Market Analysis

In-depth Analysis of Cloud Workload Protection Market Industry Landscape

The cloud workload protection market is heavily influenced by several key market factors that drive its growth and development. One significant factor is the rapid adoption of cloud computing across industries. As organizations increasingly migrate their workloads to the cloud to leverage scalability, flexibility, and cost savings, the need for robust security solutions to protect cloud-based assets becomes paramount. Cloud workload protection solutions offer advanced security capabilities tailored to the dynamic and distributed nature of cloud environments, helping organizations mitigate risks and secure their critical workloads.

Technological advancements also play a crucial role in shaping the cloud workload protection market. The evolving threat landscape, characterized by sophisticated cyberattacks and malware targeting cloud workloads, drives the demand for innovative security technologies and approaches. Cloud workload protection vendors leverage cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), behavioral analysis, and threat intelligence to detect and respond to security threats in real-time. Additionally, the integration of automation and orchestration capabilities enables organizations to streamline security operations and respond rapidly to security incidents.

Another market factor driving the growth of the cloud workload protection market is the increasing regulatory compliance requirements and data privacy regulations. Organizations operating in regulated industries such as finance, healthcare, and government must comply with industry-specific regulations and standards governing data protection and privacy. Cloud workload protection solutions help organizations achieve and maintain compliance by providing capabilities such as data encryption, access controls, auditing, and reporting. Additionally, compliance-driven initiatives such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) compel organizations to invest in robust security measures to protect sensitive data in the cloud.

Furthermore, the growing adoption of hybrid and multi-cloud environments contributes to the demand for cloud workload protection solutions. As organizations embrace hybrid cloud architectures to leverage the benefits of both public and private clouds, they face the challenge of ensuring consistent security across disparate cloud platforms. Cloud workload protection solutions offer centralized visibility and control over security policies and configurations across hybrid and multi-cloud environments, enabling organizations to enforce consistent security posture and mitigate risks associated with cloud migration and integration.

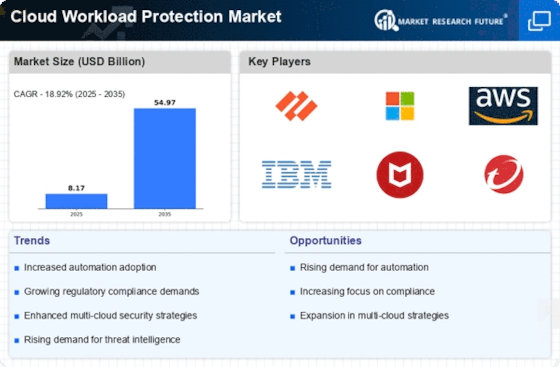

Market competition also drives innovation and evolution in the cloud workload protection landscape. With an increasing number of vendors entering the market, competition intensifies, prompting vendors to differentiate themselves through advanced features, integration capabilities, and value-added services. Additionally, strategic partnerships and alliances between cloud workload protection vendors and cloud service providers (CSPs) enhance interoperability and enable seamless integration with cloud platforms, enhancing the overall security posture of cloud environments.

Moreover, the growing awareness of cybersecurity risks and the impact of high-profile data breaches and cyberattacks drive organizations to prioritize investments in cloud workload protection solutions. According to industry reports, the cost of data breaches continues to rise, underscoring the need for proactive security measures to prevent, detect, and respond to security incidents effectively. Cloud workload protection solutions help organizations strengthen their security posture, reduce the risk of data breaches, and safeguard sensitive information stored in the cloud.

Economic factors such as budget constraints and cost optimization initiatives also influence the cloud workload protection market. Organizations seek cost-effective security solutions that offer comprehensive protection without compromising performance or scalability. Cloud-native security solutions, offered on a subscription or pay-as-you-go basis, provide flexibility and cost savings compared to traditional on-premises security solutions. Additionally, vendors offering flexible pricing models and value-added services gain a competitive edge in the market.

Leave a Comment