Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cardiovascular disorders, and renal diseases is a primary driver for the Clinical Chemistry Analyzers Devices Market. As these conditions require regular monitoring and management, healthcare providers are increasingly investing in advanced clinical chemistry analyzers. According to recent data, the prevalence of diabetes alone is projected to reach 700 million by 2045, necessitating efficient diagnostic tools. This trend indicates a growing demand for reliable and accurate testing devices, which are essential for timely diagnosis and treatment. Consequently, the market for clinical chemistry analyzers is expected to expand significantly, as healthcare systems adapt to the rising burden of chronic diseases.

Expansion of Healthcare Infrastructure

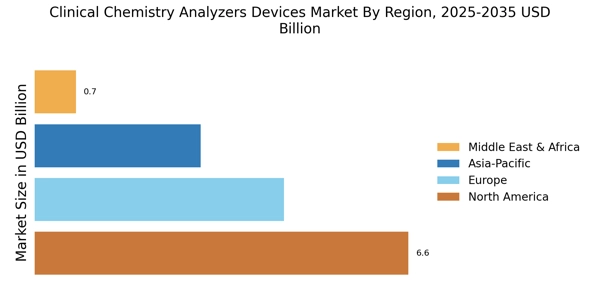

The expansion of healthcare infrastructure, particularly in emerging economies, is a significant driver for the Clinical Chemistry Analyzers Devices Market. As countries invest in modernizing their healthcare facilities, there is an increasing need for advanced diagnostic equipment, including clinical chemistry analyzers. This expansion is not only improving access to healthcare services but also enhancing the quality of diagnostics available to patients. Market analysis indicates that the healthcare infrastructure sector is projected to grow substantially, with investments in laboratory facilities and diagnostic centers. This growth is likely to create a favorable environment for the adoption of clinical chemistry analyzers, thereby propelling market growth.

Technological Innovations in Analyzers

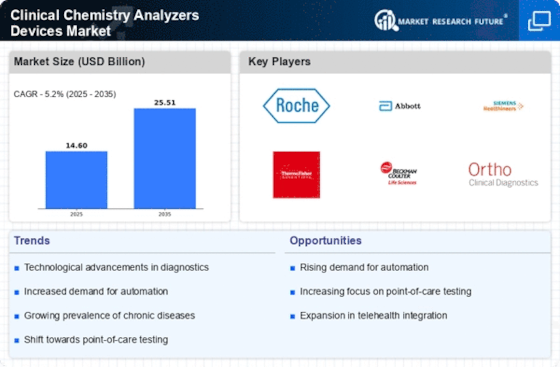

Technological advancements in clinical chemistry analyzers are transforming the landscape of the Clinical Chemistry Analyzers Devices Market. Innovations such as automation, miniaturization, and integration of artificial intelligence are enhancing the efficiency and accuracy of diagnostic processes. For instance, the introduction of high-throughput analyzers allows laboratories to process a larger volume of tests in a shorter time frame, thereby improving patient outcomes. Furthermore, the market is witnessing a shift towards point-of-care testing devices, which provide rapid results and facilitate immediate clinical decisions. This evolution in technology not only meets the growing demand for faster diagnostics but also supports the overall efficiency of healthcare delivery systems.

Increasing Demand for Preventive Healthcare

The growing emphasis on preventive healthcare is significantly influencing the Clinical Chemistry Analyzers Devices Market. As healthcare systems worldwide shift towards proactive management of health, there is a heightened focus on early detection and monitoring of diseases. This trend is driving the demand for clinical chemistry analyzers that can provide comprehensive metabolic panels and other essential tests. Market data suggests that the preventive healthcare market is expected to grow at a compound annual growth rate (CAGR) of over 7% in the coming years. This shift not only enhances patient care but also reduces long-term healthcare costs, thereby encouraging healthcare providers to invest in advanced diagnostic technologies.

Regulatory Support for Diagnostic Innovations

Regulatory bodies are increasingly supporting innovations in the Clinical Chemistry Analyzers Devices Market, which is fostering growth and development. Streamlined approval processes for new diagnostic devices and technologies are encouraging manufacturers to invest in research and development. This regulatory support is crucial for the introduction of novel analyzers that meet stringent quality and safety standards. Moreover, initiatives aimed at enhancing laboratory accreditation and quality assurance are further driving the adoption of advanced clinical chemistry analyzers. As a result, the market is likely to witness a surge in innovative products that improve diagnostic accuracy and patient care.