Emergence of New Market Players

The emergence of new market players is reshaping the commercial satellite launch service Market. Startups and smaller companies are entering the market, driven by advancements in technology and a growing appetite for satellite launches. These new entrants often focus on niche markets, such as small satellite launches, which are becoming increasingly popular due to their cost-effectiveness and rapid deployment capabilities. The competitive dynamics are shifting as these companies challenge traditional players, leading to innovation and improved service offerings. Furthermore, the entry of new players is likely to drive down launch costs, making space more accessible for various sectors. This trend indicates a vibrant and evolving landscape within the Commercial Satellite Launch Service Market.

Government Initiatives and Funding

Government initiatives and funding are crucial drivers of the Commercial Satellite Launch Service Market. Various nations are increasingly recognizing the strategic importance of space capabilities, leading to enhanced investments in satellite launch services. For example, government agencies are establishing partnerships with private companies to foster innovation and reduce costs. In recent years, funding for space exploration and satellite technology has seen a marked increase, with budgets for space agencies expanding significantly. This financial support not only stimulates the development of new launch vehicles but also encourages the establishment of launch facilities. As a result, the market is likely to benefit from a more competitive landscape, with increased opportunities for both established players and new entrants in the Commercial Satellite Launch Service Market.

Growing Demand for Satellite-Based Services

The demand for satellite-based services is a primary driver of the Commercial Satellite Launch Service Market. As industries such as telecommunications, earth observation, and navigation expand, the need for satellite deployment increases correspondingly. The proliferation of Internet of Things (IoT) devices and the growing reliance on satellite communications for broadband services are notable trends. According to recent data, the satellite communications sector alone is expected to reach a valuation of over 100 billion USD by 2026. This escalating demand for satellite services necessitates frequent launches, thereby propelling the growth of the launch service market. Consequently, companies are investing in more efficient launch solutions to meet this burgeoning demand, indicating a robust future for the Commercial Satellite Launch Service Market.

Technological Advancements in Launch Vehicles

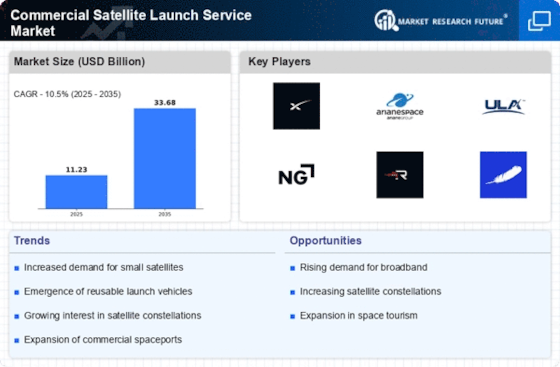

The Commercial Satellite Launch Service Market is experiencing a surge in technological advancements, particularly in launch vehicle design and manufacturing. Innovations such as reusable rocket technology have significantly reduced launch costs, making space access more affordable. For instance, companies are now able to achieve multiple launches with the same vehicle, which enhances operational efficiency. The introduction of advanced propulsion systems and lightweight materials further contributes to improved payload capacity and reliability. As a result, the market is witnessing an increase in demand for satellite launches, with projections indicating a compound annual growth rate of over 10% in the coming years. This trend suggests that technological progress will continue to play a pivotal role in shaping the future of the Commercial Satellite Launch Service Market.

Increased Focus on International Collaboration

Increased focus on international collaboration is a notable trend within the Commercial Satellite Launch Service Market. Countries are recognizing the benefits of working together on space missions, leading to joint ventures and collaborative projects. Such partnerships often result in shared resources, knowledge exchange, and reduced costs for satellite launches. For instance, international agreements facilitate the pooling of expertise in satellite technology and launch capabilities, enhancing overall mission success rates. This collaborative approach not only accelerates the pace of innovation but also expands the market for satellite launches. As nations continue to pursue cooperative strategies in space exploration, the Commercial Satellite Launch Service Market is likely to experience sustained growth and diversification.

.png)