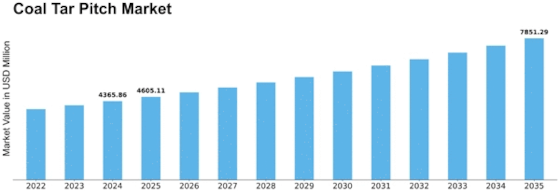

Coal Tar Pitch Size

Coal Tar Pitch Market Growth Projections and Opportunities

The coal tar pitch market is influenced by several key factors that shape its growth and dynamics. One significant driver is the demand for coal tar pitch in the aluminum smelting industry. Coal tar pitch is a crucial raw material used in the production of carbon anodes, which are essential components in the electrolytic process of aluminum production. As global demand for aluminum continues to rise, particularly in industries such as automotive, construction, and packaging, there is a growing need for coal tar pitch to manufacture high-quality carbon anodes, driving market growth.

Additionally, infrastructure development projects and construction activities contribute to the demand for coal tar pitch. Coal tar pitch is used in the construction industry as a binder and waterproofing agent in the production of asphalt and roofing materials. With rapid urbanization and industrialization in emerging economies, there is a significant demand for infrastructure development, driving the need for coal tar pitch in road construction, roofing applications, and waterproofing solutions, thereby fueling market growth.

Moreover, the growing demand for specialty chemicals and high-performance materials influences the coal tar pitch market. Coal tar pitch is used as a precursor in the production of various specialty chemicals, including carbon fibers, electrodes, and coatings. These specialty chemicals find applications in industries such as aerospace, defense, electronics, and automotive, where high-performance materials are required. As industries continue to innovate and demand advanced materials with superior properties, the demand for coal tar pitch as a raw material for specialty chemical production grows, driving market demand.

Furthermore, regulatory compliance and environmental concerns impact the coal tar pitch market. Environmental regulations restrict the use of certain chemicals and emissions from industrial processes, including coal tar distillation. Manufacturers must adhere to stringent environmental regulations and invest in pollution control technologies to minimize environmental impact and ensure compliance with regulatory requirements. Additionally, increasing awareness of environmental sustainability drives market demand for alternative raw materials and cleaner production methods, influencing the dynamics of the coal tar pitch market.

Additionally, the availability and cost of raw materials such as coal tar, naphthalene, and other aromatic compounds influence the coal tar pitch market. Fluctuations in coal prices, supply chain disruptions, and changes in demand from other industries can impact production costs and profitability for coal tar pitch manufacturers. Companies must carefully monitor raw material markets, optimize procurement processes, and implement strategies to mitigate risks and maintain a competitive advantage in the market.

Moreover, technological advancements and innovations in coal tar distillation processes drive market growth by improving efficiency, yield, and product quality. Manufacturers are investing in research and development to develop advanced distillation technologies, catalysts, and process optimization techniques to enhance the production of coal tar pitch. Additionally, innovations in carbonization and graphitization processes enable the production of high-quality carbon materials from coal tar pitch, expanding its application possibilities and driving market demand.

Furthermore, the competitive landscape and market dynamics play a significant role in shaping the coal tar pitch market. Intense competition among key players prompts manufacturers to focus on product differentiation, innovation, and operational excellence to gain a competitive edge. Strategic partnerships, mergers, and acquisitions are common strategies adopted by companies to expand their market presence, diversify their product portfolios, and enhance their competitive positioning in the market.

Leave a Comment