which are crucial for meeting the unique needs of the financial sector, where data sensitivity and compliance are paramount.

In the context of the China Financial Cloud Market, JD.com stands out with its robust infrastructure and extensive experience in logistics and technology. The company has strategically positioned itself to leverage its e-commerce expertise for financial cloud services, providing solutions that cater to various segments, including payments, credit services, and supply chain financing. JD.com’s strengths lie in its ability to integrate its vast network and data resources, allowing for tailored solutions that enhance financial efficiency for businesses. The company has committed to continuous development in cloud technology, ensuring it remains a competitive player capable of meeting the evolving requirements of financial institutions across China.

Xunlei is another noteworthy competitor in the China Financial Cloud Market, leveraging its strengths in internet technology and cloud computing. It offers a range of products and services, including cloud storage, content delivery networks, and blockchain solutions, which are particularly relevant in the financial sector. Xunlei's market presence is bolstered by its focus on innovation and the use of big data analytics to enhance user experiences. While the company actively seeks acquisitions to expand its technological capabilities and market reach, its partnerships with various financial institutions help reinforce its position in this competitive landscape. Additionally, Xunlei's emphasis on security and compliance within its service offerings aligns well with the stringent requirements of the Chinese financial market, granting it a unique advantage.

Key Companies in the China Financial Cloud Market Include

- JD.com

- Xunlei

- Tencent

- Digital China

- ZTE

- Huawei

- China Mobile

- Ping An Technology

- Baidu

- China Telecom

- Lenovo

- Kingdee

- Qihu 360

- Alibaba

China Financial Cloud Industry Developments

The China Financial Cloud Market has recently seen significant developments, with major companies such as JD.com, Tencent, and Alibaba actively shaping the landscape. In September 2023, Alibaba announced an expansion of its cloud services, enhancing its offerings for financial institutions amid increasing competition. Meanwhile, Tencent is collaborating with China Mobile to further integrate cloud solutions into financial services, aiming to streamline processes and enhance security. Notably, Xunlei made strides in October 2023 by upgrading its cloud infrastructure to better serve its financial sector clients.

Regarding mergers and acquisitions, Ping An Technology acquired a controlling stake in a local fintech company in August 2023, reinforcing its dominance in the market. Additionally, Huawei and ZTE have been scaling up their cloud services to cater to a growing demand for secure financial transactions. The financial cloud environment in China has been bolstered by rapid growth rates in market valuation, spurred by government support for digital finance initiatives, which has notably impacted the expansion strategies of these major players over the past two years, emphasizing innovation and collaboration within the sector.

China Financial Cloud Market Segmentation Insights

Financial Cloud Market Component Outlook

Financial Cloud Market Cloud Type Outlook

- Public Cloud

- Private Cloud

Financial Cloud Market Organization Size Outlook

- Sub-industry (Banking and financial services)

- Sub-industry (insurance)

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.77 (USD Billion) |

| MARKET SIZE 2024 |

3.0 (USD Billion) |

| MARKET SIZE 2035 |

8.0 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

9.326% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

JD.com, Xunlei, Tencent, Digital China, ZTE, Huawei, China Mobile, Ping An Technology, Baidu, China Telecom, Lenovo, Kingdee, Qihu 360, Alibaba |

| SEGMENTS COVERED |

Component, Cloud Type, Organization size |

| KEY MARKET OPPORTUNITIES |

Rapid fintech adoption, Increased regulatory compliance needs, Growing demand for data analytics, Enhanced cybersecurity solutions, Expanding digital payment ecosystem |

| KEY MARKET DYNAMICS |

regulatory compliance requirements, increasing digital transformation adoption, growing demand for cybersecurity solutions, enhanced data analytics capabilities, competitive pricing strategies |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ) :

In 2024, the China Financial Cloud Market is expected to be valued at 3.0 billion USD.

By 2035, the China Financial Cloud Market is anticipated to reach a value of 8.0 billion USD.

The expected CAGR for the China Financial Cloud Market from 2025 to 2035 is 9.326 percent.

In 2024, the services segment is valued higher at 1.8 billion USD compared to the solutions segment, which stands at 1.2 billion USD.

The solutions segment in the China Financial Cloud Market is projected to reach a value of 3.2 billion USD by 2035.

By 2035, the services segment of the China Financial Cloud Market is anticipated to attain a value of 4.8 billion USD.

Major players in the China Financial Cloud Market include JD.com, Tencent, Alibaba, Huawei, and Ping An Technology among others.

Emerging trends in the China Financial Cloud Market include increased investment in cloud solutions, enhanced cybersecurity measures, and the adoption of artificial intelligence.

Key growth drivers for the China Financial Cloud Market include digital transformation in the finance sector and the rising demand for advanced data analytics.

In 2025, the competitive landscape is characterized by significant investments from both established and emerging players aiming to capture market share.