Clamshell Packaging Size

Market Size Snapshot

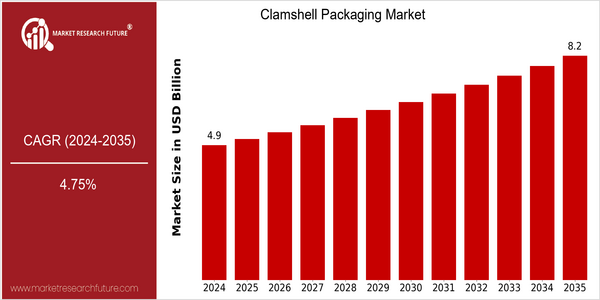

| Year | Value |

|---|---|

| 2024 | USD 4.92 Billion |

| 2035 | USD 8.2 Billion |

| CAGR (2025-2035) | 4.75 % |

Note – Market size depicts the revenue generated over the financial year

Clamshell packaging is a very important packaging material for the production of clamshells, and the market is expected to grow from $ 4.92 billion in 2024 to $ 8.2 billion in 2035. It is expected to grow at a compound annual growth rate of 4.75% from 2025 to 2035, indicating that the demand for clamshells is strong in various industries. The increase in the demand for clamshells is mainly driven by the trend of sustainable development and the rise in e-commerce and retail. Also, the development of packaging materials and design has also led to the expansion of the market. The new clamshell material is expected to be biodegradable and recyclable, and will be able to meet the sustainable development trend. The major players in the market, such as Amcor, Sealed Air and Westrock, are actively investing in research and development to meet the needs of consumers. The development of clamshells has become a new trend in the packaging industry.

Regional Market Size

Regional Deep Dive

The clamshell market is experiencing significant growth in various regions of the world, mainly driven by the increasing demand for convenience, sustainability, and visibility of the product. In North America, the market is characterized by a strong presence of key players and a focus on the development of innovative packaging solutions. In Europe, the focus is on the use of sustainable materials, while the Asia-Pacific region is growing rapidly due to increasing disposable income and urbanization. Middle East and Africa are gradually adopting clamshell packaging, influenced by the changing retail environment. Latin America is also a promising market due to the growing interest in clamshells and the rising demand for food products.

Europe

- In Europe, the rise of the circular economy has led to increased demand for sustainable clamshell packaging solutions, with companies like Smurfit Kappa investing in recyclable materials and eco-friendly designs.

- The European Union's stringent regulations on single-use plastics are prompting manufacturers to innovate and adapt their packaging solutions, which is expected to reshape the market landscape significantly.

Asia Pacific

- The Asia-Pacific region is witnessing rapid urbanization and a growing middle class, leading to increased demand for packaged food products, with companies like Amcor and Sealed Air expanding their operations to cater to this trend.

- Innovations in manufacturing processes, such as the use of advanced thermoforming techniques, are enhancing the efficiency and sustainability of clamshell packaging production in countries like China and India.

Latin America

- Latin America is experiencing a shift towards modern retail formats, which is increasing the demand for clamshell packaging, particularly in countries like Brazil and Mexico, where companies like Grupo Pochteca are leading the charge.

- The region's focus on food safety and quality is driving innovations in clamshell packaging, with an emphasis on materials that extend shelf life and maintain product integrity.

North America

- The North American market is heavily influenced by the food and beverage sector, with companies like Berry Global and Sonoco Products leading the way in innovative clamshell designs that enhance product visibility and shelf appeal.

- Recent regulatory changes in California, aimed at reducing plastic waste, are pushing manufacturers to explore biodegradable and recyclable materials for clamshell packaging, which is expected to drive innovation and sustainability in the market.

Middle East And Africa

- In the Middle East and Africa, the growing retail sector is driving the adoption of clamshell packaging, with local companies like Al Bayader International focusing on developing customized solutions for the food industry.

- Government initiatives aimed at promoting sustainable packaging practices are encouraging manufacturers to invest in eco-friendly clamshell options, which is expected to foster market growth in the region.

Did You Know?

“Did you know that clamshell packaging can reduce food waste by up to 30% due to its ability to provide better protection and visibility for products?” — Food Packaging Forum

Segmental Market Size

Clamshell packaging plays a crucial role in the overall packaging market, which is currently growing steadily, mainly because of the growing demand for convenience and visibility. The increasing e-commerce is another important growth factor. The e-packaging needs to be protected and visible. The demand for sustainable materials is a growing trend. At the forefront of this trend are companies like Amcor and Sealed Air, which are at the forefront of developing new designs that enhance the customer experience while complying with the environment. Clamshell packaging is currently in its deployment stage. The most obvious examples are in the food and retail industries. Protective properties are used in fresh fruit and vegetables and in the electronics industry. The development of sustainable initiatives and the shift to recyclable materials accelerates the growth of clamshell packaging, because consumers prefer eco-friendly products. And thermoforming and automation are shaping the evolution of the industry. They allow manufacturers to meet the most varied customer needs and optimize the efficiency of production.

Future Outlook

Clamshell Packaging Market is expected to grow at a CAGR of 4.7% from 2024 to 2035. The growth of the market is driven by the growing demand for sustainable packaging solutions, as consumers and companies are increasingly focusing on sustainable materials. The increasing penetration of clamshell packaging in various industries, especially in the food & beverage, consumer goods, and retail sectors, is expected to drive the market growth. Clamshell packaging is expected to grow at a CAGR of approximately 16% from 2024 to 2035. Also, the development of biodegradable and recyclable materials will drive the market growth. Clamshell packaging will continue to gain traction due to the introduction of automation and smart packaging technology. Moreover, the introduction of government regulations to promote sustainable development and reduce waste is expected to create a favorable environment for market growth. Clamshell packaging will not only continue to grow, but also evolve in line with the needs of consumers for sustainable products.

Leave a Comment