Increasing Demand for Perishable Goods

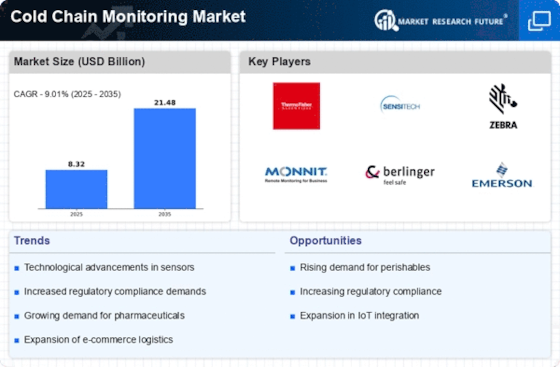

The Cold Chain Monitoring Market is experiencing a surge in demand for perishable goods, driven by changing consumer preferences and dietary habits. As consumers increasingly seek fresh and organic products, the need for effective cold chain solutions becomes paramount. According to industry estimates, the perishable goods segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth necessitates robust cold chain monitoring systems to ensure the integrity and quality of products throughout the supply chain. Retailers and distributors are investing in advanced monitoring technologies to maintain optimal temperature conditions, thereby reducing spoilage and waste. Consequently, the Cold Chain Monitoring Market is poised to benefit from this trend, as stakeholders prioritize the implementation of reliable monitoring solutions to meet consumer expectations.

Regulatory Pressures and Compliance Requirements

The Cold Chain Monitoring Market is shaped by stringent regulatory pressures and compliance requirements imposed by various authorities. Governments and regulatory bodies are increasingly mandating the implementation of robust cold chain monitoring systems to ensure the safety and quality of food and pharmaceutical products. For instance, regulations concerning temperature control during transportation and storage are becoming more rigorous, compelling companies to adopt comprehensive monitoring solutions. This trend is particularly evident in the pharmaceutical sector, where the need for compliance with Good Distribution Practices (GDP) is critical. As a result, the Cold Chain Monitoring Market is likely to experience growth as businesses invest in technologies that facilitate compliance and enhance traceability. The increasing focus on regulatory adherence not only protects consumers but also drives innovation within the market, as companies seek to develop solutions that meet evolving standards.

Technological Advancements in Monitoring Solutions

The Cold Chain Monitoring Market is significantly influenced by rapid technological advancements in monitoring solutions. Innovations such as IoT-enabled sensors, real-time tracking systems, and data analytics are transforming how temperature-sensitive products are managed. These technologies facilitate continuous monitoring of temperature and humidity levels, providing stakeholders with actionable insights to enhance operational efficiency. The integration of artificial intelligence and machine learning further optimizes supply chain processes by predicting potential disruptions and enabling proactive measures. As a result, the Cold Chain Monitoring Market is likely to witness increased adoption of these advanced solutions, which can lead to improved compliance with safety regulations and reduced operational costs. The market is expected to expand as companies recognize the value of investing in cutting-edge monitoring technologies to safeguard their perishable inventories.

Expansion of E-commerce and Online Grocery Services

The Cold Chain Monitoring Market is benefiting from the expansion of e-commerce and online grocery services, which have gained traction in recent years. As consumers increasingly turn to online platforms for their grocery needs, the demand for efficient cold chain solutions has intensified. E-commerce companies are required to ensure that perishable items are delivered in optimal conditions, necessitating the implementation of advanced monitoring systems. According to market analysis, the online grocery segment is expected to grow at a rate of over 15% annually, further driving the need for effective cold chain monitoring. This trend presents a significant opportunity for the Cold Chain Monitoring Market, as businesses seek to enhance their logistics capabilities and maintain product quality during transit. The integration of real-time tracking and monitoring technologies is likely to become a standard practice in the e-commerce sector.

Rising Consumer Awareness and Demand for Quality Assurance

The Cold Chain Monitoring Market is increasingly influenced by rising consumer awareness regarding food safety and quality assurance. As consumers become more informed about the importance of proper handling and storage of perishable goods, they are demanding greater transparency from suppliers. This shift in consumer behavior is prompting companies to invest in cold chain monitoring solutions that provide real-time data on product conditions. The emphasis on quality assurance is particularly pronounced in the food and pharmaceutical sectors, where any lapse in the cold chain can lead to significant health risks. Consequently, the Cold Chain Monitoring Market is likely to see a surge in demand for monitoring technologies that ensure compliance with safety standards and enhance consumer trust. This trend underscores the critical role of effective cold chain management in meeting consumer expectations and safeguarding public health.

Leave a Comment