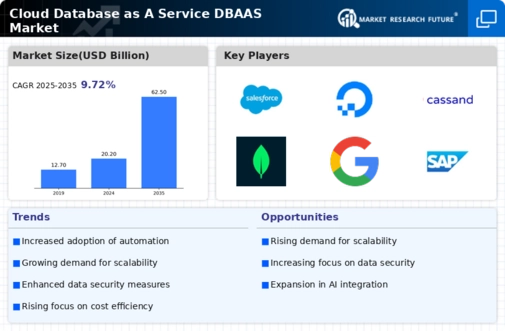

Growing Demand for Scalability

The Cloud Database as A Service DBAAS Market is experiencing a notable surge in demand for scalable solutions. Organizations are increasingly seeking databases that can effortlessly scale up or down based on their operational needs. This flexibility is particularly appealing to businesses that experience fluctuating workloads, as it allows them to optimize costs while maintaining performance. According to recent data, the scalability feature is a primary driver for over 60% of enterprises adopting DBAAS solutions. As companies expand their digital footprint, the ability to scale databases in real-time becomes essential, thereby propelling the growth of the Cloud Database as A Service DBAAS Market.

Increased Focus on Data Security

Data security is a critical concern for organizations, driving the Cloud Database as A Service DBAAS Market. With the rise of cyber threats and stringent regulatory requirements, businesses are prioritizing secure database solutions. DBAAS providers are responding by implementing advanced security measures, including encryption, access controls, and compliance certifications. Recent surveys indicate that over 80% of enterprises consider data security a top priority when choosing a DBAAS provider. This heightened focus on security not only protects sensitive information but also builds trust with customers, thereby propelling the growth of the Cloud Database as A Service DBAAS Market.

Rapid Technological Advancements

Technological advancements are significantly influencing the Cloud Database as A Service DBAAS Market. Innovations in cloud computing, artificial intelligence, and machine learning are reshaping how databases are managed and utilized. These advancements enable DBAAS providers to offer more efficient, reliable, and user-friendly solutions. For instance, the integration of AI-driven automation in database management is streamlining operations and reducing the need for manual intervention. As organizations seek to leverage these technologies for improved performance, the demand for DBAAS solutions is expected to rise. This trend suggests that ongoing technological evolution will continue to be a key driver in the Cloud Database as A Service DBAAS Market.

Enhanced Data Analytics Capabilities

The Cloud Database as A Service DBAAS Market is witnessing a growing emphasis on enhanced data analytics capabilities. As organizations increasingly rely on data-driven decision-making, the need for robust analytics tools integrated within cloud databases becomes paramount. DBAAS solutions often come equipped with advanced analytics features, enabling businesses to derive actionable insights from their data. This trend is underscored by the fact that approximately 70% of companies prioritize analytics capabilities when selecting a DBAAS provider. The integration of analytics within the Cloud Database as A Service DBAAS Market not only enhances operational efficiency but also fosters innovation and competitive advantage.

Cost Efficiency and Reduced IT Overhead

Cost efficiency remains a pivotal driver in the Cloud Database as A Service DBAAS Market. Organizations are increasingly drawn to DBAAS solutions due to their potential to significantly reduce IT overhead costs. By leveraging cloud-based databases, companies can minimize the expenses associated with hardware procurement, maintenance, and upgrades. Recent statistics indicate that businesses can save up to 30% on operational costs by transitioning to DBAAS. This financial incentive is compelling, particularly for small to medium-sized enterprises that may lack the resources for extensive IT infrastructure. Consequently, the emphasis on cost efficiency is likely to continue driving the Cloud Database as A Service DBAAS Market forward.

Leave a Comment