- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

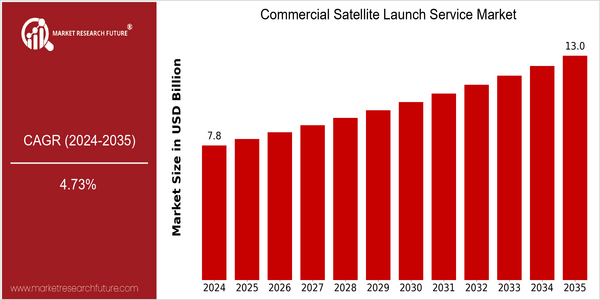

| Year | Value |

|---|---|

| 2024 | USD 7.82 Billion |

| 2035 | USD 13.0 Billion |

| CAGR (2025-2035) | 4.73 % |

Note – Market size depicts the revenue generated over the financial year

The global commercial satellite launch service market is poised for significant growth, with a current market size of USD 7.82 billion in 2024, projected to expand to USD 13.0 billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.73% from 2025 to 2035. The increasing demand for satellite-based services, driven by advancements in technology and the rising need for global connectivity, is a primary factor propelling this market forward. As nations and private entities alike invest in satellite infrastructure for applications ranging from telecommunications to Earth observation, the market is expected to witness robust expansion. Key technological trends, such as the miniaturization of satellites and the emergence of reusable launch vehicles, are further enhancing the efficiency and cost-effectiveness of satellite launches. Companies like SpaceX, with its Falcon 9 and Starship programs, and Arianespace, with its Ariane 6 launch vehicle, are at the forefront of these innovations. Strategic initiatives, including partnerships between commercial entities and government agencies, as well as increased investments in launch capabilities, are also shaping the competitive landscape. As the market evolves, these factors will continue to drive growth and foster a dynamic environment for new entrants and established players alike.

Regional Market Size

Regional Deep Dive

The Commercial Satellite Launch Service Market is experiencing significant growth across various regions, driven by advancements in technology, increasing demand for satellite-based services, and supportive government policies. Each region exhibits unique characteristics that influence market dynamics, including varying levels of investment, regulatory frameworks, and technological capabilities. The North American market is characterized by a strong presence of established players and innovative startups, while Europe focuses on collaborative projects and regulatory harmonization. The Asia-Pacific region is rapidly expanding due to increasing satellite launches and investments in space infrastructure. The Middle East and Africa are witnessing emerging opportunities driven by government initiatives, and Latin America is gradually developing its capabilities in satellite launch services.

Europe

- The European Space Agency (ESA) has launched the 'Space 4.0' initiative, promoting innovation and collaboration among member states to enhance satellite launch capabilities and foster a competitive market.

- Notable developments include the successful launch of the Ariane 6 rocket, which aims to reduce costs and improve efficiency in satellite launches, positioning Europe as a key player in the global market.

Asia Pacific

- Countries like India and China are ramping up their satellite launch capabilities, with the Indian Space Research Organisation (ISRO) and China National Space Administration (CNSA) leading the charge, resulting in a surge of commercial launches.

- The region is witnessing increased investment in space technology, with private companies such as OneWeb and Rocket Lab establishing operations to cater to the growing demand for satellite services.

Latin America

- Brazil is emerging as a key player in the Latin American satellite launch market, with the development of the Alcântara Launch Center, which offers a strategic location for launching satellites into equatorial orbits.

- The region is witnessing increased collaboration between governments and private entities, such as the partnership between the Brazilian Space Agency and SpaceX, aimed at enhancing satellite launch capabilities.

North America

- The U.S. government has increased its investment in space exploration and satellite technology, with initiatives like the Space Force and partnerships with private companies such as SpaceX and Blue Origin, which are reshaping the competitive landscape.

- Recent regulatory changes, including streamlined licensing processes by the Federal Aviation Administration (FAA), have facilitated quicker deployment of satellite launch services, encouraging more companies to enter the market.

Middle East And Africa

- The UAE has made significant strides in the space sector, with the Mohammed bin Rashid Space Centre (MBRSC) launching the Hope Probe to Mars, showcasing the region's growing capabilities in satellite technology.

- Governments in Africa are increasingly recognizing the importance of satellite technology for development, leading to initiatives like the African Space Strategy, which aims to enhance regional cooperation and investment in satellite launch services.

Did You Know?

“Did you know that the first commercial satellite launch took place in 1980, and since then, the industry has evolved to include over 100 companies globally, with a significant increase in launches in recent years?” — Space Foundation

Segmental Market Size

The Commercial Satellite Launch Service Market is currently experiencing robust growth, driven by increasing demand for satellite deployment across various sectors, including telecommunications, Earth observation, and scientific research. Key factors propelling this segment include the rising need for global connectivity, advancements in satellite technology, and supportive regulatory frameworks that encourage private sector participation in space activities. Notably, companies like SpaceX and Rocket Lab are at the forefront, demonstrating significant adoption through their successful launch services and innovative approaches to reduce costs and increase launch frequency. This segment is in a mature adoption stage, with numerous successful launches and a growing number of players entering the market. Primary applications include launching small satellites for Internet of Things (IoT) connectivity, remote sensing for agriculture, and disaster management. Trends such as the push for sustainable space practices and government initiatives to enhance national security through satellite capabilities are accelerating growth. Technologies like reusable launch vehicles and advanced propulsion systems are shaping the future of this market, enabling more efficient and cost-effective satellite launches.

Future Outlook

The Commercial Satellite Launch Service Market is poised for significant growth from 2024 to 2035, with the market value projected to increase from $7.82 billion to $13.0 billion, reflecting a compound annual growth rate (CAGR) of 4.73%. This growth trajectory is underpinned by the increasing demand for satellite-based services, including telecommunications, Earth observation, and global internet coverage. As more countries and private entities enter the space sector, the number of satellite launches is expected to rise, further driving market expansion. By 2035, it is anticipated that the penetration of commercial satellite launch services will reach approximately 30% of the global satellite deployment needs, highlighting a robust shift towards privatization in space exploration and utilization. Key technological advancements, such as reusable launch vehicles and miniaturized satellite technology, are expected to play a crucial role in shaping the market landscape. Companies like SpaceX and Blue Origin are leading the charge in developing cost-effective launch solutions, which will lower barriers to entry for new players and stimulate competition. Additionally, supportive government policies and international collaborations aimed at fostering space innovation will further enhance market dynamics. Emerging trends, including the rise of small satellite constellations and the increasing focus on sustainable space practices, will also contribute to the evolving commercial satellite launch service ecosystem, ensuring that the market remains vibrant and responsive to global needs.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 10.50% (2023-2032) |

Commercial Satellite Launch Service Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.