- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

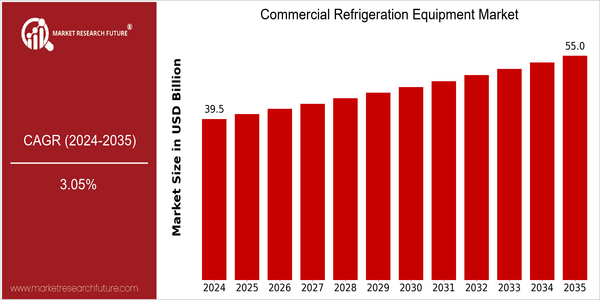

Commercial Refrigeration Equipment Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 39.51 Billion |

| 2035 | USD 55.0 Billion |

| CAGR (2025-2035) | 3.05 % |

Note – Market size depicts the revenue generated over the financial year

The commercial refrigerant market is expected to grow steadily, with a current market size of $39.51 billion in 2024, expected to reach $55.0 billion by 2035. This is a CAGR of 3.05% from 2025 to 2035. This growth is due to several key factors, including the increasing demand for energy-efficient refrigerants, the growing food and beverage industry, and the increasing emphasis on sustainable practices in commercial operations. The use of green refrigerants and smart refrigerant systems is becoming more common as businesses strive to reduce their carbon footprint. Companies such as Carrier, Daikin, and Hussmann, which are the mainstays of the commercial refrigerant industry, are actively investing in R & D to improve the efficiency and green credentials of their products. Strategic initiatives such as the launch of advanced cooling solutions and the development of the Internet of Things are also driving the growth of the market. These developments will probably shape the future of commercial refrigerants, making them an important part of the broader energy management and sustainable development picture.

Regional Deep Dive

The market for commercial refrigerating appliances is growing at a fast pace across all regions, owing to the growing demand for energy-efficient solutions, changing customer preferences, and the imposing of strict regulations for reducing the impact on the environment. In North America, the market is characterized by the adoption of advanced technology and the focus on energy efficiency, whereas in Europe, the focus is on meeting the regulatory requirements. The rapidly urbanizing Asia-Pacific region, where the food and beverage industry is growing rapidly, is characterized by a high demand for refrigerating appliances. In the Middle East and Africa, the increasing investments in the construction of roads and railways, and the rising purchasing power of the population are expected to boost the market growth. Latin America, with its diverse economies, is gradually adopting modern refrigerating appliances, which are influenced by both local and international players.

North America

- The stricter regulations on refrigerants by the U.S. Environmental Protection Agency have forced manufacturers to develop low GWP (global warming potential) refrigerants, which are reshaping the product offerings in the market.

- Carrier and Trane are investing heavily in smart cooling systems, which will lead to increased market growth.

- The growth of e-commerce and the spread of food delivery services has led to an increased demand for cold storage and logistics, and this has led companies to adapt their products to meet the changing requirements of the market.

Europe

- In order to protect the ozone layer, the European Union has introduced the F-Gas Regulation, and companies like Danfoss and Bitzer are leading the way in the development of natural refrigerants.

- CO2 is a natural refrigerant that is widely used in the cooling industry.

- In Europe, too, the trend towards greater urbanization is bringing an increased demand for compact and efficient cooling equipment in densely populated areas.

Asia-Pacific

- The rapid urbanization and the development of the food and beverage industry in China and India have prompted the rapid development of commercial refrigerators. Local manufacturers such as Haier and Midea have expanded their product lines.

- The food hygiene laws have made it necessary to invest in advanced cooling systems, which has led to an increase in market growth.

- In addition, smart refrigeration is becoming popular, and the application of AI and IoT is expected to optimize the energy efficiency and operating efficiency of the company.

MEA

- The vision of the United Arab Emirates for 2021, a programme of sustainable development, has led to a large investment in energy-saving equipment, especially in the retail and hospitality industries.

- The growing middle classes in countries such as Saudi Arabia and South Africa are increasing the demand for modern cooling devices, and are changing their habits in favor of quality and comfort.

- The development of new cities, such as the NEOM project in Saudi Arabia, is expected to offer significant opportunities for suppliers of commercial cooling equipment in the region.

Latin America

- In recent years, new regulations in Brazil have sought to reduce the energy consumption of commercial buildings. This has led to a greater demand for energy-efficient cooling technology.

- The agribusinesses have been growing steadily, and the products are becoming more and more diverse. They are working more and more with international firms, and the market is becoming more and more competitive.

- In the cities, the growth of the catering industry is creating a demand for advanced cooling devices. Restaurants and cafes want to ensure food safety and hygiene.

Did You Know?

“The cooling equipment accounts for about one-third of the energy consumed by commercial buildings. Energy-saving devices, therefore, are of great importance for the reduction of energy consumption.” — U.S. Department of Energy

Segmental Market Size

The commercial refrigeration equipment market is a significant sector of the overall industry, currently experiencing steady growth. The main demand drivers are the growing need for energy-efficient solutions, driven by the rising cost of electricity and stricter regulations on reducing carbon emissions. In addition, the growing trend for sustainable food and beverage production is a further driver for the adoption of advanced refrigerating equipment.

In North America and Europe, the acclimatization market is already a mature market. Leading manufacturers like Carrier and Daikin are already implementing new solutions. In addition to the use in the food industry, the main application areas are in the fields of retail, restaurants and cold storage, where energy-efficient cooling is indispensable for the preservation of perishable goods. Besides the trend towards eco-friendly refrigerants, the growing focus on energy efficiency and the increasing importance of government regulations will further accelerate growth. The evolution of the industry is being shaped by Internet of Things-based monitoring systems and the development of the latest generation of screw compressors.

Future Outlook

The market for commercial refrigerating equipment is forecast to grow at a steady rate from 2024 to 2035, from $39.51 billion to $55 billion, at a CAGR of 3.05%. The rising demand for energy-efficient cooling systems in various sectors, such as food service, retail and pharmaceuticals, will spur the market. Also, the increasing importance of the environment in the eyes of businesses will increase the use of environmentally friendly refrigerants and advanced equipment, such as smart cooling systems, which will reduce the carbon footprint of businesses.

The development of new products based on the Internet of Things (IoT) and artificial intelligence (AI) in the field of industrial cooling systems will be a major growth driver for the market. These innovations will allow for real-time monitoring and preventive maintenance, thus reducing downtime and reducing energy consumption. Moreover, the phasing-out of high-GWP refrigerants will drive the transition towards more sustainable solutions. By 2035, it is expected that more than 60 percent of commercial cooling systems will be equipped with low-GWP refrigerants, which will significantly change the competitive dynamics of the market. Moreover, the growing importance of e-grocery and the expansion of cold chain logistics will increase the penetration of commercial cooling systems and strengthen their role in the supply chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 32.41 Billion |

| Market Size Value In 2023 | USD 33,947.3 Billion |

| Growth Rate | 5.77% (2022-2030) |

Commercial Refrigeration Equipment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.