Clutch Friction Plate Size

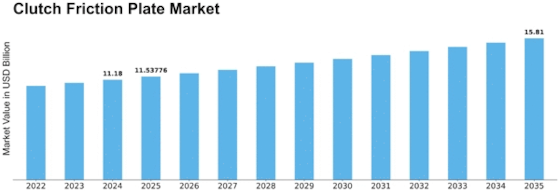

Clutch Friction Plate Market Growth Projections and Opportunities

The automobile industry's display is one of the primary factors since the clutch friction plate is a fundamental component of automobiles. The market for clutch friction plates is directly impacted by variations in consumer interest in automobiles, which are influenced by factors such as financial situations, administrative changes, and client preferences. For instance, consumers may postpone purchasing a car during economic downturns, which might affect the demand for clutch friction plates overall. Furthermore, mechanical headways have a big role in shaping the market environment. Modern automobiles require better clutch friction plates to fulfill their evolving needs. This is made possible by improvements in assembly techniques and materials. Manufacturers in the clutch friction plate industry must stay competitive and meet the evolving needs of automakers by staying abreast of mechanical trends. Changes in international variables can impact the obtaining of unrefined substances and assembling areas, adding an extra layer of intricacy for market players. With a developing accentuation on decreasing fossil fuel byproducts and advancing ecological practices, automobile makers are looking for lightweight and effective parts, including clutch friction plates. Market players need to adjust their items to these maintainability objectives to remain pertinent and fulfill the needs of ecologically cognizant purchasers and administrative bodies. Customers are becoming more interested in clutch friction plates with enhanced highlights as they prioritize strength, performance, and environmental friendliness in their cars. Furthermore, the growing popularity of electric and hybrid vehicles poses both new challenges and tremendous opportunities for the industry, because these optional drivetrain systems sometimes call for specific clutch architectures or even eliminate the need for traditional friction plates entirely. There is fierce competition amongst firms in the industry as they fight for market share. Firms in the clutch friction plate industry should set themselves apart by innovation, useful invention, and important relationships to thrive in this competitive environment. The aftermarket fragment likewise assumes an imperative part in the clutch friction plate market. As vehicles age, there is a constant interest for new parts, including clutch friction plates. Effective players in this market should explore these elements proficiently, adjusting to changes and remaining in front of industry patterns to guarantee supported development and pertinence in the consistently advancing car outlook.

Leave a Comment