Cold Chain Equipment Market Overview:

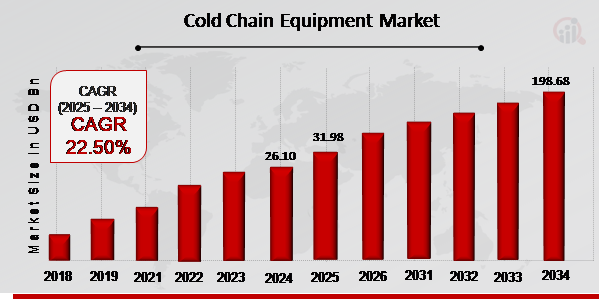

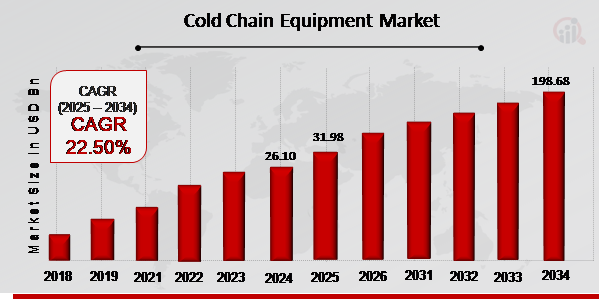

As per MRFR analysis, the Cold Chain Equipment Market Size was estimated at 26.10 (USD Billion) in 2024. The Cold Chain Equipment Market Industry is expected to grow from 31.98 (USD Billion) in 2025 to 198.68 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 22.50% during the forecast period (2025 - 2034). Growing consumer demand for temperature-controlled alternatives for perishable goods like food and medicines in storage and transit is a major market drivers fueling market revenue growth

.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Cold Chain Equipment Market Trends

Growing need for processed and frozen foods is driving the market growth

The food and beverage industry need specialized equipment for the cold chain. For food safety, food hygiene, health, and the environment, equipment for the cold chain is advantageous. The dependence on the processed food sector has grown as a result of shifting lifestyles, urbanization, population growth, and rising purchasing power. According to the World Bank, 4.28 billion people—or around 56% of the world's population—live in urban areas today. Furthermore, the demand for temperature-controlled storage facilities has increased as a result of international fish and meat commerce. The expansion of the market for cold chain equipment is probably being fueled by the new trend of buying meat and seafood online as well as the increased number of hypermarkets & supermarkets that sell fresh and frozen goods. The need for processed and frozen foods increased as well during the pandemic.

In developing nations like Latin America, Africa, and Asia, there is still plenty of space for the market for cold chain equipment to expand. The need for equipment and infrastructural changes in the cold chain is growing as a result of the middle class expansion and rising temperatures. Improved product quality, higher efficiency, and lower costs for enterprises are the results of advancements in cold chain technology, which include insulating materials, more energy-efficient refrigeration systems, and monitoring technologies. These developments provide up new possibilities for raising product quality while lowering prices and operational costs. Recent initiatives to improve the cold chain industry's sustainability have come under fire, especially those that seek to cut down on energy use and carbon emissions. This opens up possibilities for creating cold chain systems that are more environmentally friendly.

Transport and storage of temperature-sensitive items have a significant influence on a number of industries, including pharmaceuticals, biotechnology, food processing, breweries, and wineries. This is necessary to preserve the quality, safety, and efficacy of the products. Healthcare products such as biopharmaceuticals, individualized medicine, gene treatments, vaccinations, and biologics must be stored and transported under strict temperature control. The current COVID-19 has further highlighted the significance of cold chain equipment for the swift and secure distribution of vaccinations and medical supplies around the world. Cold storage and refrigerated transportation are needed in the food processing industry, which includes the production of fresh produce, ice cream, dairy products, ready-to-eat meals, and seafood. This is done to prevent spoiling and maintain the freshness of the product. Thus, driving the cold chain equipment market revenue.

Cold Chain Equipment Market Segment Insights:

Cold Chain Equipment Type Insights

The Cold Chain Equipment Market segmentation, based on type includes Storage Equipment and Transportation Equipment. The storage equipment segment dominated the market. The storage equipment is designed to keep a specific temperature range appropriate for the product being stored. This temperature range can range from below freezing to just above freezing for some products, like vaccinations, and above freezing for others, including fruits and vegetables. It is crucial to maintain the products' quality, safety, and effectiveness throughout the cold chain process, which necessitates the use of suitable storage equipment and temperature control.

Figure 1: Cold Chain Equipment Market by Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Cold Chain Equipment Application Insights

The Cold Chain Equipment Market segmentation, based on application, includes Meat, Dairy & Frozen Desserts, Bakery & Confectionary, Processed Food, Food Waste Management, Pharmaceuticals, Vegetables & Fruits and Others. The processed food category generated the most income. The significant market share of this industry sector is attributed to the growing demand for cold chain equipment to preserve the quality, safety, and shelf life of perishable food products like fish, milk, meat, cheese, and yogurt. These products include poultry, meat, and dairy products.

Cold Chain Equipment Regional Insights

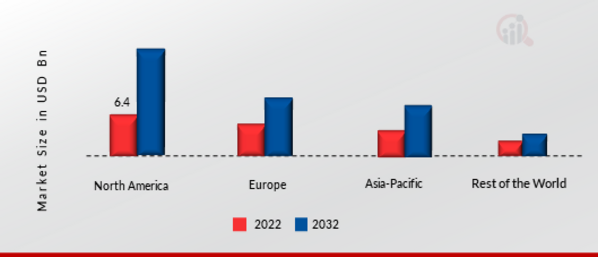

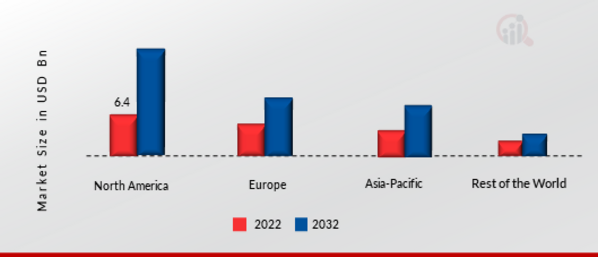

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American cold chain equipment market area will dominate this market. This is because cold chain equipment companies in North America are very fragmented. During the projection period, demand is also anticipated to be fueled by rising disposable income, an aging population, and regulations that assure food safety during storage and transit. The expansion of regional markets is anticipated to be fueled by the rise in demand for fresh meat, seafood, and vegetables.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Cold Chain Equipment Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe cold chain equipment market accounts for the second-largest market share due to the recent increase in demand for a variety of food products, increased public knowledge of hygienic and safety standards, etc. Additionally, a growing number of cold storage facilities are being constructed throughout this region to satisfy expanding consumer demand, which will further fuel market expansion over the course of the projection period. Further, the German cold chain equipment market held the largest market share, and the UK cold chain equipment market was the fastest growing market in the European region

The Asia-Pacific Cold Chain Equipment Market is expected to grow at the fastest CAGR from 2025 to 2034. The Asia Pacific region's cold chain equipment market is expanding quickly because to the need for fresh and frozen foods, pharmaceuticals, and other perishable commodities. In this region, which is home to some of the world's main population centers, there is a growing awareness of the necessity of assuring product quality and safety throughout shipment and storage. Moreover, China’s cold chain equipment market held the largest market share, and the Indian cold chain equipment market was the fastest growing market in the Asia-Pacific region.

Cold Chain Equipment Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the cold chain equipment market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, cold chain equipment industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global cold chain equipment industry to benefit clients and increase the market sector. In recent years, the cold chain equipment industry has offered some of the most significant advantages to medicine. Major players in the cold chain equipment market are attempting to increase market demand by investing in research and development operations includes Thermo King, Carrier Transicold, Zanotti SpA, Fermod, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries Inc., Intertecnica, ebm-papst Group, CHG Europe BV, Viessmann and Schmitz Cargobull.

The refrigeration, foodservice, and truck body industries all depend on Kason, a top-tier provider of necessary hardware, accessories, and supplies. In order to provide great products, it designs new solutions supported by strong quality control. One may count on Kason for solutions that support businesses in operating more successfully and effectively, including premium hinges, handles, LED lights, vinyl curtains, a wide selection of fabrication materials, and more.

Solutions for transporting refrigerated cargo from Carrier Transicold contribute to making life better for people all around the world. Carrier Transicold offers a full range of products and services for refrigerated transport and cold chain visibility, which improves the transportation of temperature-controlled goods. Carrier Transicold has been a market leader for more than 50 years, offering clients all over the world cutting-edge, ecologically friendly, and energy-efficient transport refrigeration systems for LCV vehicles, trucks, and trailers. In 2023, Carrier has announced measures to cut greenhouse gas (GHG) emissions in accordance with science-based targets and steps to prevent global warming and promote decarburization efforts. Carrier is a global provider of healthy, sustainable, safe, and intelligent building and cold chain solutions.

Key Companies in the cold chain equipment market include

- Thermo King

- Carrier Transicold

- Zanotti SpA

- Fermod

- Intertecnica

- ebm-papst Group

- CAREL

- Bitzer

- Kelvion

- Incold S.p.A.

- Rivacold srl

- Kason Industries Inc.

- CHG Europe BV

- Viessmann

- Schmitz Cargobull

Cold Chain Equipment Industry Developments

September 2022: Grupo Fuentes, a Spanish transport and cold storage company, was purchased by Lineage Logistics. Lineage's presence will be strengthened in the major fresh produce marketplaces in Europe as a result of this development in Spain. Through this acquisition, Lineage will be better positioned to distribute cold storage products throughout Europe.

June 2022: The newest facility for Americold Logistics was opened in Dunkirk, New York. To meet the needs of cold storage in the western New York region, this facility contains about 181,000 square feet of operational space, 25,000 pallet positions, and cold storage space. The company's footprint will grow across the US thanks to this new location.

Cold Chain Equipment Market Segmentation

Cold Chain Equipment Type Outlook (USD Billion, 2018-2032)

- Storage Equipment

- Transportation Equipment

Cold Chain Equipment Application Outlook (USD Billion, 2018-2032)

- Meat

- Dairy & Frozen Desserts

- Bakery & Confectionary

- Processed Food

- Pharmaceuticals

- Vegetables & Fruits

- Others

Cold Chain Equipment Regional Outlook (USD Billion, 2018-2032)

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

26.10 (USD Billion)

|

|

Market Size 2025

|

31.98 (USD Billion)

|

|

Market Size 2034

|

198.68 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

22.50% (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2019 - 2023

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Application and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Thermo King, Carrier Transicold, Zanotti SpA, Fermod, Intertecnica, Kelvion,ebm-papst Group, CAREL, Bitzer, Incold S.p.A., Rivacold srl, Kason Industries Inc., CHG Europe BV, Viessmann and Schmitz Cargobull |

| Key Market Opportunities |

In the upcoming years, it is anticipated that government agencies' strict requirements on food safety would also fuel industry expansion |

| Key Market Dynamics |

Consumers' rising quality and cleanliness consciousness is a major driver of the need for cold chain equipment during the coming few years In the near future, it is also projected that the growth of supermarkets, hypermarkets, and convenience stores will increase demand for cold chain equipment |

Frequently Asked Questions (FAQ) :

The Cold Chain Equipment Market size was valued at USD 26.10 Billion in 2024.

The global market is projected to grow at a CAGR of 22.50% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are Thermo King, Carrier Transicold, Zanotti SpA, Fermod, Intertecnica, ebm-papst Group, Incold S.p.A., CAREL, Bitzer, Kelvion, Rivacold srl, Kason Industries Inc., CHG Europe BV, Viessmann and Schmitz Cargobull.

The storage equipment category dominated the market in 2022.

The processed food category had the largest share in the global market.