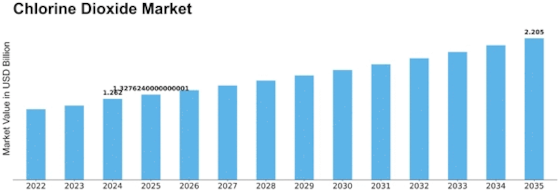

Chlorine Dioxide Size

Chlorine Dioxide Market Growth Projections and Opportunities

The chlorine dioxide market is influenced by various factors that shape its growth, demand, and overall dynamics. One significant factor driving the market is the widespread use of chlorine dioxide across multiple industries for its powerful disinfection properties. Chlorine dioxide is a highly effective biocide and oxidizing agent used for water treatment, disinfection of surfaces, and sterilization in industries such as municipal water treatment, healthcare, food and beverage processing, and pulp and paper manufacturing. Its ability to eliminate bacteria, viruses, fungi, and other pathogens makes it an essential chemical in maintaining public health and safety, driving demand for chlorine dioxide in the market.

Technological advancements also play a crucial role in shaping the chlorine dioxide market. Innovations in chlorine dioxide production methods, delivery systems, and application techniques contribute to improving efficiency, safety, and environmental sustainability. Advanced manufacturing processes, such as the use of membrane electrochemical cells and chlorine dioxide generators, enable on-site production of chlorine dioxide, reducing transportation costs and minimizing chemical waste. Additionally, advancements in dosing and monitoring systems enhance control and precision in chlorine dioxide application, ensuring optimal disinfection and compliance with regulatory standards.

Market factors also include regulatory policies and safety standards governing the production, handling, and use of chlorine dioxide. Regulatory agencies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in Europe impose regulations on the use of chlorine dioxide to protect human health and the environment. Compliance with these regulations is essential for manufacturers to obtain permits, certifications, and approvals for production and distribution of chlorine dioxide products. Moreover, adherence to industry standards and best practices enhances market credibility and consumer trust in chlorine dioxide products.

Economic factors such as population growth, urbanization, and industrialization influence the demand for chlorine dioxide products. The expansion of urban areas and increasing industrial activity lead to higher demand for clean water, sanitation, and disinfection solutions, driving market growth for chlorine dioxide in municipal water treatment, wastewater treatment, and industrial processes. Moreover, population growth and rising healthcare expenditures contribute to increased demand for chlorine dioxide-based disinfectants and sterilization products in healthcare facilities, laboratories, and pharmaceutical manufacturing.

Raw material availability and pricing are critical market factors for the chlorine dioxide industry. Chlorine dioxide can be produced from various precursor chemicals such as sodium chlorite, chlorine gas, and sulfuric acid. Fluctuations in the prices and availability of these raw materials, as well as energy costs, can impact production costs and pricing strategies for chlorine dioxide manufacturers. Additionally, sourcing high-quality raw materials and ensuring a reliable supply chain are essential for maintaining product quality and meeting market demand.

Consumer preferences and environmental considerations also shape the chlorine dioxide market landscape. With increasing awareness of waterborne diseases, food safety, and healthcare-associated infections, consumers are seeking effective and eco-friendly disinfection solutions. Manufacturers are responding by developing chlorine dioxide products that are safe, sustainable, and environmentally friendly. Moreover, the growing demand for green technologies and eco-friendly alternatives drives innovation in chlorine dioxide production methods and applications, such as chlorine dioxide tablets for water purification and chlorine dioxide gas for surface disinfection.

Competition within the industry also influences the chlorine dioxide market dynamics. With numerous manufacturers and suppliers operating globally, competition can be intense, leading to price competition, product differentiation, and marketing efforts to gain market share. Companies may differentiate themselves through product quality, purity, packaging, branding, and customer service. Moreover, strategic partnerships, collaborations, and mergers and acquisitions may help companies strengthen their competitive position and expand their market presence in the chlorine dioxide industry.

Leave a Comment