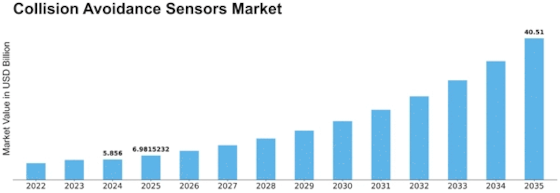

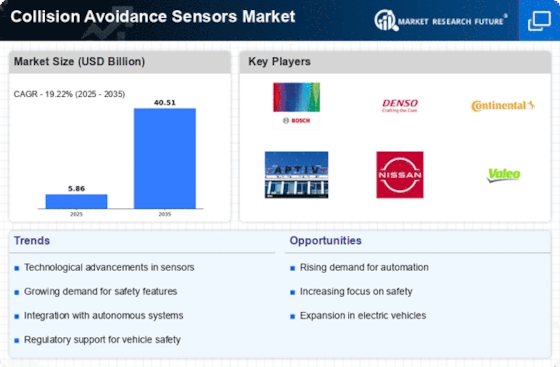

Collision Avoidance Sensors Size

Collision Avoidance Sensors Market Growth Projections and Opportunities

The Collision avoidance sensors Market is fashioned via a large number of factors that collectively affect its boom and dynamics. One pivotal element using the market is the increasing emphasis on road safety. As governments and regulatory bodies globally intensify their efforts to reduce accidents and beautify transportation safety, the demand for collision avoidance sensors has witnessed a sizable surge. These sensors play a critical role in preventing collisions by imparting real-time facts about the vehicle's surroundings, allowing well-timed interventions and indicators to drivers. The automobile sector, particularly, plays a pivotal position in propelling the Collision avoidance sensors Market forward. With the growing demand for connected and self-reliant cars, collision avoidance sensors have become an imperative part of the car safety ecosystem. Manufacturers are increasingly integrating these sensors into motors to offer features such as automatic emergency braking, lane departure caution, and adaptive cruise control. Additionally, the growing consumer recognition of advanced protection functions and the willingness to put money into such technologies contribute considerably to the marketplace's growth. Global urbanization and the following growth in site visitor congestion additionally contribute to the demand for collision avoidance sensors. As urban regions continue to make bigger, the chance of injuries rises, necessitating the implementation of advanced protection measures. Collision avoidance sensors prove to be integral in those scenarios by presenting a proactive approach to twist-of-fate prevention. The capability of these sensors to come across boundaries, pedestrians, and other cars in actual time offers an important layer of protection, specifically in densely populated regions. Cost issues and regulatory frameworks additionally play an essential role in shaping the collision avoidance sensors market. While advancements in generation have caused extra cost-effective sensor answers, the overall value of imposing collision avoidance structures remains an essential aspect for end customers. Moreover, the regulatory panorama, including protection requirements and mandates, extensively affects the adoption of collision avoidance sensors. Compliance with those policies becomes a driving pressure for producers to innovate and improve sensor abilities to fulfill or exceed the set requirements. Collaborations and partnerships among sensor producers and car businesses mark the competitive panorama. As the market continues to develop, collaboration becomes vital for developing inclusive and comprehensive solutions. The synergy among sensor manufacturers, software program builders, and car OEMs fosters innovation and quickens the deployment of superior collision avoidance systems.

Leave a Comment