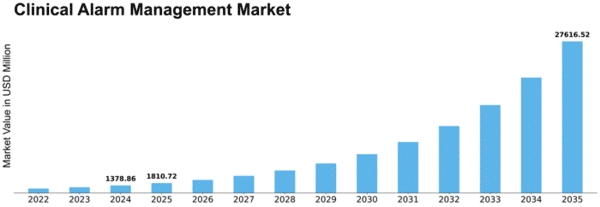

Clinical Alarm Management Size

Clinical Alarm Management Market Growth Projections and Opportunities

The clinical alarm management market is influenced by a variety of factors that shape its growth and evolution. Firstly, the increasing focus on patient safety and regulatory compliance drives the demand for clinical alarm management solutions. Clinical alarms play a critical role in alerting healthcare providers to potential patient care issues and medical emergencies. However, alarm fatigue—a phenomenon where healthcare providers become desensitized to frequent and non-actionable alarms—poses a significant challenge to patient safety. Regulatory agencies such as the Joint Commission and the Food and Drug Administration (FDA) have issued guidelines and recommendations to address alarm fatigue and improve alarm management practices in healthcare facilities. As a result, there is a growing need for advanced alarm management solutions that prioritize clinically relevant alarms, reduce false alarms, and enhance situational awareness among healthcare providers.

Secondly, technological advancements in alarm management systems and healthcare IT infrastructure contribute to market growth. Modern clinical alarm management solutions leverage advanced algorithms, machine learning techniques, and interoperable platforms to analyze and prioritize alarms based on patient context, clinical significance, and user preferences. Integration with electronic health records (EHR) systems, medical devices, and nurse call systems enables real-time alarm notification, data visualization, and clinical decision support, empowering healthcare providers to respond promptly to critical alarms and coordinate patient care more effectively. As healthcare organizations continue to digitize and modernize their infrastructure, the demand for integrated alarm management solutions is expected to increase.

Another significant factor driving the clinical alarm management market is the rising adoption of wearable and remote patient monitoring devices. Wearable sensors, physiological monitors, and mobile health apps enable continuous monitoring of patient vital signs and biometric data outside of traditional healthcare settings. While remote monitoring technologies offer numerous benefits, including early detection of clinical deterioration and improved patient outcomes, they also generate a significant volume of alarms and alerts that can overwhelm healthcare providers. Clinical alarm management solutions play a vital role in filtering and prioritizing remote monitoring alarms, facilitating timely intervention and care coordination for patients at risk of adverse events.

Moreover, the growing emphasis on value-based care and patient-centered healthcare delivery models drives demand for clinical alarm management solutions that optimize resource utilization and improve care coordination. Alarm management strategies that prioritize clinically actionable alarms, minimize alarm burden, and enhance communication and collaboration among multidisciplinary care teams can help healthcare organizations reduce unnecessary interventions, prevent alarm-related errors, and improve patient satisfaction and outcomes. By aligning alarm management practices with value-based care principles, healthcare providers can enhance patient safety, streamline workflows, and achieve better clinical and financial outcomes.

Furthermore, the COVID-19 pandemic has underscored the importance of effective alarm management in managing healthcare resources and prioritizing patient care. The surge in patient admissions, intensive care unit (ICU) occupancy, and medical device utilization during the pandemic has heightened the risk of alarm fatigue and overwhelmed healthcare providers with a deluge of alarms and alerts. Clinical alarm management solutions that enable remote alarm monitoring, centralized alarm surveillance, and intelligent alarm prioritization have become essential tools for healthcare organizations to mitigate alarm fatigue, maintain situational awareness, and allocate resources efficiently in response to evolving patient needs.

Leave a Comment