Chlorhexidine Gluconate Cloth Size

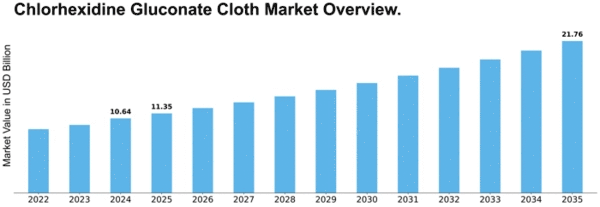

Chlorhexidine Gluconate Cloth Market. Growth Projections and Opportunities

Surgical site infections (SSIs) represent a common and significant concern in the realm of surgical procedures. Addressing this challenge, Chlorhexidine gluconate (CHG) cloths have emerged as a vital tool in preoperative skin preparation. These cloths are premoistened with an FDA-approved antiseptic solution designed to reduce bacteria on the skin before surgery. The rinse-free formula adheres to the skin, earning the trust of healthcare professionals, particularly nurses, in mitigating the risk of developing SSIs. While the use of CHG cloths has seen a notable uptick, factors such as rising surgical site infections and robust recommendations for CHG products by authorized healthcare organizations have been pivotal in driving the global chlorhexidine gluconate (CHG) cloth market's growth in recent years. However, it is essential to acknowledge that potential side effects associated with CHG may pose challenges to market expansion over the forecast period.

The global chlorhexidine gluconate (CHG) cloth market has experienced rapid growth, and projections indicate it is poised to reach USD 16,469.14 thousand by 2023, exhibiting a Compound Annual Growth Rate (CAGR) of 3.80% from 2018 to 2023. In 2017, the Americas dominated the market with a substantial share of 48.70%, followed by Europe and Asia-Pacific with shares of 28.41% and 16.57%, respectively.

The driving force behind the escalating demand for CHG cloths lies in the pressing need to combat surgical site infections. Surgical procedures inherently carry the risk of infections, making preoperative measures crucial in minimizing adverse outcomes. CHG cloths have become integral in the preoperative routine, offering a reliable and effective means of reducing bacterial load on the skin, thus contributing significantly to infection prevention.

Healthcare organizations and professionals have increasingly embraced the use of CHG products, with authoritative bodies endorsing their efficacy in preoperative skin preparation. The FDA-approved antiseptic solution in CHG cloths aligns with established guidelines and best practices, providing a standardized approach to infection control in surgical settings. This widespread acceptance has played a pivotal role in propelling the growth of the CHG cloth market globally.

However, as with any medical intervention, potential side effects associated with CHG must be considered. While CHG is generally recognized as safe and effective, there have been instances of skin reactions or hypersensitivity in some individuals. The awareness of these side effects underscores the importance of careful consideration and adherence to individual patient characteristics in clinical practice.

The geographical distribution of the market highlights the dominance of the Americas, comprising North and South America, as the leading region in CHG cloth consumption. This can be attributed to the robust healthcare infrastructure, stringent infection control protocols, and a high volume of surgical procedures in these regions. Europe and Asia-Pacific follow suit, each contributing significantly to the market's overall growth.

In conclusion, the global chlorhexidine gluconate (CHG) cloth market is witnessing robust growth, fueled by the imperative to address surgical site infections. The efficacy of CHG cloths in preoperative skin preparation has gained widespread acceptance among healthcare professionals globally. While the market is on a trajectory of expansion, the potential side effects associated with CHG necessitate a balanced approach, emphasizing patient safety and individualized care. As healthcare organizations continue to prioritize infection prevention, CHG cloths are expected to play an integral role in shaping the landscape of preoperative practices, ensuring safer surgical outcomes.

Leave a Comment