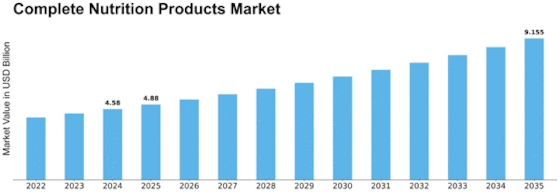

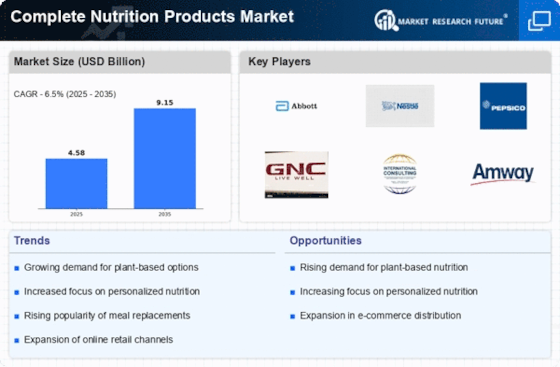

Complete Nutrition Products Size

Complete Nutrition Products Market Growth Projections and Opportunities

A variety of variables impact the entire complete nutrition products market, shaping its structure and future path. Another important influence is buyers' growing understanding & commitment to eating well. As people become more cognizant of the significance of nourishment in general health, their will be a rise of preference towards goods which offer full nutritional value. The change of customer tastes has moved the whole complete nutrition products market ahead.

Another important industry element is a growing number of lifestyle-associated disorders including health issues. Diabetes, hypertension, and heart conditions are among those on an increase as increasing numbers of individuals choose to be inactive. In reaction to such issues with health, people have begun turning toward diets as a straightforward way for controlling their wellness. It has resulted in a rising market towards treatments which tackle particular medical issues including reducing weight, adrenaline steroids, and autoimmune assistance.

The changing population environment also influences the overall nutrition goods industry. Since humanity ages, elderly people are increasingly concerned about their health and well-being. The aging population transition is resulting in a rise of interest over dietary items that target age-associated illnesses including joint wellness, memory, and density of bones. Companies within the sector have responded through the development of items targeted at meeting the special demands faced by the ageing generation.

Technological and scientific developments have an impact on markets as well. Continuous study in the food and health disciplines has causing the creation of new products along with components. Customers become more drawn towards items that include the most recent discoveries and developments. It has led firms throughout the complete nutrition products market spend within R&D in order to keep leading the competition and provide new products which fulfill what consumers want.

Furthermore, the effect of variables notably culture and society can't be ignore within complete nutrition products market. Societal developments favoring an increasingly healthy way of life, in addition to the role of the internet for encouraging wellbeing patterns, all have added the increasing appeal of comprehensive nutrition solutions. Customers look for goods that give them basic nutrients yet reflect their beliefs, including long-term viability, fair trade, and brand clarity.

Financial difficulties are also impacting the marketplace scene. Customers' free time and capacity to shell out on well-being items influence purchase patterns throughout the whole nutrition product sector. Financial stability and prosperity boost consumer confidence, resulting in higher inclination towards luxury and specialist nutrition goods.

To summarize, the marketplace for full food items is a changing and varied environment affected by several interconnected forces. From altering customer tastes and nutritional worries to technical improvements and financial motion, these key components all contribute towards the overall development and change of the scenario of complete nutrition products market. When the sector responds to such variables, it is set for additional expansion and creativity in order to fulfill the broad demands by customers wanting an all-encompassing approach to food and happiness.

Leave a Comment