Command Control Systems Size

Market Size Snapshot

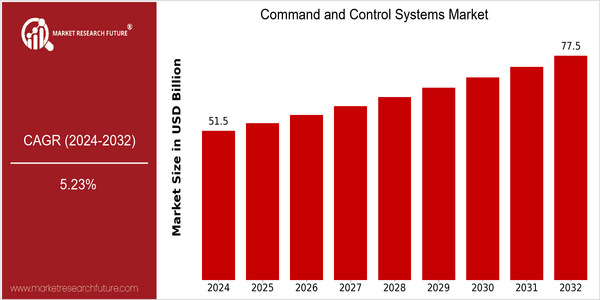

| Year | Value |

|---|---|

| 2024 | USD 51.516 Billion |

| 2032 | USD 77.5 Billion |

| CAGR (2024-2032) | 5.23 % |

Note – Market size depicts the revenue generated over the financial year

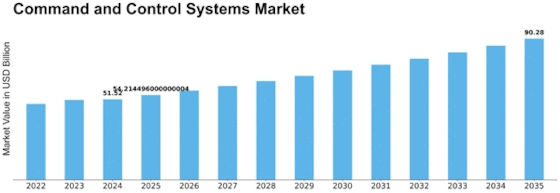

In the past the command and control system market has grown steadily, with a market value of $ 51.162 billion in 2024, and an expected market value of $ 77.3 billion in 2032. This growth trend is characterized by a CAGR of 5.23% during the forecast period. The growing complexity of military operations, and the growing demand for improved situational awareness and decision-making, are the main driving forces for the growth of the market. Furthermore, technological innovations such as artificial intelligence, machine learning, and the Internet of Things are revolutionizing command and control systems, enabling them to handle and process data more efficiently, and provide real-time analysis. And the main players in the market, such as Lockheed Martin, Northrop Grumman, and Raytheon, are constantly investing in the development of new products and solutions and entering into strategic alliances to enhance their product portfolios. In this way, recent collaborations on the integration of artificial intelligence into command and control systems are expected to improve the efficiency of military operations and the response to critical situations. With the increasing defense budgets, the demand for advanced command and control systems is likely to remain high, thereby strengthening the growth trend of the market in the coming years.

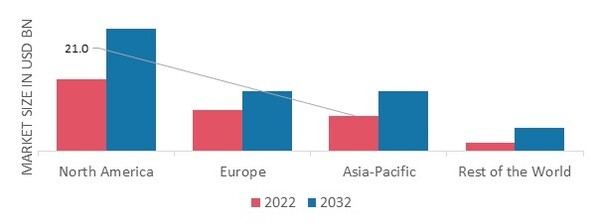

Regional Market Size

Regional Deep Dive

The command and control systems market is characterized by rapid technological advancements and the increasing demand for integrated solutions in various sectors, such as defense, security, and transport. In each region, the market has its own characteristics, which are mainly influenced by the geopolitical, regulatory, and economic environment. The need for increased situational awareness and better decision-making capabilities, and the integration of new technologies such as artificial intelligence and big data, are the key drivers for the market. The market is mainly driven by the need for national security and disaster response capabilities.

Europe

- The European Union has launched the European Defence Fund, which allocates significant resources to developing advanced command and control technologies, fostering collaboration among member states and defense contractors.

- Countries like the UK and France are focusing on joint military exercises that utilize advanced command and control systems, highlighting the importance of interoperability among NATO allies in response to evolving security threats.

Asia Pacific

- China's rapid military modernization includes significant investments in command and control systems, with the establishment of the Integrated Command and Control System (ICCS) to enhance military coordination and response capabilities.

- India's Defence Research and Development Organisation (DRDO) is developing indigenous command and control systems to support its armed forces, reflecting a broader trend of self-reliance in defense technology across the region.

Latin America

- Countries like Brazil and Colombia are enhancing their command and control capabilities to address internal security challenges, with investments in technology aimed at improving law enforcement and emergency response.

- The region is witnessing a growing trend towards public-private partnerships in developing command and control systems, as governments seek to leverage private sector innovation to enhance public safety.

North America

- The U.S. Department of Defense has been investing heavily in modernizing its command and control systems, with initiatives like the Joint All-Domain Command and Control (JADC2) program aimed at integrating data across all military branches.

- In recent years, the security of command and control systems has become the focus of the regulatory environment. This has led to increased collaboration between private companies such as Raytheon and government agencies in order to ensure the resilience of such systems against cyber-attacks.

Middle East And Africa

- The Gulf Cooperation Council (GCC) countries are increasingly investing in command and control systems to enhance their defense capabilities, with projects like the Integrated Air and Missile Defense System being a focal point for regional security.

- The rise of non-state actors and asymmetric warfare in the region has prompted governments to adopt advanced command and control systems to improve situational awareness and response times in crisis situations.

Did You Know?

“Did you know that the global command and control systems market is increasingly integrating artificial intelligence, with predictions that AI-driven analytics will significantly enhance decision-making processes in military and civilian applications?” — Market Research Future

Segmental Market Size

In the field of command and control systems, the company plays a key role in the understanding of the situation and the decisions to be made in various industries, such as defense, transport, and emergency response. This field is currently experiencing strong growth due to the growing demand for integrated systems that increase efficiency and response speed. The complexity of security threats is increasing, and the need for real-time data processing to support critical decision-making is growing. The implementation of command and control systems has already reached a high level of maturity, as shown by the advanced systems of the United States Department of Defense for military operations and by the use of command and control systems by cities such as New York for emergency response. The most important applications are military operations, disaster response, and traffic control. The trend towards smart cities and the development of machine learning and artificial intelligence will accelerate the growth of this field as companies seek to use these tools to improve their operational capabilities.

Future Outlook

From 2024 to 2032, the Command and Control systems market is expected to grow at a CAGR of 5.23%. This growth is based on the increasing demand for advanced situational awareness and decision-making capabilities in various sectors, such as defense, public safety, and critical infrastructure. In addition, the increasing need for efficiency and responsiveness in organizations will lead to the growing adoption of integrated command and control systems, which will lead to a more connected and data-driven operational environment. The integration of artificial intelligence, machine learning, and the Internet of Things will revolutionize the command and control systems. These technologies will allow the processing and analysis of data in real time, which will lead to faster and more accurate decisions. In addition, the growing emphasis on cybersecurity and the need for reliable communication networks will also boost the market. Also, the increasing use of mobile command centers and the trend towards cloud-based solutions will have a major impact on the future of the market. By 2032, penetration rates are expected to reach over 60% in the most important sectors.

Leave a Comment