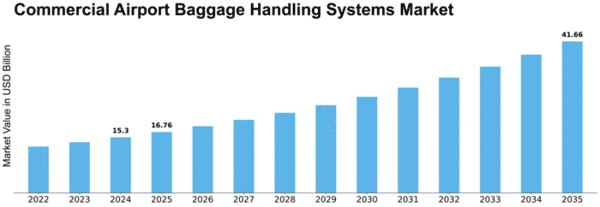

Commercial Airport Baggage Handling Systems Size

Commercial Airport Baggage Handling Systems Market Growth Projections and Opportunities

An essential variable forming this market is the consistently expanding global air travel demand. As traveler numbers keep on rising, airports are feeling the squeeze to improve their baggage handling abilities to gratify the developing volumes. The requirement for effective and solid systems that can handle huge amounts of gear is moving interests in cutting edge baggage handling solutions. Functional expense contemplations address another key market factor. Airports are continually endeavoring to upgrade their functional expenses while keeping up with elevated expectations of administration. Productive baggage handling systems add to this goal by smoothing out processes, limiting postponements, and diminishing the requirement for manual interventions. As airports face monetary anxieties and look for ways of working on their main concern, interests in current baggage handling systems become an essential objective. Furthermore, the elevated spotlight on security is a huge driver in the Commercial Airport Baggage Handling Systems market. With expanding security guidelines and the requirement for rigid screening processes, airports are putting resources into cutting edge baggage screening innovations. Coordinated baggage handling systems that integrate cutting edge security highlights assist airports with conforming to security standards while keeping up with the progression of baggage through the airport proficiently. The global pattern towards manageability is additionally impacting the market elements of baggage handling systems. Airports are progressively considering eco-accommodating solutions to limit their natural effect. This incorporates the reception of energy-proficient advances, the utilization of reused materials, and the execution of systems that lessen fossil fuel byproducts. As the aeronautics business faces investigation in regards to its ecological impression, the demand for maintainable baggage handling solutions is probably going to develop. Besides, the development of airport foundation and the rise of new airports add to the market's elements. New airports frequently look for the most recent and most exceptional baggage handling systems all along, while existing airports might go through moves up to remain competitive and satisfy developing guidelines.

Leave a Comment