Market Analysis

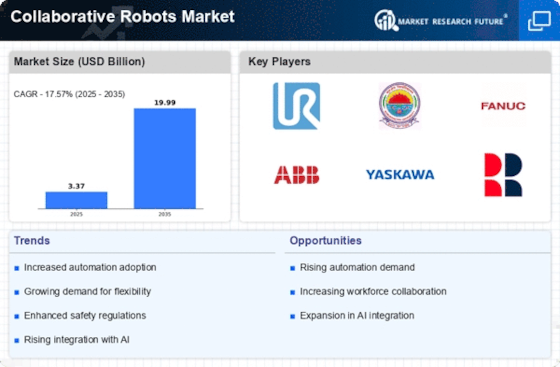

Collaborative Robots Market (Global, 2024)

Introduction

The market for collaborative robots is undergoing significant transformation as industries recognize the value of combining automation with human labor. These cobots, or co-workers, are designed to work alongside people, enhancing productivity while ensuring worker safety and efficiency. They are being used in many applications, from manufacturing to health care. The versatility of these machines will continue to increase as companies seek to optimize their operations and address the shortage of workers. In addition, technological advances, such as advances in artificial intelligence and machine learning, are making cobots increasingly capable of performing complex tasks with greater precision and adaptability. This report examines the main drivers, challenges, and trends in the collaborative robots market and provides insights into how to take advantage of these innovations to stay competitive in an increasingly automated world.

PESTLE Analysis

- Political

- The future of the collaborative robots market will be influenced by several political factors in 2024, including government policies to promote automation and robotics. For example, the United States government has allocated about $ 1,500,000,000 for research and development in the field of robotics, which includes collaborative robots, as part of a larger initiative to improve manufacturing capabilities. Similarly, the European Union has adopted regulations that encourage the use of automation technology, with a focus on the development of safety standards that require collaborative robots to meet specific criteria for operation, which will affect their deployment in various industries.

- Economic

- In 2024 the market for cooperative robots will be shaped by the rising demand for automation in the manufacturing and logistics industries. The average cost of a cooperative robot is around 30,000 dollars, which makes it affordable for small and medium-sized enterprises (SMEs) seeking to boost their productivity. The labor market is facing a shortage of skilled workers. By 2025, a projected 2.4 million vacancies in the United States are expected to be unfilled in the manufacturing industry. As a result, companies will have to turn to cooperative robots to maintain their competitiveness.

- Social

- It is the emergence of a new social acceptance of co-robots, especially in industries where human-robot collaboration can improve safety and efficiency. In fact, research has shown that around seventy per cent of factory workers are open to working with robots, seeing the technology as a way of reducing monotonous tasks and improving job satisfaction. In parallel, educational initiatives are being taken. Today over 500 universities worldwide offer courses in automation and robotics, thereby helping to create a workforce more familiar with working alongside robots.

- Technological

- The market for the cooperative robot is dominated by technological progress, especially the development of artificial intelligence and machine learning. By 2024, it is expected that more than 60 percent of the robots will be equipped with advanced artificial intelligence algorithms, which will allow them to learn from their surroundings and improve their performance over time. Furthermore, the integration of IoT (internet of things) technology enables the exchange of real-time data between robots and other equipment. By the end of 2024, an estimated 1.2 million IoT devices will be installed in manufacturing environments.

- Legal

- Legal factors affecting the market for co-robots are safety regulations and employment laws. In 2024, the International Organization for Standardization (ISO) established new safety standards for co-robots, namely ISO/TS 15066, which outlines the requirements for safe human-robot collaboration. These standards must be met in order to avoid a potential lawsuit for a company if it does not comply with them. Depending on the country and the severity of the violation, the fine for not complying with these standards can be as high as $500,000.

- Environmental

- The market for collaborative robots is increasingly being influenced by considerations for the environment, with a growing focus on energy-saving and sustainable solutions. In 2024 it is estimated that the use of collaborative robots could reduce energy consumption in production processes by as much as 30 per cent compared with traditional automation solutions. The manufacturers of collaborative robots are also taking on board considerations for the environment, with 40 per cent of them pledging to use recycled materials in their products. In line with international sustainable development goals, this will help to reduce the negative impact of industry on the environment.

Porter's Five Forces

- Threat of New Entrants

- Medium - The collaborative robots market is experiencing growth, attracting new players. However, significant capital investment, technological expertise, and established brand loyalty create barriers to entry, limiting the threat from new entrants.

- Bargaining Power of Suppliers

- Low - The market has a diverse range of suppliers providing components and technologies for collaborative robots. This abundance reduces supplier power, as manufacturers can easily switch suppliers or negotiate better terms.

- Bargaining Power of Buyers

- The buyers of the collaborative robots have substantial bargaining power due to the availability of many alternatives and the ability to compare features and prices. This forces the manufacturers to offer the most attractive solutions and the most competitive prices.

- Threat of Substitutes

- Medium - While there are alternative automation solutions, such as traditional industrial robots and manual labor, the unique advantages of collaborative robots, like safety and flexibility, mitigate the threat of substitutes to some extent.

- Competitive Rivalry

- High - The collaborative robots market is characterized by intense competition among established players and new entrants. Companies are continuously innovating and improving their offerings, leading to a highly competitive environment.

SWOT Analysis

Strengths

- Increased efficiency and productivity in manufacturing processes.

- Enhanced safety for human workers through collaborative designs.

- Flexibility in deployment across various industries and tasks.

- Growing acceptance and integration of automation in workplaces.

- Cost-effectiveness in the long run due to reduced labor costs.

Weaknesses

- High initial investment costs for small and medium enterprises.

- Limited programming skills among workforce to operate advanced robots.

- Potential job displacement concerns leading to resistance from labor unions.

- Dependence on technology which may lead to vulnerabilities in case of failures.

- Regulatory challenges and compliance issues in different regions.

Opportunities

- Expansion into emerging markets with increasing industrial automation.

- Development of advanced AI and machine learning capabilities for smarter robots.

- Growing demand for customized solutions in various sectors.

- Partnerships with tech companies to enhance product offerings.

- Increased focus on sustainability and eco-friendly manufacturing processes.

Threats

- Intense competition from traditional automation and robotics companies.

- Rapid technological advancements leading to obsolescence of current models.

- Economic downturns affecting capital investment in automation.

- Cybersecurity risks associated with connected robotic systems.

- Changing regulations and standards that may impact market dynamics.

Summary

The Collaborative Robots Market in 2024 is characterized by notable strengths such as increased productivity and safety, as well as notable weaknesses such as high initial costs and lack of skills. Opportunities for growth are numerous, especially in emerging markets and through technological progress, while threats from competition and economic fluctuations are threatening. Strategic focus on innovation, cooperation and regulatory issues will be crucial for market participants to navigate this evolving market.

Leave a Comment