Cloud Computing in InsurTech Market Overview

Cloud Computing in InsurTech Market is projected to grow from USD 21.56 Billion in 2025 to USD 100.74 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 18.68% during the forecast period (2025 - 2034).

Additionally, the market size for Cloud Computing in InsurTech Market was valued at USD 18.17 billion in 2024.

Key Cloud Computing in InsurTech Market Trends Highlighted

The Global Cloud Computing in InsurTech Market is driven by several key factors, including the increasing demand for digital transformation in the insurance sector. Companies are looking for ways to reduce operational costs and improve efficiency, leading to a greater reliance on cloud technologies. Enhanced customer experiences through innovative online services are also encouraging insurers to adopt cloud-based solutions. Moreover, regulatory pressures and the need for improved data management have made cloud computing an attractive option.

Companies can manage risk better and streamline their operations, which adds to the appeal of adopting these technologies.There are numerous opportunities to be explored in this rapidly evolving market.

The integration of artificial intelligence and machine learning within cloud solutions presents the potential for predictive analytics, helping insurers better understand risks and customer needs. Additionally, the rise of insurtech startups is creating a competitive landscape, prompting traditional insurers to collaborate and innovate. The focus on developing tailored insurance products that cater to specific demographics or emerging risks, such as climate change or cyber threats, highlights the adaptability of cloud technology in insurance.

Recent trends indicate a strong shift toward using cloud-native applications and microservices architectures, allowing insurers to be more agile and responsive to market demands.The ongoing migration to multi-cloud environments reflects a preference for flexibility and scalability, as companies aim to avoid vendor lock-in. Enhancements in security measures are also becoming a focal point, as data breaches remain a concerning issue. Overall, the landscape is evolving quickly, with traditional and emerging players recognizing the importance of cloud adoption to meet future challenges effectively.

Figure 1: Cloud Computing in InsurTech Market size 2025-2034

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Cloud Computing in InsurTech Market Drivers

Increased Demand for Digital Transformation in the Insurance Sector

The Global Cloud Computing in InsurTech Market Industry is witnessing a notable increase in the demand for digital transformation within the insurance sector. This surge is primarily driven by an urgent need for insurance companies to modernize their operations and enhance customer experiences in a rapidly evolving digital landscape. Insurers are realizing that traditional methods are no longer sufficient in the face of changing consumer expectations and technological advancements.By integrating cloud computing solutions, insurers are able to leverage data analytics, access scalable resources, and improve collaboration among stakeholders.

Consequently, these technologies facilitate the development of innovative products and services that can be tailored to meet diverse customer needs. As the market continues to evolve, the reliance on cloud-based solutions will only grow as organizations seek to optimize their operations, reduce costs, and remain competitive in a crowded marketplace.The integration of advanced technologies such as artificial intelligence and machine learning within cloud infrastructure further enhances the capabilities of insurance providers, allowing them to deliver personalized offerings while ensuring compliance with regulatory standards.

Therefore, as more companies within the sector prioritize digital transformation, the Global Cloud Computing in InsurTech Market Industry is positioned to experience significant growth fueled by this fundamental shift.

Rise in Customer Expectations and Personalization

The Global Cloud Computing in InsurTech Market Industry is being driven by the rising expectations of customers for personalized insurance solutions. Modern consumers increasingly demand customized products and services that align with their unique needs and preferences. Cloud computing enables insurers to collect and analyze extensive data quickly, giving them the insights needed to offer tailored solutions.

By using cloud-based platforms, companies can create flexible insurance products, provide dynamic pricing, and enhance customer engagement through personalized communication.This shift towards personalization not only helps insurers meet the evolving demands of their clients but also fosters customer loyalty and retention, ultimately contributing to the growth of the market.

Cost Efficiency and Operational Agility

Another significant driver for the Global Cloud Computing in InsurTech Market Industry is the emphasis on cost efficiency and operational agility. By adopting cloud computing solutions, insurance companies can significantly reduce their IT infrastructure costs and operational expenses. Traditional on-premise systems require substantial investments in hardware and maintenance, whereas cloud services offer scalable solutions that can be tailored to an insurer's specific needs.This flexibility ensures that companies can adapt quickly to changing market conditions and customer demands without incurring exorbitant costs.

The agility provided by cloud solutions allows insurers to innovate and deploy new products faster than ever, leading to enhanced competitive advantage and overall market growth.

Cloud Computing in InsurTech Market Segment Insights

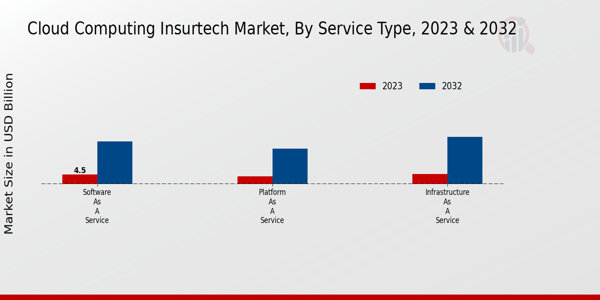

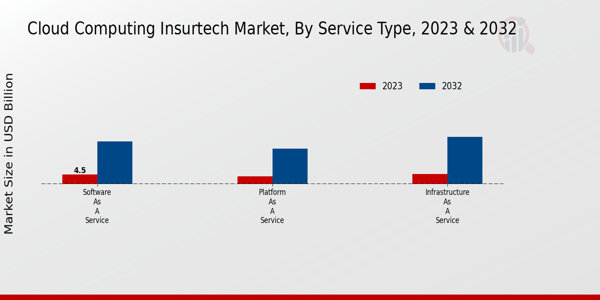

Cloud Computing in InsurTech Market Service Type Insights

The Service Type segment of the Global Cloud Computing in InsurTech Market plays a critical role in shaping the industry's landscape. In 2023, the sector is valued at 12.9 USD Billion, with expectations for substantial growth. Among the various categories, Software as a Service contributes significantly, with a valuation of 4.5 USD Billion in 2023, and is projected to escalate to 20.5 USD Billion by 2032.

This category dominates due to its flexibility, allowing insurers to deploy applications without the burden of complex infrastructure management.Platform as a Service also shows a robust market presence, valued at 3.6 USD Billion in 2023 and expected to reach 17.0 USD Billion by 2032, serving as a vital enabler for developers and insurers to build solutions tailored to the evolving demands of consumers.

Meanwhile, Infrastructure as a Service accounts for a valuation of 4.8 USD Billion in 2023, with a projection of 22.7 USD Billion by 2032, representing an essential foundation layer for various InsurTech services, offering scalability and cost-efficiency that are crucial for modern businesses.

The combination of these service types helps companies to adopt innovative technologies and respond rapidly to changing market conditions. The Global Cloud Computing in InsurTech Market statistics indicate that the growth in these service types is driven by increasing demand for digital solutions in the insurance sector, where traditional models struggle to meet customers' expectations for immediate access and personalized services.

Additionally, the rise of advanced analytics and artificial intelligence is prompting insurers to leverage these technologies through cloud-based platforms, creating a significant opportunity for future growth.Collectively, these dynamics underscore the importance of the Service Type segmentation in driving the overall market forward, as companies in the sector seek to capitalize on the emerging trends and consumer preferences shaping the insurance landscape today. The rapid escalation in valuations across these service types accentuates their role in not only providing immediate operational benefits but also fostering long-term strategic advantages for insurance providers in the Global Cloud Computing in InsurTech Market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Cloud Computing in InsurTech Market End User Insights

The Global Cloud Computing in InsurTech Market, valued at 12.9 USD Billion in 2023, showcases robust activity among its End User segment. This segment includes vital players such as Insurance Providers, Brokers, Reinsurers, and InsurTech Startups, each contributing distinctly to market dynamics. Insurance Providers play a crucial role, leveraging cloud technology to enhance customer experiences and streamline claims processing, which is pivotal in a competitive landscape. Brokers are increasingly adopting cloud solutions to optimize underwriting processes and offer personalized services.Reinsurers utilize cloud-based platforms for data analytics and risk management, ensuring informed decision-making.

InsurTech Startups dominate innovation within the industry, frequently disrupting traditional models and enhancing efficiency through agile cloud-based solutions. Together, these components highlight the diverse nature of the market growth in the Global Cloud Computing in InsurTech Market, driven by technology adoption and increasing demand for digital insurance solutions. The evolution of these End Users not only supports significant market revenue but also represents broader trends towards digital transformation and adaptability in the insurance sector.

Cloud Computing in InsurTech Market Deployment Model Insights

The Global Cloud Computing in InsurTech Market has demonstrated significant growth, currently valued at 12.9 USD billion in 2023, with the deployment model playing a crucial role in this expansion. The market comprises various deployment models, predominantly Public Cloud, Private Cloud, and Hybrid Cloud, each serving unique customer needs and operational demands. Public Cloud is widely adopted, as it offers cost-effectiveness and scalability, appealing to many insurtech companies seeking to optimize their resources.

Meanwhile, Private Cloud caters to organizations with stringent regulatory requirements, ensuring data privacy and security, thus holding a significant share within the market.The Hybrid Cloud model stands out for its flexibility, allowing businesses to combine both public and private deployments, effectively addressing diverse operational challenges.

As the market progresses, the Global Cloud Computing in InsurTech Market revenue is poised to reach 60.2 USD billion by 2032, underpinned by trends towards digital transformation, enhancing customer experience, and increasing efficiency. However, this growth trajectory also faces challenges such as data security concerns and regulatory compliance, which require ongoing innovation and adaptation in the industry.The market growth is driven by the increasing demand for advanced technology solutions and a heightened focus on customer-centric services.

The Global Cloud Computing in InsurTech Market statistics highlight the importance of strategic planning in leveraging these deployment models effectively to capitalize on emerging opportunities.

Cloud Computing in InsurTech Market Application Insights

The Global Cloud Computing in InsurTech Market around the Application segment is poised for notable growth, with a market valuation of 12.9 billion USD in 2023, projected to reach 60.2 billion USD by 2032. The diverse application areas within this segment, such as Claims Management, Policy Administration, Fraud Detection, and Customer Relationship Management, are critical drivers of innovation in the industry. Claims Management plays a significant role by optimizing the processing of claims, enhancing efficiency, and improving customer satisfaction.Similarly, the importance of Policy Administration cannot be understated as it aids in streamlining insurance policies and improving compliance processes.

Fraud Detection has gained momentum due to the increasing prevalence of fraudulent activities, making it a necessary component for ensuring integrity within the industry. Furthermore, Customer Relationship Management enhances the interaction between insurers and clients, fostering strong relationships through personalized services. The cumulative impact of these applications is expected to propel the Global Cloud Computing in InsurTech Market revenue, driven by increasing digitalization and the demand for efficiency in insurance operations.This market growth provides numerous opportunities for stakeholders while facing challenges like data security and regulatory compliance.

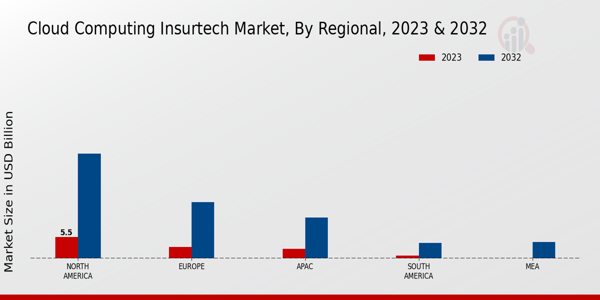

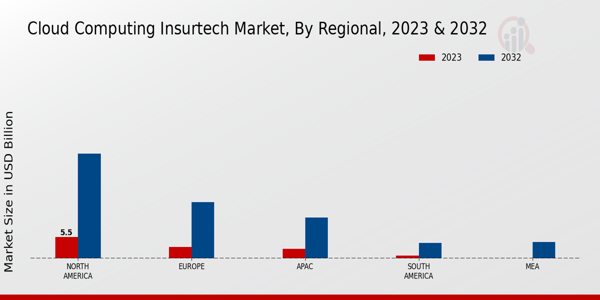

Cloud Computing in InsurTech Market Regional Insights

The Global Cloud Computing in InsurTech Market was valued at 12.9 USD Billion in 2023 and is projected to grow significantly by 2032. North America is the leading region in this market, holding a majority share with a valuation of 5.5 USD Billion in 2023 and expected to reach 27.0 USD Billion by 2032, primarily driven by advanced technology adoption and favorable regulatory environments.

Europe follows closely, valued at 3.0 USD Billion in 2023, reflecting a significant growth potential in the region due to an increasing emphasis on digital transformation in the insurance sector which is expected to reach 14.5 USD Billion by 2032.The Asia-Pacific (APAC) region, with a valuation of 2.5 USD Billion in 2023, is rapidly evolving, as it embraces innovative technologies coupled with growing insurance needs, projected to expand to 10.5 USD Billion by 2032.

South America and the Middle East Africa (MEA) regions, comparatively smaller, were valued at 0.8 USD Billion and 0.1 USD Billion respectively in 2023. However, their growth prospects are promising, with South America expected to reach 4.0 USD Billion and MEA expected to climb to 4.2 USD Billion by 2032, as they increasingly adopt cloud solutions to enhance operational efficiencies and customer service.Overall, regional segmentation highlights key growth drivers and opportunities within the Global Cloud Computing in InsurTech Market, showcasing the diverse landscape shaped by technology advancement and market demand.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Cloud Computing in InsurTech Market Key Players and Competitive Insights

The Global Cloud Computing in InsurTech Market is experiencing significant growth, driven by the increasing need for innovative technological solutions in the insurance sector. As companies strive to enhance operational efficiency, reduce costs, and improve customer experiences, the integration of cloud computing within the InsurTech landscape has become critical. This market is characterized by fierce competition among key players, each offering unique services and products aimed at meeting the demands of insurance companies.

The competitive landscape is defined by strategic partnerships, technological advancements, and a focus on data security as firms seek to establish themselves as leaders in this transformative space. The emergence of new entrants alongside established organizations further intensifies this competition, as each strives to differentiate its offerings to capture market share.

Microsoft stands out in the Global Cloud Computing in InsurTech Market through its robust cloud platform and a comprehensive suite of solutions designed specifically for the insurance industry. Its Azure cloud services provide scalable infrastructure, advanced analytics, and integrated tools that enable InsurTech companies to develop innovative applications and services rapidly. The company's focus on regulatory compliance and data security plays a crucial role in attracting insurance clients who prioritize risk management. Furthermore, Microsoft’s commitment to continuous innovation ensures that it remains at the forefront of technological advancements.

The extensive network of partners and ecosystem developed around Azure enhances its market presence, allowing Microsoft to leverage collaborations to deliver tailored solutions that meet the unique needs of insurers navigating the complexities of digital transformation.Google also plays a pivotal role in the Global Cloud Computing in InsurTech Market, known for its cloud computing prowess and data analytics capabilities.

Google Cloud offers a wide array of services that cater to the insurance industry, particularly in areas such as machine learning and big data analytics. By providing tools that enhance data processing and client insights, Google empowers InsurTech firms to make informed decisions and improve customer interactions. The company’s emphasis on artificial intelligence further enhances its offerings, enabling insurance companies to automate processes and personalize customer experiences effectively. Google's extensive infrastructure and reliable performance support the scalability and flexibility that InsurTechs seek, making it a formidable competitor in the market.

With continuous investments in innovation and a strong commitment to research and development, Google strengthens its position as a leading provider for cloud solutions within the insurance technology landscape.

Key Companies in the Cloud Computing in InsurTech Market Include

Cloud Computing in InsurTech Market Industry Developments

Recent developments in the Global Cloud Computing in InsurTech Market have been marked by advancements in technology and strategic partnerships among major players. Microsoft and Amazon continue to enhance their cloud offerings, focusing on machine learning and AI capabilities to optimize risk assessment in insurance. Google's collaboration with key insurance firms aims to improve data analytics for better customer insights. Meanwhile, Accenture has been actively facilitating digital transformation for insurers through its cloud services, enabling faster claim processing and improving overall customer experience.

In terms of mergers and acquisitions, notable activity includes Salesforce acquiring a leading InsurTech firm to expand its product suite and capabilities. IBM is also making waves by integrating advanced analytics into their cloud infrastructure for insurance companies, leading to heightened market valuations. Companies like Oracle and SAP are enhancing their cloud platforms to meet the growing demand for scalable solutions, driven by increased digitization in the insurance sector.

The market is witnessing significant growth, with investments from Cognizant and Tata Consultancy Services focused on innovative cloud-based solutions that enhance operational efficiency for insurers, thereby shaping the future landscape of the InsurTech industry.

Cloud Computing in InsurTech Market Segmentation Insights

-

Cloud Computing in InsurTech Market Service Type Outlook

-

Cloud Computing in InsurTech Market End User Outlook

-

Cloud Computing in InsurTech Market Deployment Model Outlook

-

Cloud Computing in InsurTech Market Application Outlook

-

Cloud Computing in InsurTech Market Regional Outlook

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

18.17 (USD Billion)

|

|

Market Size 2025

|

21.56 (USD Billion)

|

|

Market Size 2034

|

100.74 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

18.68% (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2019 - 2023

|

|

Market Forecast Units

|

USD Billion

|

| Key Companies Profiled |

Microsoft, Google, Accenture, Amazon, IBM, Salesforce, Infosys, Wipro, Oracle, Cognizant, SAP, Capgemini, Zensar Technologies, Deloitte, Tata Consultancy Services |

| Segments Covered |

Service Type, End User, Deployment Model, Application, Regional |

| Key Market Opportunities |

Enhanced data analytics capabilities, Increased regulatory compliance solutions, Streamlined claims processing automation, Personalized customer experience platforms, Scalable infrastructure for startups |

| Key Market Dynamics |

Growing demand for digital solutions, Increased operational efficiency, Enhanced data security measures, Rising customer expectations, Regulatory compliance requirements |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Global Cloud Computing in InsurTech Market is expected to be valued at 100.74 USD Billion in 2034

The projected CAGR for the Global Cloud Computing in InsurTech Market is 18.68% from 2025 to 2034

By 2032, North America is expected to dominate the Cloud Computing in InsurTech Market with a valuation of 27.0 USD Billion.

The Software as a Service segment of the Cloud Computing in InsurTech Market is expected to reach 20.5 USD Billion in 2032.

Key players in the Global Cloud Computing in InsurTech Market include Microsoft, Google, Accenture, Amazon, and IBM.

The Platform as a Service segment is projected to be valued at 17.0 USD Billion in 2032 within the Cloud Computing in InsurTech Market.

The Infrastructure as a Service segment of the Cloud Computing in InsurTech Market is anticipated to reach a valuation of 22.7 USD Billion in 2032.

The estimated market size for the Cloud Computing in InsurTech Market in Europe is expected to be 14.5 USD Billion by 2032.

The Global Cloud Computing in InsurTech Market offers growth opportunities through the adoption of digital transformation and enhanced customer experiences.

South America is projected to reach a market size of 4.0 USD Billion in the Cloud Computing in InsurTech Market by 2032.