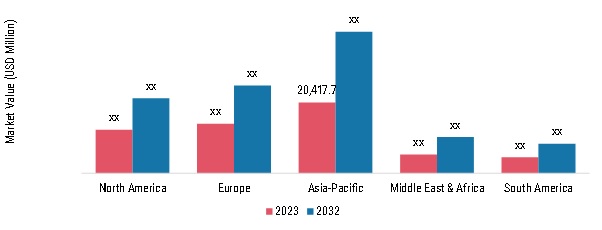

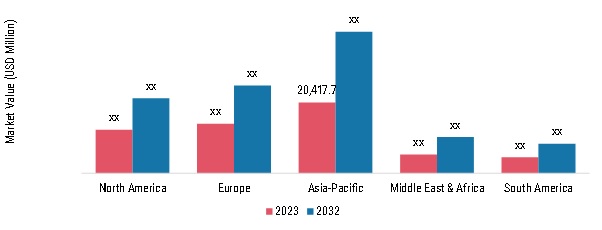

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia-Pacific Commercial HVAC Market accounted for largest market share in 2022 and is expected to exhibit a significant CAGR growth during the study period.

The Commercial HVAC market in the APAC region is experiencing substantial growth and development, with key countries such as China, Japan, South Korea, India, and the rest of APAC actively contributing to this transformation. Governments and businesses across APAC are recognizing the importance of advanced HVAC systems in enhancing indoor comfort, energy efficiency, and environmental sustainability in commercial buildings. Several factors are driving the expansion of the Commercial HVAC market in the APAC region.

One of the key drivers is the region's rapid urbanization and industrialization. As cities in China, India, and other APAC countries expand, there is a growing demand for modern HVAC solutions in commercial spaces, including office buildings, shopping malls, and hospitality establishments.

Figure 3: Commercial HVAC Market, by Region, 2023 & 2032 (USD Million)

North America, comprising the United States, Canada, and Mexico, is a region known for its robust commercial HVAC market. With a focus on technological innovation and sustainable building practices, the region is witnessing significant growth in the adoption of advanced commercial HVAC systems. The demand for these systems is driven by both private sector investments and government initiatives aimed at improving energy efficiency and indoor air quality in commercial spaces.

Commercial HVAC technologies are improving quickly, with a focus on making them more energy-efficient, sustainable, and comfortable for occupants. Smart HVAC controls solutions and advanced control systems are being integrated to achieve this goal. However, North America is facing challenges in fully optimizing commercial HVAC systems despite these technological advancements. The future of the commercial HVAC market in North America is being shaped by the emergence of advanced HVAC standards and regulations, such as those promoting energy-efficient equipment and refrigerants with lower global warming potential.

In the United States, federal, state, and local governments have introduced various incentive programs and regulations to encourage the adoption of energy-efficient HVAC systems in commercial buildings. These initiatives incentivize businesses to invest in modern HVAC technologies and implement sustainable practices. For instance, Federal Energy Management Program (FEMP) provides acquisition guidance for commercial central air conditioners with cooling capacities at or above a certain level. Moreover, real-time data monitoring and advanced analytics tools are becoming integral to commercial HVAC systems, allowing building owners and facility managers to make data-driven decisions.

This data-driven approach leads to better HVAC system performance, optimized resource allocation, and improved cost-effectiveness.

The commercial HVAC market in North America is not only evolving to meet energy efficiency standards but also adapting to changing environmental regulations and customer demands for improved indoor air quality and comfort in commercial spaces. Innovations such as variable refrigerant flow (VRF) systems, heat recovery systems, and air quality monitoring are gaining prominence in the region's commercial HVAC market, ensuring that buildings remain comfortable, efficient, and environmentally responsible.