Personalization of Financial Services

In the China generative ai fintech market, the demand for personalized financial services is on the rise. Consumers increasingly expect tailored solutions that cater to their unique financial needs and preferences. Generative AI technologies enable financial institutions to analyze vast amounts of data, allowing for the creation of customized products and services. For example, AI-driven chatbots can provide personalized investment advice based on individual risk profiles. This trend is reflected in the growing number of fintech startups that leverage AI to enhance customer experiences. According to recent data, over 60% of Chinese consumers express a preference for personalized financial services, indicating a significant market opportunity for companies that can effectively harness generative AI capabilities.

Regulatory Support for AI Integration

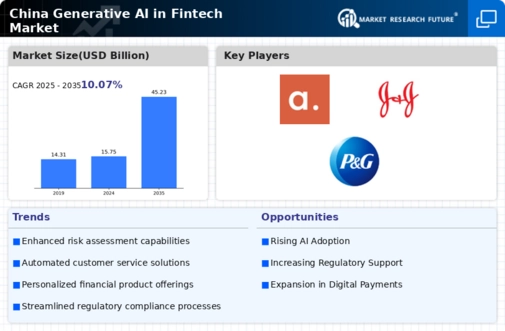

The China generative ai fintech market benefits from robust regulatory support aimed at fostering innovation. The Chinese government has implemented policies that encourage the integration of artificial intelligence into financial services. For instance, the People's Bank of China has issued guidelines that promote the use of AI technologies in risk management and fraud detection. This regulatory framework not only enhances the operational efficiency of financial institutions but also instills consumer confidence in AI-driven solutions. As a result, the market is witnessing a surge in AI applications, with an estimated growth rate of 30% annually in the fintech sector. Such supportive measures are likely to propel the adoption of generative AI technologies, positioning China as a leader in the global fintech landscape.

Collaboration Between Tech and Finance

The synergy between technology and finance is a pivotal driver in the China generative ai fintech market. Traditional financial institutions are increasingly partnering with tech companies to leverage their expertise in AI and data analytics. This collaboration facilitates the development of innovative financial products that meet the evolving needs of consumers. For instance, major banks in China are collaborating with AI startups to enhance their digital offerings, resulting in improved customer engagement and operational efficiency. The market is projected to grow by 25% over the next five years, driven by these strategic partnerships. Such collaborations not only enhance the competitive landscape but also accelerate the adoption of generative AI technologies across the financial sector.

Investment in AI Research and Development

Investment in research and development is a crucial driver for the China generative ai fintech market. Both private and public sectors are channeling significant resources into AI R&D, aiming to advance the capabilities of generative AI technologies. The Chinese government has set ambitious targets for AI development, with plans to invest over 150 billion USD in AI initiatives by 2030. This influx of capital is likely to spur innovation within the fintech sector, leading to the emergence of new AI-driven solutions that enhance financial services. Furthermore, as companies invest in R&D, they are expected to create a more competitive environment, fostering advancements that could redefine the landscape of the generative AI fintech market.

Consumer Adoption of Digital Financial Solutions

Consumer adoption of digital financial solutions is a key driver in the China generative ai fintech market. As digital literacy increases among the population, more consumers are embracing AI-powered financial services. The proliferation of smartphones and internet access has facilitated this trend, enabling users to engage with fintech applications seamlessly. Recent statistics indicate that over 70% of Chinese consumers utilize digital payment platforms, showcasing a strong inclination towards technology-driven financial solutions. This growing acceptance of digital finance is likely to accelerate the integration of generative AI technologies, as companies strive to meet the demands of a tech-savvy consumer base. Consequently, the market is poised for substantial growth as more individuals seek innovative financial services.