Market Share

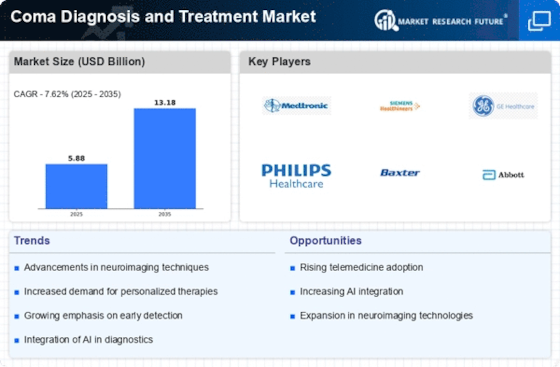

Coma Diagnosis and Treatment Market Share Analysis

Introduce coma as a condition of unconsciousness when a person cannot be woken or stimulated. Explain its severity and causes, such as traumatic brain damage, stroke, or metabolic abnormalities. Assess coma prevalence, cause, and treatment options. Market segmentation by coma etiology, patient age, severity, and healthcare environment (e.g., emergency rooms, intensive care units). Assess competitors' diagnostic, monitoring, therapeutic, and supportive coma care tools. Assess their market share, products, price, and customer happiness. Write a persuasive value proposition about how early identification, tailored care plans, multidisciplinary approach, and holistic patient management enhance outcomes and quality of life for coma patients. Provide instructional materials and training for emergency doctors, neurologists, intensivists, nurses, and allied health workers who diagnose and treat coma. Provide clinical updates, treatment recommendations, and best practices to improve provider abilities. Provide educational information, resources, and assistance to coma patients and their families to understand the diagnosis, treatment choices, prognosis, and recovery process. Help in communication, decision-making, and coping during coma recovery. Research and develop new coma diagnostic, monitoring, and treatment technologies. To improve patient care and results, use neuroimaging (MRI, CT scans), neurophysiological monitoring devices, neurostimulation therapy, and telemedicine. Work with payers, healthcare systems, and regulators to improve coma diagnosis and treatment reimbursement. Show intervention clinical efficacy and cost-effectiveness to support reimbursement and expand patient access. Consider expanding into new markets and countries with rising healthcare infrastructure. Tailor products, distribution routes, and marketing to target markets' demands and regulations. Promote coma diagnostic and treatment research, innovation, and awareness by forming strategic partnerships with academic institutions, research organizations, and patient advocacy groups. Joint clinical trials, outcomes research, and public health activities improve treatment outcomes and patient quality of life. Monitor and enhance coma diagnosis and treatment via quality assurance systems and performance indicators. Enhance patient safety, treatment results, and satisfaction to promote continual improvement. Ensure all healthcare marketing and promotions follow ethical and regulatory norms. To develop trust and comply with regulations, prioritize patient confidentiality, informed consent, and honest communication with stakeholders. Engage with patient advocacy groups, community organizations, and social media to increase coma awareness, stigma reduction, and early identification and treatment. Partner on education, support, and awareness initiatives to empower coma patients and their families.

Leave a Comment